- A disappointing 3 months for Blue Chip Momentum

- Is the value rotation still on?

- Long-term performance underlines the power of momentum

- 10 new Longs and Shorts for the coming three months

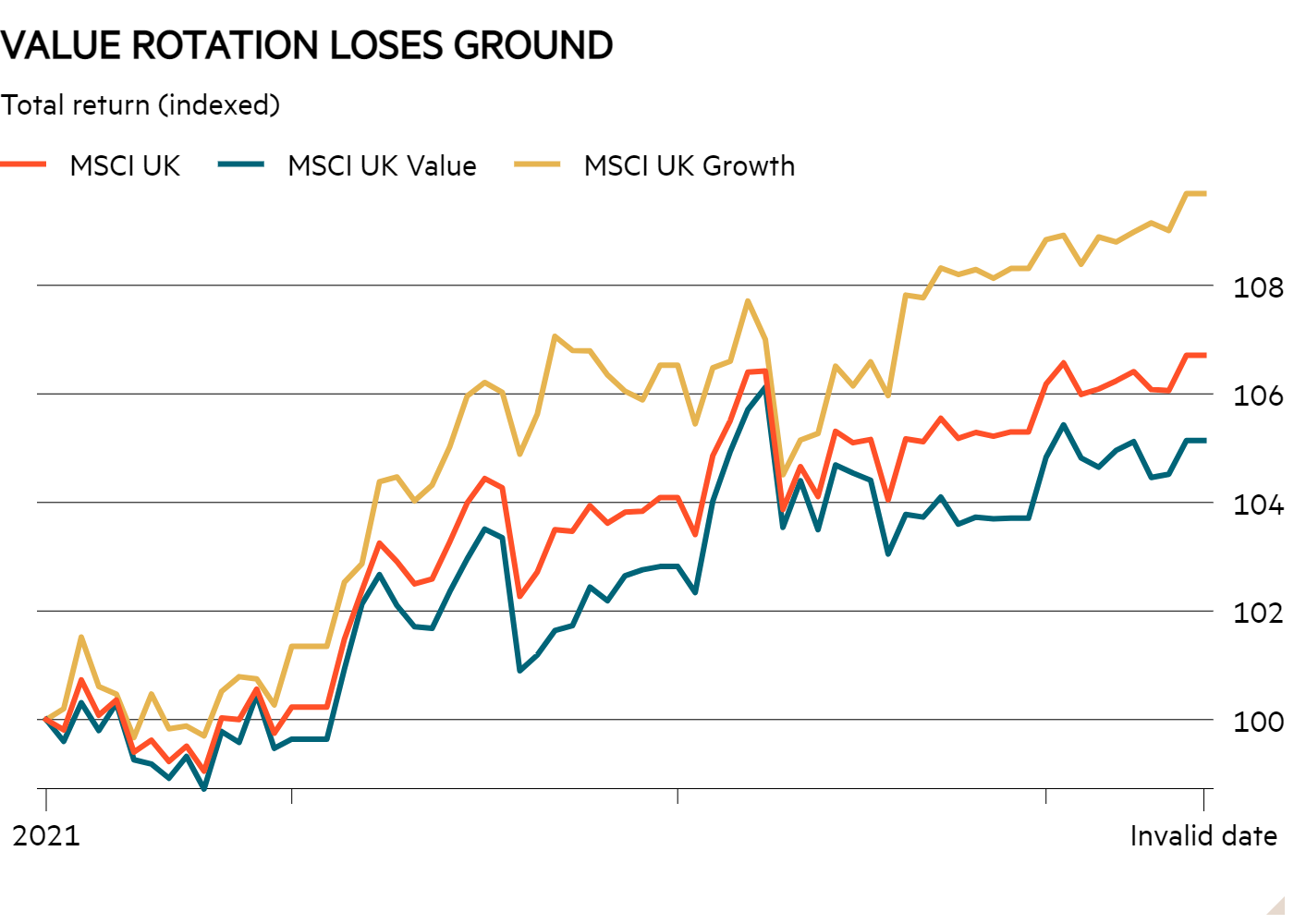

While there has been no lack of headlines about the value revival, in the past three months it seems to have lost a bit of steam. Indeed, despite all the bluster, the MSCI UK Value index has produced a 5.1 per cent total return over the past quarter compared with 6.7 per cent from the MSCI UK index and 9.7 per cent from UK Growth.