Primark looks well-placed to keep on thriving despite not having an online business and the increased scrutiny of fast fashion. The business is immensely valuable to its owner, Associated British Foods (ABF). So much so that it could probably fetch a price tag close to its current market capitalisation in the unlikely event of it being sold. This suggests that AB Foods’ shares are attractively valued.

A retailing phenomenon

Primark's promise of amazing fashion at amazing prices has been a big hit with consumers and shareholders alike. The business started in Ireland back in 1969 and is now one of the biggest fashion retailers in Europe and the biggest in the UK by sales volume.

The company’s success is down to its business model, which allows it to sell desirable fashion items at unbelievably low prices. The strength of its brand has been shown very clearly in the past year. Despite having to close its shops during lockdowns and losing market share to online sellers and supermarkets, the company quickly recovered what it had lost when it reopened and suffered far less damage to its profits than some of its peers. It would be no surprise to see it repeat this feat in the coming months.

Yet, businesses such as Primark are treated with suspicion. Many believe that it’s not possible to sell clothes as cheaply as it does without someone else paying the price. The main accusation is that it pays third-world workers very low wages to make its clothes and is therefore profiting from unethical behaviour.

Primark has denied this and puts its ability to sell cheaply down to a number of factors:

- It buys and sells huge volumes of items. This gives it vast buying power which it can pass on to consumers in the form of lower prices.

- It does not advertise and saves money by relying on word of mouth and social media to promote its business.

- Its products do not come with expensive hangers, tags and labels.

- It has a very efficient supply chain which can shift items to its stores in large volumes very quickly.

- A very good team of buyers that can source leading fashions at low prices.

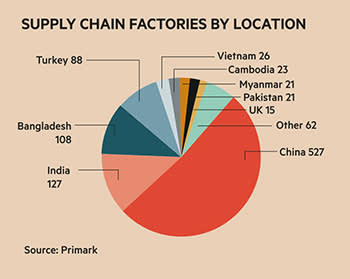

There is also no doubt that it benefits from being supplied from countries where the cost of labour is incredibly cheap compared with the western world. It is supplied from more than 1,000 third-party factories, over half of which are based in China – with significant numbers also being supplied from countries such as India, Bangladesh, Turkey and Pakistan. Very little of what it sells is made in the UK.

The thing is, with the exception of bespoke, upmarket clothing brands which sell at much higher price points, virtually every major fashion retailer is following the same supply chain model. Pick up a pair of Levi's jeans that can be priced upwards from £80 and look at the label and you will find that it may have been made in Pakistan or Turkey. The quality of Primark clothing is the subject of much debate, but it’s hard to argue that it's ripping consumers off with high prices for cheaply made stuff.

The workers in the factories it uses may be on very low wages compared with the West, but all the factories have to comply with a code of conduct on issues such as workers rights, living wages, unionisation and working hours. They are audited regularly to see that they comply.

Yet, Primark’s success is not solely down to its cheapness. The company is an innovative retailer and has wooed millions of customers over the years by making its stores destinations in their own right. It has done this by starting out with basics such as window presentations and LED lighting displays to free wifi in shops and trend rooms where it can showcase its changing fashion offers.

While its seasonal and essentials ranges make up more than half of its sales, licensed products have been a big part of its customer offer. Primark has partnered with companies including Disney, Warner Brothers, Netflix and gaming brands to offer clothes and accessories. Some of its stores have had Harry Potter themes while many bigger stores offer cafes, and hair and beauty services.

Another big success in recent years has been the launch of its PS beauty products range which aims to offer quality products at very low prices.

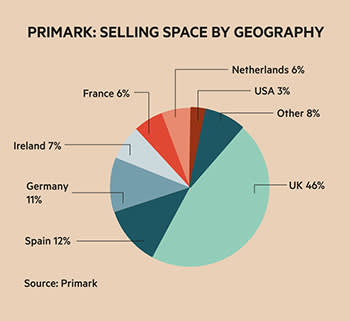

Primark made its first venture into Europe when it opened a store in Spain in 2006. It now has close to 400 shops in 13 countries which will become 15 over the next year when it opens in Prague in the Czech Republic this year and in Slovakia next year. The UK now accounts for less than half of its total selling space.

The average size of a Primark store is just under 42,000 square feet (sq ft), but this is skewed somewhat by 16 very big city centre stores across Europe which accounted for 13 per cent of its total sales before Covid-19 came along. Its Birmingham High Street store is a massive 160,000 sq ft.

Pre-Covid, Primark had been able to grow its revenue and profits quite nicely. A criticism of the business in recent years is that growth from existing stores in general has been hard to come by and that most of the growth has come from increases in selling space.

| Primark: Key financials | ||||||||

|---|---|---|---|---|---|---|---|---|

£m | Revenues | Op Profit | Op margin | EBITDA | Capex | FCF | Assets | ROA |

2010 | 2730 | 341 | 12.5% | 443 | 214 | 229 | 1892 | 18.0% |

2011 | 3043 | 309 | 10.2% | 409 | 323 | 86 | 2310 | 13.4% |

2012 | 3503 | 356 | 10.2% | 488 | 329 | 159 | 2423 | 14.7% |

2013 | 4273 | 514 | 12.0% | 665 | 220 | 445 | 2677 | 19.2% |

2014 | 4950 | 662 | 13.4% | 833 | 394 | 439 | 2948 | 22.5% |

2015 | 5347 | 673 | 12.6% | 846 | 351 | 495 | 3126 | 21.5% |

2016 | 5949 | 689 | 11.6% | 891 | 466 | 425 | 3942 | 17.5% |

2017 | 7053 | 735 | 10.4% | 986 | 519 | 467 | 4245 | 17.3% |

2018 | 7477 | 843 | 11.3% | 1112 | 533 | 579 | 4556 | 18.5% |

2019 | 7792 | 969 | 12.4% | 1284 | 382 | 902 | 4775 | 20.3% |

2020 | 5895 | 362 | 6.1% | 932 | 476 | 456 | 7372 | 4.9% |

| Source: Annual reports/Investors Chronicle | ||||||||

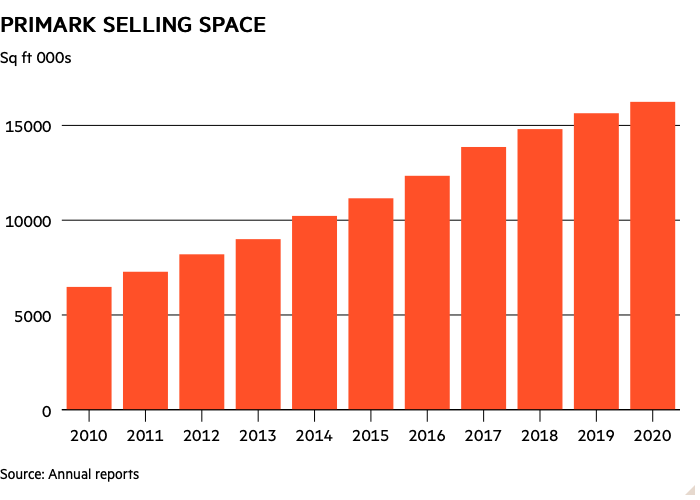

Covid cost Primark around £650m in lost profits in 2020 and is likely to have reduced them to a breakeven level in the first half of its current financial year to March 2021. Before then, it has been able to add selling space at a rate of 0.7m to 1m additional sq ft per year over the past decade while keeping operating margins in the 10-12 per cent range. This has allowed a very respectable return on operating assets (ROA).

Primark makes large purchases in US dollars and sells in sterling and euros. The value of the dollar can therefore have a significant impact on profit margins from year to year. A higher dollar tends to weaken margins with the opposite occurring when the dollar is weaker.

Margin stability is also attributable to the success of the company’s buying team, while in recent years Primark has been very good at selling its ranges quickly – it typically gets new products to its shops within six weeks – and minimising price markdowns and the hit to profit margins these can cause.

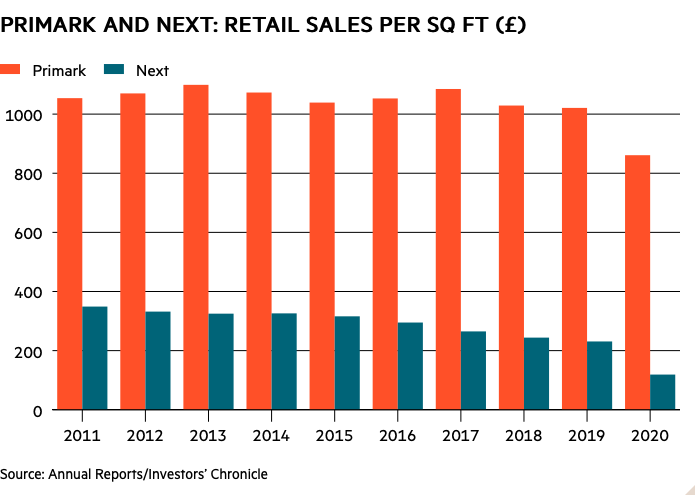

The sheer volume of what Primark sells can be seen in its sales densities (sales per sq ft of selling space) and comparing them with other high-street fashion retailers.

Before Covid-19, Primark had been very good at keeping its sales densities relatively stable and at a very high level. In 2019, it was selling more than four times in value per sq ft than Next. This is even more in volume terms given that Primark's average selling price is much lower than Next’s.

While Next’s sales densities have collapsed in its high-street business and profit margins have almost halved between 2015 and 2020, the fact that Primark has maintained its performance on both measures is testament to how good a retailer it is.

No online sales presence but the internet is key to its success

Primark does not sell online. This has cost it sales and profits in lockdowns but its business model is not suited to it. Making money selling clothes online is not easy because the cost of doing business is very expensive. Huge investment is needed in websites, IT systems, warehousing, deliveries and processing returns.

It’s very hard to make acceptable profit margins at Primark’s low selling prices while the attraction to the customer buying a t-shirt for £3 disappears when it costs more to deliver it. Primark believes that it can do better by selling huge volumes from its bricks-and-mortar stores instead and the numbers seem to prove that it may be right.

That’s not to say that the internet is not a key part of Primark’s business strategy. It is. It has been building up its presence on social media channels to more than 22m followers, while it uses channels such as YouTube to demonstrate its products and promote its brands.

Primark.com has also become a key site to promote the business. There is a section on the site called Primania, which is Primark’s own social platform where fans post their favourite Primark purchases online.

Where’s the future growth going to come from?

Primark has immense brand power among a wide range of customer demographics. The fact that you can go into its shops and buy plenty of clothes for very little money is something that has obvious attractions and is hard to compete against. There is still plenty of scope to expand the company’s footprint.

Primark is very bullish on its ability to expand in markets such as France, Spain, Portugal and Italy where the performance and reception of the brand has been strong. It also has very little presence in eastern Europe where its low-price model arguably has lots of potential. There is also still scope to expand in smaller UK towns which has proved to be very successful in the past.

Not all of Primark’s foreign ventures have gone smoothly. Its venture into the US has yet to make a profit after five years as the company has struggled to find the optimal store size for the market. It has also suffered from a brand image problem related to fast fashion in Germany. Both issues seem to be close to being fixed.

However, investors should expect growth to be controlled at a rate of up to 1m extra sq ft of selling space per year. This means that the percentage rate of growth will be smaller as the size of the store base gets bigger.

There have been concerns that a change in working patterns towards more home working may hurt Primark’s city centre stores and result in lower sales. This has been the case when stores have reopened after lockdowns, but it is too early to tell if any permanent damage has been done as the company recovered the market share it lost in the UK by selling more in out-of-town stores.

Could Primark suffer from a backlash against fast fashion?

Cheap clothing currently has a bad press. Rivals such as boohoo (BOO) have come under scrutiny for the working conditions at some of its suppliers’ factories. There is a growing view that the cost of very cheap clothing is paid by the workers making it in countries far away.

The other concern is that the business model of fast-fashion retailers is based on encouraging overconsumption and a throw-away culture. The vast use of polyester and certain chemicals means there are good reasons to worry about large amounts of disused clothes ending up in landfill sites, harming the environment.

Primark is trying to counter this with initiatives such as giving unsold clothes to charities and encouraging recycling within its stores. It is also increasing its use of sustainable cotton in its products while it has sold its products in brown paper bags for years. The company also argues that its store-based model has a lower cost and lower carbon footprint than one based around masses of delivery vans.

At the moment, it seems that the growing awareness of the downside of cheap clothing has yet to offset the pull of bagging a bargain at Primark.

The value of Primark suggests AB Foods shares could be undervalued

For some time, Primark has been the biggest provider of profits and value to its owner. Primark is unlikely to ever be sold off, but it is worth a large chunk of AB Foods' current market capitalisation of £19.5bn.

Peers such as Hennes & Mauritz (SW:HM-B) and TJX (US:TJX) trade on prospective 2022 calendar EV/Ebit multiples of 20 times and 18 times, respectively. Without Covid-19, Primark would probably be making over £1bn of operating profits which would suggest a valuation of £18bn-£20bn.

However, according to FactSet estimates analysts currently think that Primark profits are not going to get back to 2019 levels that quickly. 2021 is going to be difficult with the business likely to have made no money in the first half and current full-year forecasts of £371m. Profits are then expected to rise to £782m in 2022 and £892m in 2023.

This suggests that analysts think that Covid-19 will permanently reduce city centre shopping levels across Europe and the profits of Primark’s 16 flagship stores. This is possible, but it could also be too bearish an outlook. The company has already shown an ability to bounce back quickly after previous lockdowns and could do so again. If so, then these profit forecasts could be much too low.

Primark is well-placed going into the reopening of economies. It has a good stock position which means that it doesn’t have to buy as much as it usually does and should generate lots of free cash flow over the spring and summer. Without further lockdowns, I think there’s a strong possibility that Primark profits can rebuild quickly.

ABF’s sugar business and the volatility of its profits has often offset the good work done at Primark but it is in its best position for years and is unlikely to do much damage in the near term. Its food ingredients and agriculture businesses are unlikely to grow much, but are trading very solidly right now.

The company also has a very good grocery business with some great food brands including Twinings, Ovaltine, Ryvita, Jordans and Dorset Cereals. It also has the George Weston Foods business with strong brands in Australia and New Zealand. Granted, the company also has a substantial bakery business with brands such as Kingsmill, Allinson and Sunblest where it is hard to make good money. That said, the grocery business in total should make around £450m of operating profit this year, which suggests that it also contributes a meaningful amount of value to the company.

| AB Foods forecasts | |||

|---|---|---|---|

Year (£m) | 2021 | 2022 | 2023 |

Turnover | 14,325.40 | 16,336.20 | 17,083.30 |

EBITDA | 1,883.60 | 2,428.40 | 2,564.40 |

EBIT | 1,051.80 | 1,550.90 | 1,683.20 |

Pre-tax profit | 925.8 | 1,447.80 | 1,565.20 |

Post-tax profit | 631.4 | 1,126.50 | 1,225.00 |

EPS (p) | 80.5 | 139.1 | 151.8 |

Dividend (p) | 36.4 | 48 | 52.1 |

Capex | 744.8 | 823.7 | 878.6 |

Free cash flow | 647.8 | 1,067.80 | 1,265.30 |

Net borrowing | 1,876.10 | 1,554.60 | 961.6 |

| Source: SharePad | |||

Given the value of Primark and the prospects of a strong profit recovery, I think AB Foods’ shares are arguably cheap and look good value on a forward 2022 price/earnings (PE) ratio of 17.7 times at 2,458p.