If the bear market is throwing up bargains, then one screen that should have a good chance of rooting them out is the Cornerstone Growth screen devised by quant investor Jim O’Shaughnessy.

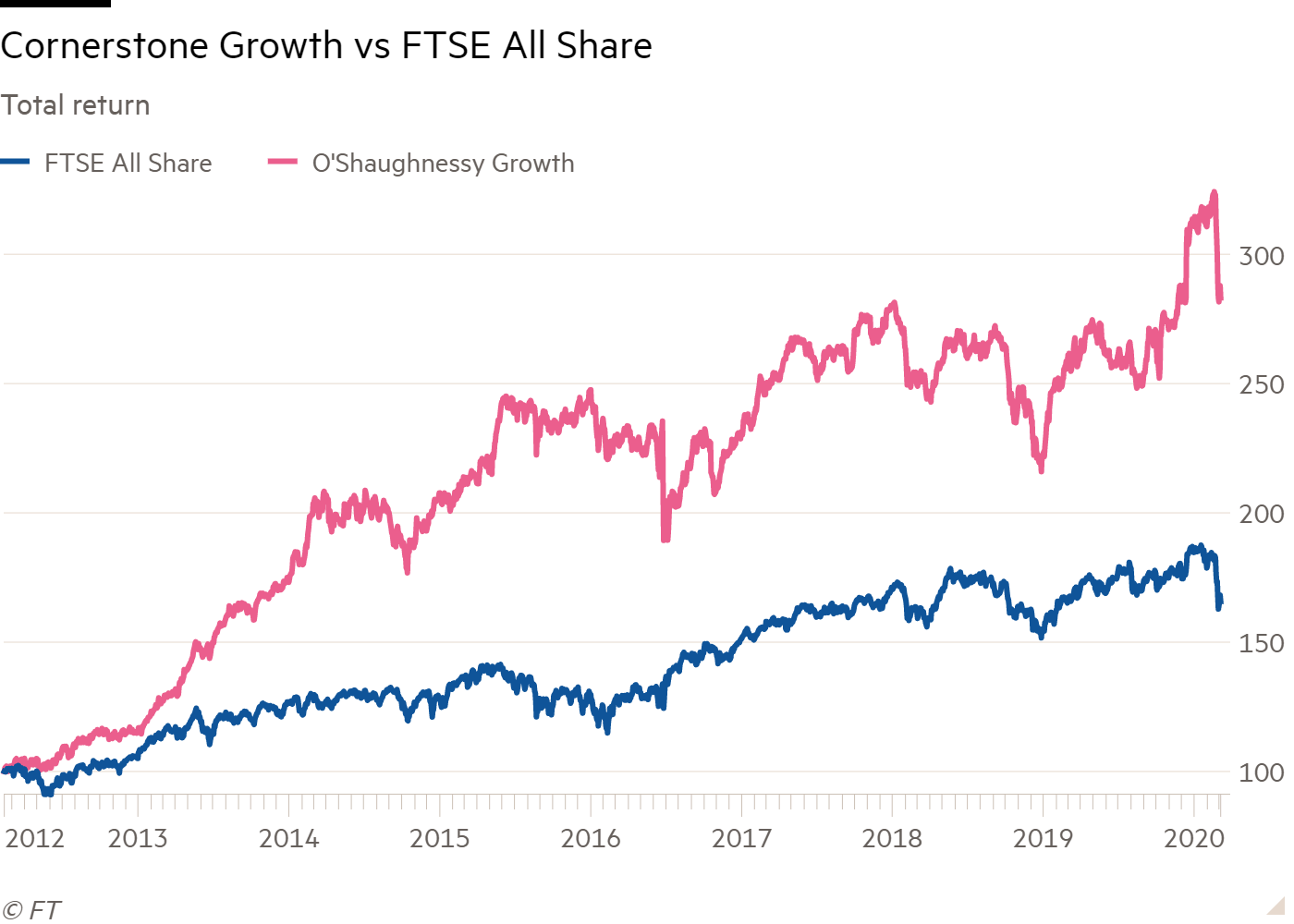

The Cornerstone Growth screen focuses on what Mr O’Shaughnessy described as “the king of value factors”; the price-to-sales ratio. While the screen’s criteria has been updated since the first publication of Mr O’Shaughnessy’s seminal book What Works on Wall Street in 1997, this column still uses the original method. The results have been good since I began monitoring the screen in early 2012. That said, the screen purposely embraces volatility in order to achieve high returns, which is in contrast to Mr O’Shaughnessy’s Cornerstone Value screen that was run in the column last week.

Over the past 12 months, despite picking one absolute stinker in the form of Ted Baker (TED), the 16 Cornerstone Growth shares from 2019 delivered a total return of 6.3 per cent compared with a negative 2.7 per cent from the FTSE All-Share. This takes the cumulative total return since I started to follow the screen eight years ago to 183 per cent compared with 67 per cent from the index. If I add in a notional 1.25 per cent annual charge to reflect dealing costs, the total return from the screen drops to 156 per cent.

2019 performance

| Name | TIDM | Total return (18 Mar 2019 - 6 Mar 2020) |

| JD Sports Fashion | JD. | 44% |

| Henry Boot | BOOT | 33% |

| Barratt Developments | BDEV | 33% |

| 4Imprint | FOUR | 32% |

| Taylor Wimpey | TW. | 26% |

| Bellway | BWY | 25% |

| Savills | SVS | 24% |

| Redrow | RDW | 21% |

| Clipper Logistics | CLG | 3.3% |

| Macfarlane | MACF | 2.8% |

| National Express | NEX | -3.2% |

| Legal & General | LGEN | -7.5% |

| DCC | DCC | -8.8% |

| Hays | HAS | -12% |

| Robert Walters | RWA | -24% |

| Ted Baker | TED | -86% |

| FTSE All Share | - | -2.7% |

| O'Shaughnessy Growth | - | 6.3% |

Source: Thomson Datastream

Normally the screens run in this column are regarded as a source of ideas for further research, but Mr O’Shaughnessy conceived this screen as an end in itself based on a portfolio of 50 stocks. That said, the relatively diminutive nature of the UK market compared with the US market for which the screen was conceived, means I’ve never had enough results to build a 50-stock portfolio. Just eight stocks pass the screen’s criteria this year. The criteria are:

Value criteria: A price-to-sales (P/S) ratio of 1.5 or less.

Growth criteria: Earnings growth in each of the past five years.

Momentum criteria: Mr O'Shaughnessy's original screen was based on selecting the 50 stocks with the best one-year momentum. Since first publishing he has said that shorter periods can also work well. I focus on three months.

Stocks that are valued at a low multiple of sales tend to have low profitability. But the upside that is often associated with this kind of situation is that profitability can improve, which in turn can drive a rerating. I’ve taken a closer look at one of the stocks highlighted by this year’s screen below to give a flavour of the output. Fundamentals relating to all the screen’s choices are detailed in the accompanying table.

Eight Cornerstone Growth Shares

| Name | TIDM | Mkt Cap | Price | Fwd NTM PE | P/S | DY | EPS grth FY+! | EPS grth FY+! | 3-mth Mom | Net Cash/Debt (-) |

| Morgan Sindall | MGNS | £788m | 1,746p | 11 | 0.3 | 3.4% | 5.3% | 5.2% | 21% | £133m |

| Robert Walters | RWA | £350m | 487p | 12 | 0.3 | 3.2% | -15% | 22% | -5.3% | £10m |

| Hilton Food | HFG | £805m | 985p | 23 | 0.5 | 2.2% | 4.6% | 13% | -2.5% | -£305m |

| Macfarlane | MACF | £150m | 95p | 11 | 0.7 | 2.6% | 36% | 3.9% | -0.6% | -£39m |

| Bunzl | BNZL | £6.4bn | 1,918p | 15 | 0.7 | 2.7% | -2.4% | 3.3% | -9.9% | -£1.7bn |

| 4imprint | FOUR | £815m | 2,910p | 21 | 1.2 | 2.2% | 15% | 5.6% | -5.8% | $39m |

| Kenmare Resources | KMR | £241m | 220p | 7 | 1.3 | 1.0% | -9.5% | 3.4% | -0.9% | -$1m |

| Bellway | BWY | £4.4bn | 3,585p | 9 | 1.4 | 4.2% | -5.5% | 4.1% | 5.6% | £186m |

Source: S&P CapitalIQ, as of 6 Mar 2020

Bunzl

Over the past decade, as the yields on government bonds have fallen to unprecedented lows, the concept of 'bond-proxy' shares has become popular. These are shares in reliable companies that have shown an ability to grow their dividend year in and year out. As interest rates paid by safe bonds have been pushed lower, reliable dividends have looked ever more attractive, causing the valuation put on bond-proxy shares to rerate higher. Many believe the rerating has become too extreme and that the risk of a fall in valuation now overshadows the assurance of reliable dividends. Indeed, the fallout from the coronavirus may provide vindication for these fears.

Distributor Bunzl (BNZL) is a great example of the rerating-de-rating rollercoaster in action, although the major de-rating happened almost a year ago.

Until last April Bunzl was something of a bond proxy poster child, with its shares changing hands at a peak valuation of 24 times earnings forecast for the next 12 months (NTM). But when the company told investors that sales growth was slowing (hardly disastrous news) the shares tanked, losing almost a fifth of their value over the next month. Almost a year on, and the shares have shown no meaningful sign of reclaiming former highs, and currently change hands at 15 times forecast NTM earnings.

But while trading conditions are challenging and forecast earnings for 2020 have been downgraded by 5 per cent over the past 12 months, there are also still things to like about the company. This begs the question of whether investors assessing the investment case should be looking in the rear-view mirror to the long-term track record or to the near-term outlook.

Track record

Bunzl is an international distributor of essential – and generally very dull – everyday items to other businesses. Its three largest geographic markets are North America at 58 per cent of sales and half underlying profit, followed by Europe, at a fifth of sales and 28 per cent of profit, and the UK at 14 per cent and 13 per cent.

It operates in a range of specialist areas. Many of its end markets have modestly defensive characteristics – such as food services at 29 per cent of sales, grocery at 26 per cent, safety at 12 per cent, and cleaning and hygiene at 12 per cent. That said, the company is far from immune to the ups and down of the global economy, with long-term organic sales growth targeted at gross domestic product (GDP) plus about 1 per cent. The reliability of demand is also underpinned by the vital role played by Bunzl products – such as toilet roll, food packaging, washing-up gloves and first-aid kits – in the day-to-day operations of its customers.

Meanwhile, Bunzl’s scale and its focus on customer service provide it with a competitive advantage in the specialist areas in which it operates. The efficiencies it can achieve with sourcing and logistics also mean it can offer compelling savings (both on cost and working capital) to businesses that outsource procurement to it. The increased importance being put on sustainability could also help make its expertise in product sourcing more valuable. Nevertheless, underlying operating margins at 6.8 per cent are nothing to write home about and the business relies on high turnover to create value for shareholders.

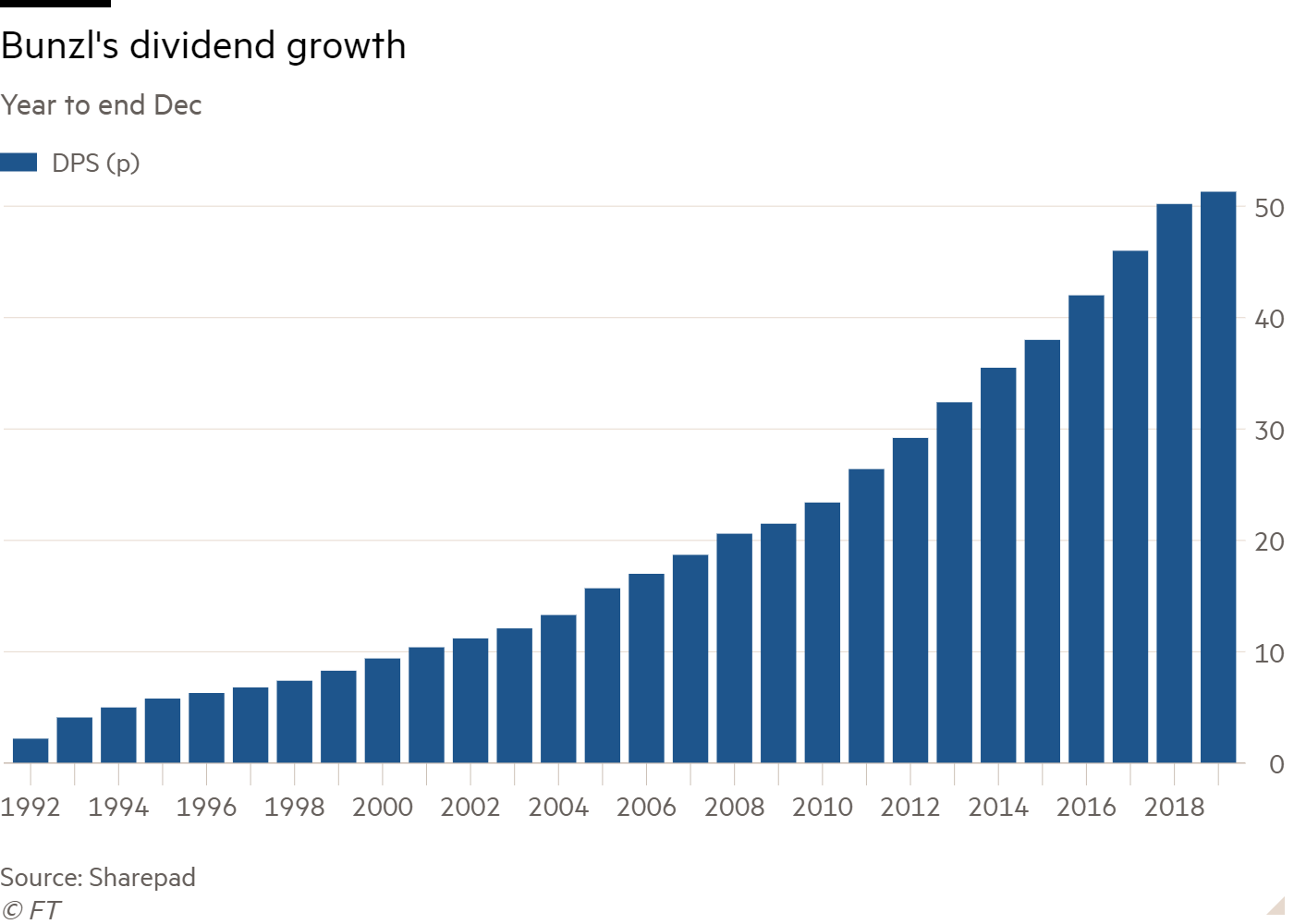

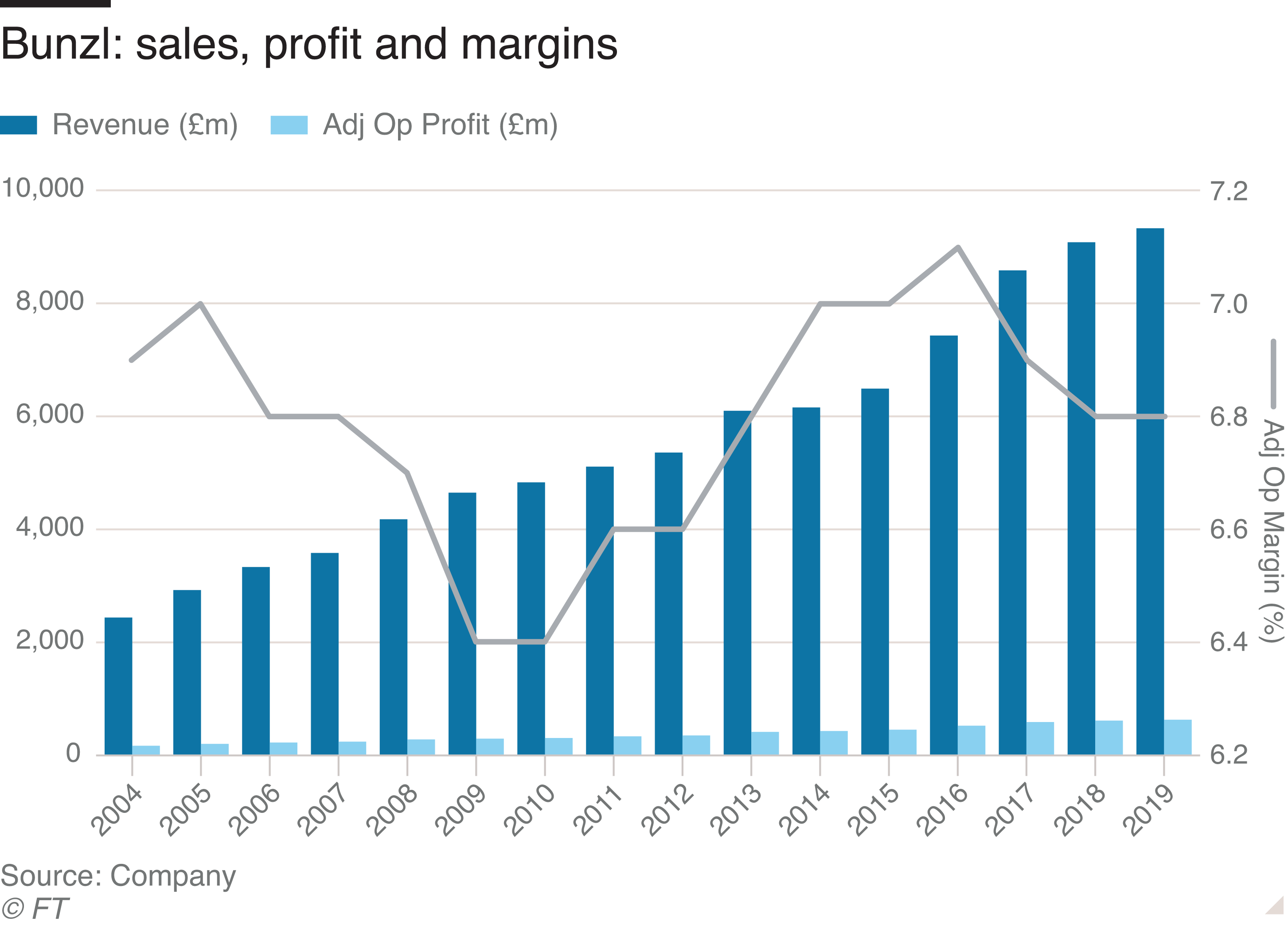

But for bond-proxy hunters, the real testament to the attractions of Bunzl’s business is its long-term track record. The dividend per share has risen consistently for 27 years, while both sales and profits managed to power ahead even through the financial crisis (see charts).

Broken dreams

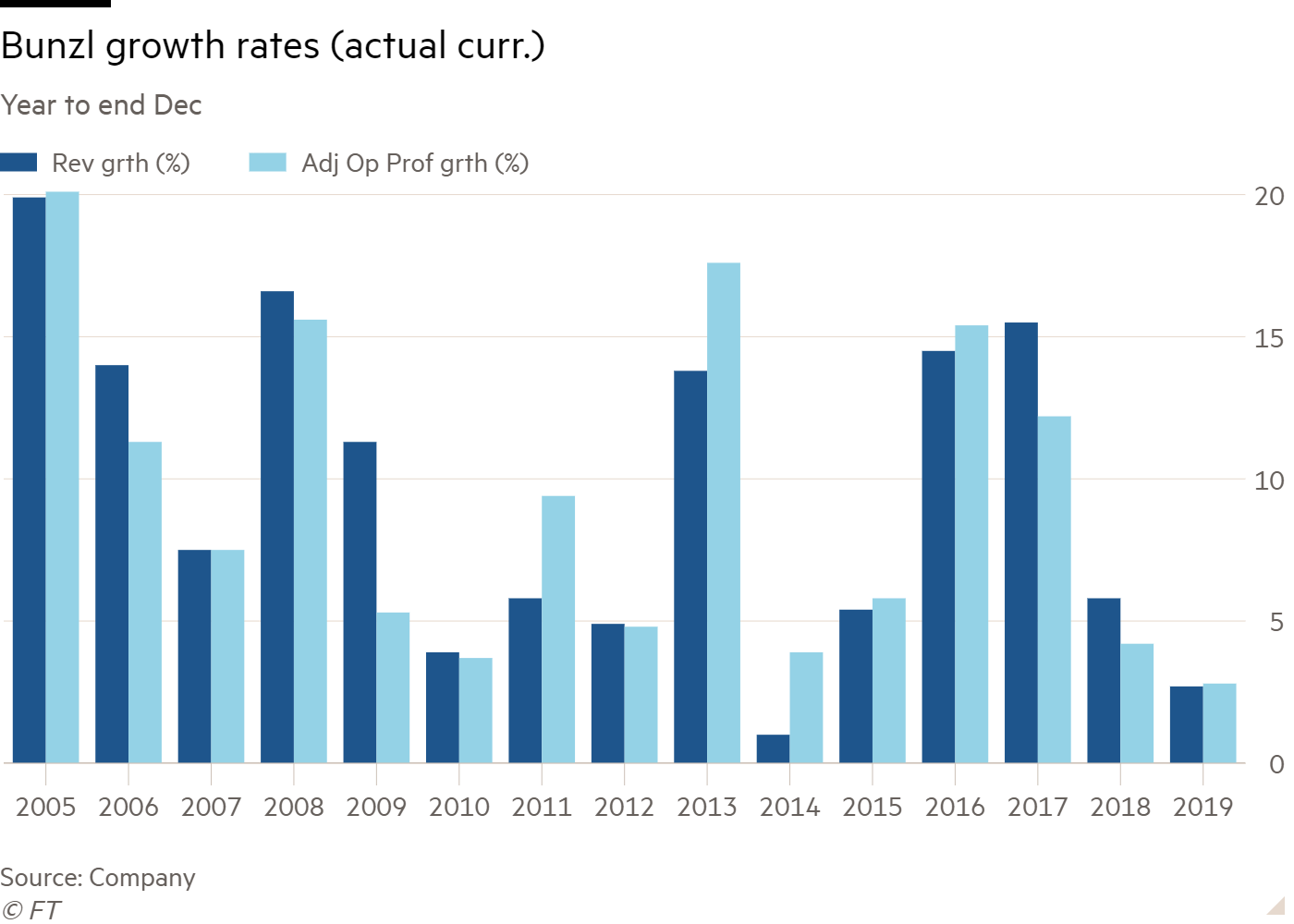

Unfortunately, 2019 gave cause to question the impenetrability of Bunzl’s steady growth story. The growth rate of sales and adjusted profit (at actual currencies) during the year was actually worse than at the company’s lowest point during the financial crisis (2010).

The problems Bunzl has recently faced are twofold. Firstly, following a strong 2018, demand began to slow in the second quarter of last year. Trading is expected to continue to be challenging in the early part of this year, too. Aside from a general slowdown in the global economy, a key reason for the weakness was that the company’s largest US grocery customer pushed down prices and changed the specifications of its orders. In all so-called “organic” sales, which exclude the contribution of acquisitions, fell 0.2 per cent in 2019. What’s more, the coronavirus could cause major disruption to procurement and demand depending on the ultimate severity of the outbreak and the international policy response.

Without doubt, the trading slowdown is disappointing and coronavirus is a big worry, but these issues would not have been so keenly felt had Bunzl’s main growth engine (acquisitions) not also dropped off.

Buying growth

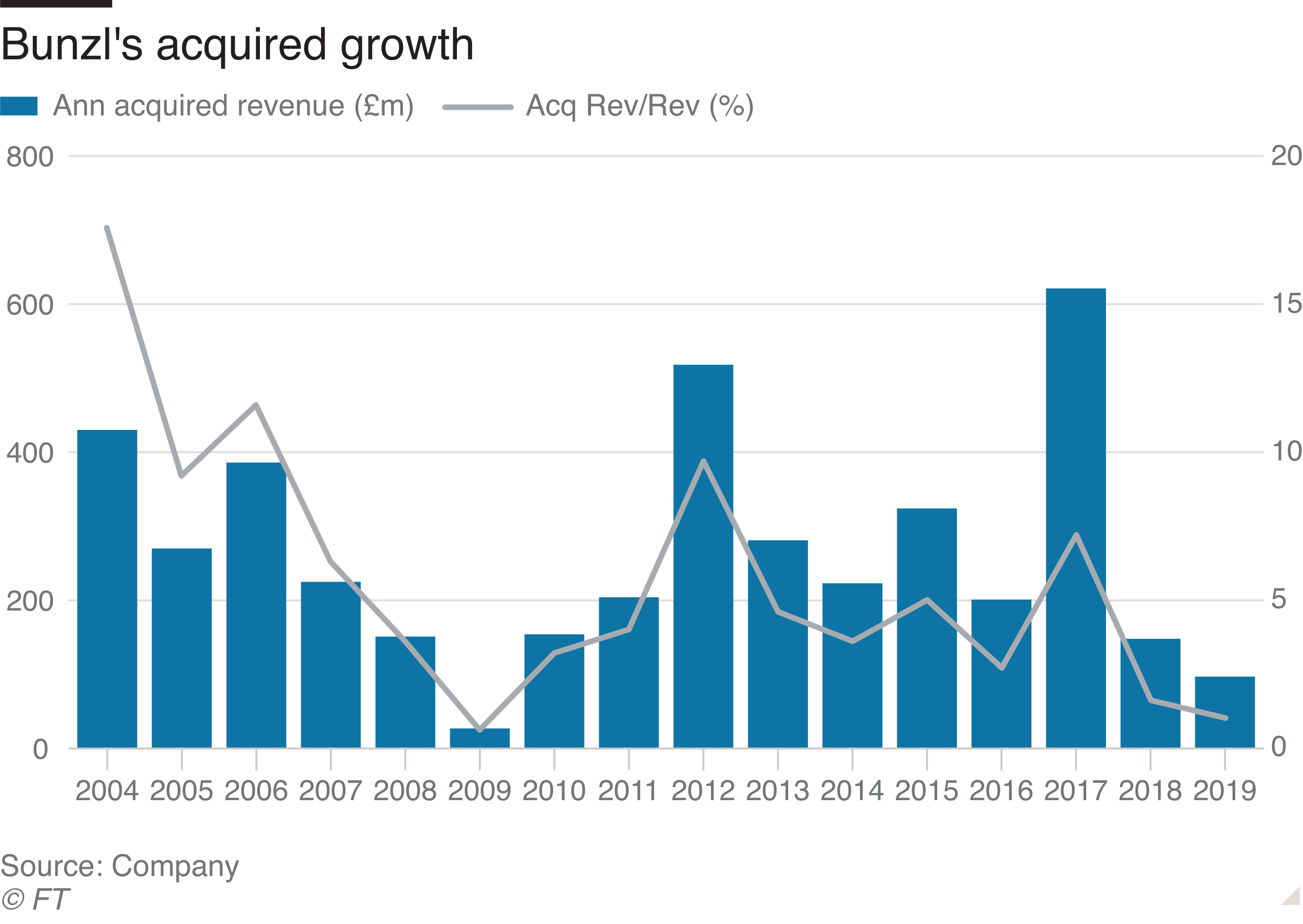

Indeed, the second recent issue for growth is that following a big year for acquisitions in 2017, dealmaking slowed markedly for the next two years. Indeed, annualised revenue added through acquisition in 2019 was the lowest in a decade.

This really matters because historically about three-quarters of Bunzl’s growth has come from acquiring other companies. The hunting ground is fertile, as markets are very fragmented, with Bunzl competing with many smaller national and regional players. Bunzl’s scale puts it in a good position to cut duplicated costs when it buys and integrates rivals.

While there may not be much reason to be positive about growth based on the near-term trading outlook, it’s a different story when it comes to acquisitions. Bunzl made three acquisitions in the first two months of 2020 that have added £284m of revenue on an annualised basis. This is more than the total annualised revenue added through acquisition for the past two financial years of £245m. Furthermore, management describes the acquisition pipeline as strong. As long as Bunzl retains a strong acquisition discipline, a silver lining to the current tough trading environment could be that it motivates sellers.

The $64k questions

The $64,000 question for investors in acquisitive companies is whether deals are actually creating value for shareholders. Overpaying for businesses or purchases based on a flawed strategic rationale can often cause value to be destroyed.

Bunzl’s strategy is to make many small acquisitions. It has bought 153 businesses over the 15 years to the end of 2019 for a total of £3.4bn. This kind of strategy is generally considered a more reliable way of creating value than 'transformational- mega-deals that routinely end in disaster.

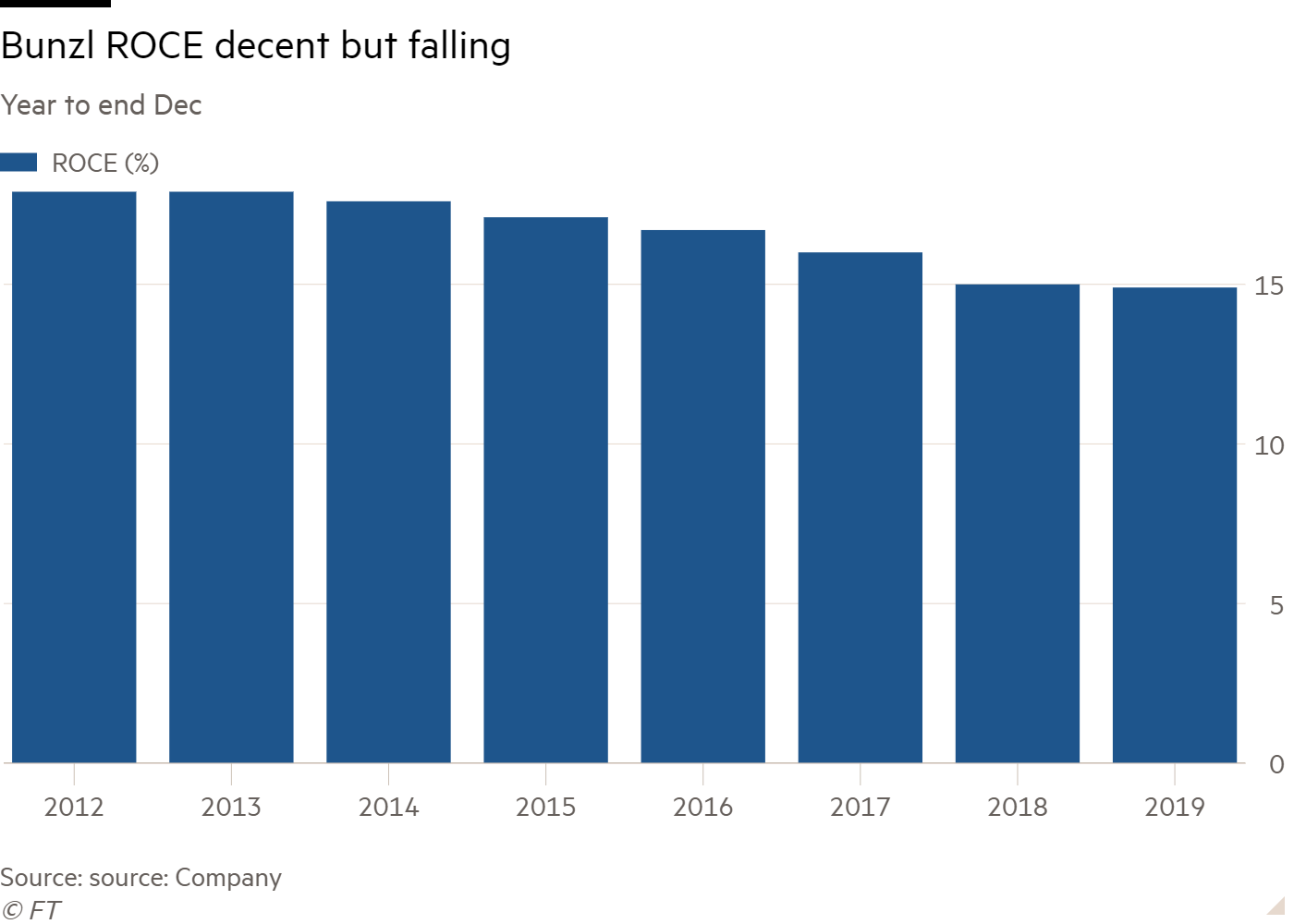

A good check on whether an acquisition strategy is working for shareholders is whether the acquisitive company is able to maintain a good level of return on capital employed (ROCE). The idea here is that if returns (including acquisition-related goodwill and amortisation) are falling and low, then acquisitions may not be serving shareholders well. And if the return on money invested in acquisitions is below a company's cost of capital, shareholder value is actually being destroyed.

On this front, it is not good that Bunzl’s return on capital has been declining for some time (see chart). Effectively, over the years Bunzl appears to be getting less bang for every buck invested in the business – agnostic to whether said buck is invested in acquiring businesses or the existing business. That said, ROCE is still at an okay level: 14.6 per cent on the company-defined measure and 11.9 per cent on SharePad numbers.

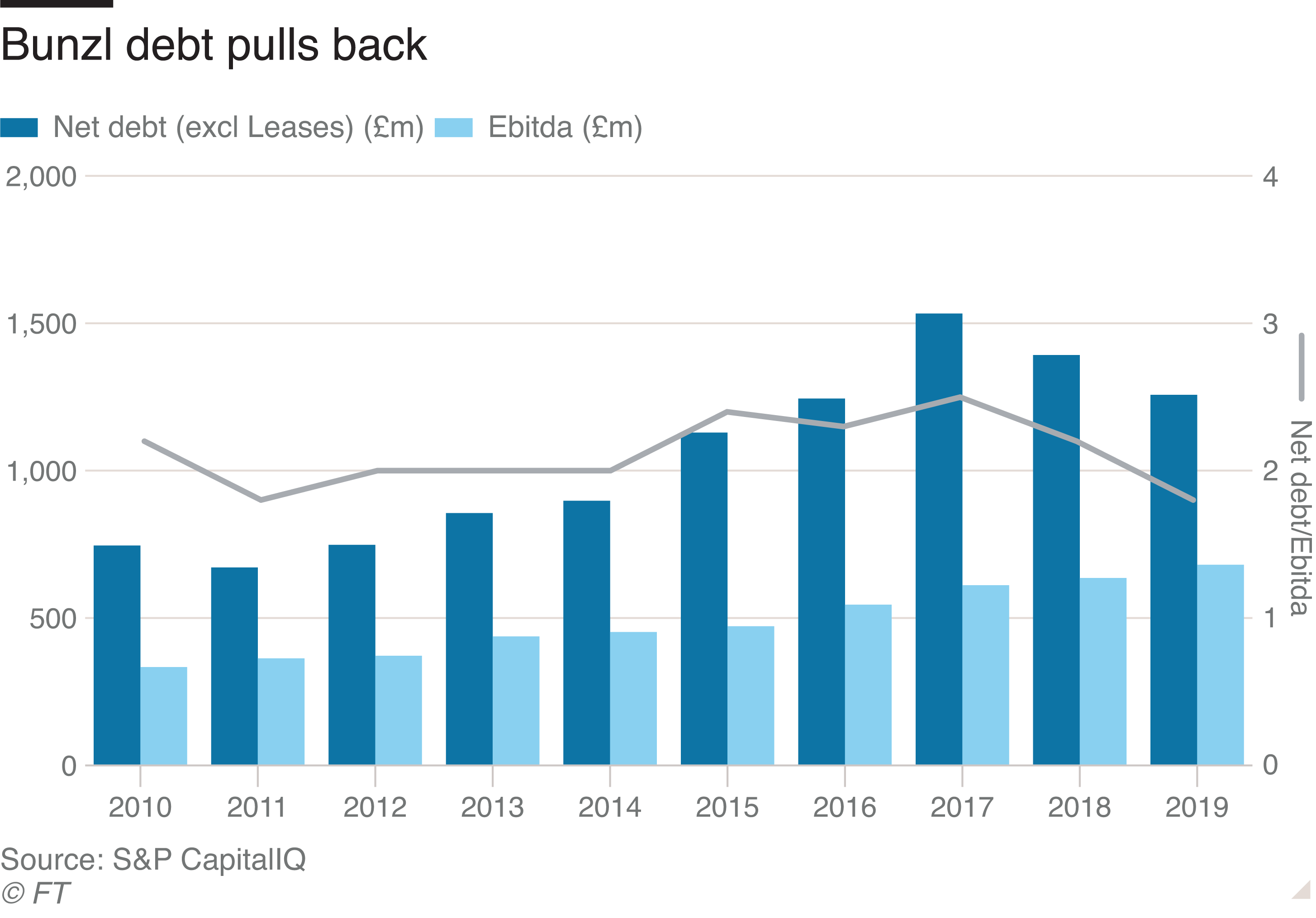

A definite feather in Bunzl’s acquirer cap is that its cash generation means it has been able to self-fund acquisitions while keeping debt at sensible levels. Indeed, the drop-off in acquisition activity over the past two years has caused a marked fall in net debt, and the ratio of net debt to cash profits (see chart). This puts Bunzl in a good position to fund a pick-up in purchases.

Value

The real crux of whether Bunzl shares look attractive at the current price comes down to whether it should be judged on its long-term track record or the less enticing near-term outlook. For a company with the characteristics of Bunzl, especially in light of the pick-up in acquisition activity, there is a good argument in favour of putting more weight on the history rather than forecasts. But the downward trend of return on capital is a concern.

The share price is not in bargain basement territory, but nevertheless looks fairly attractive from a historical perspective. A rerating to bond-proxy-poster-child highs offers about 40 per cent upside based on the 10-year valuation range based on enterprise-value-to-forecast-sales (EV/Fwd Sales). A warming to bond proxies could be prompted by coronavirus-related cuts to interest rates, but as these cuts are in response to an event that should remind investors of the risks of overpaying for shares, the relationship between rates and ratings could work in reverse this time. Still, there is also upside (13 per cent) were the valuation simply to retrace to the 10-year median level.

Coronavirus aside, a pick-up in EPS growth due to the recent pick-up in acquisitions may well prompt an improvement sentiment towards the shares. That said, the long-term decline in return on capital is reason to be circumspect on what would otherwise look like a promising story.