- Still waiting for the market to turn

- Charges will continue to distort earnings

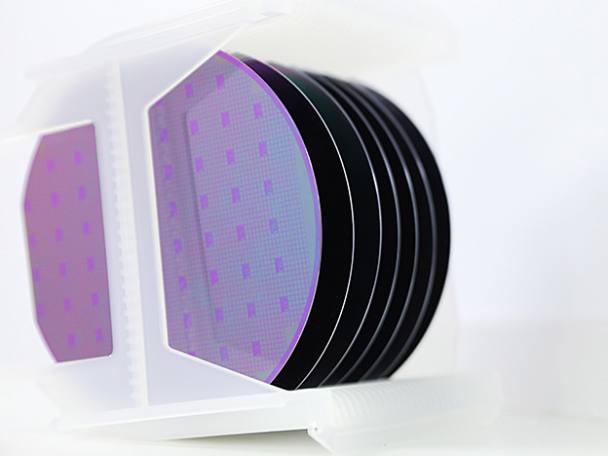

Results for microprocessor manufacturer IQE (IQE) were a mixed bag as the company tries to recover its poise after a difficult period dominated by supply chain problems and shortages of semiconductors across the globe. There are encouraging signs that the shortages in semiconductors are starting to abate, with more normal products flows across major sectors. However, whether this means that an uptick is inevitable is open to question, although management did reaffirm its guidance for full-year low single-digit revenue growth.

At a granular level, the results confirmed that nothing about research & development is either cheap, or with an assured outcome. The widening of reported losses was mainly down to the impairment of intangibles related to IQE’s failed development attempt at feedback laser technology. The impairment was added to the company’s administration expenses, with the £3.4mn non-cash charge behind the widening of reported losses during the half. IQE also took a £1.3mn charge related to its programme to consolidate its presence in North America – with the company rationalising its operations around one site. Overall, the balance sheet still has the scope to generate further losses for the income statement, as and when money set aside for provisions crosses over the line when charges fall due. Currently, there are provisions totalling £5.26mn that have yet to be charged.

Valuation is tricky because of IQE’s ongoing losses – broker Numis forecasts losses for the year of 1.3p a share. A lot seems to be riding on whether electronics maker Sony will start buying chips from IQE, which sums up the highly speculative nature of the company. Hold.

Last IC View: Hold, 39p, 29 Mar 2022

| IQE (IQE) | ||||

| ORD PRICE: | 34.5p | MARKET VALUE: | £278mn | |

| TOUCH: | 34-35p | 12-MONTH HIGH: | 55p | LOW: 27.5p |

| DIVIDEND YIELD: | nil | PE RATIO: | na | |

| NET ASSET VALUE: | 30p* | NET DEBT: | 27% | |

| Half-year to 30 Jun | Turnover (£mn) | Pre-tax profit (£mn) | Earnings per share (p) | Dividend per share (p) |

| 2021 | 79.5 | -3.00 | -0.34 | nil |

| 2022 | 86.1 | -8.53 | -1.03 | nil |

| % change | +8 | - | - | - |

| Ex-div: | - | |||

| Payment: | - | |||

| *Includes intangible assets of £100mn, or 12p a share | ||||