Nearly two years ago, we took a broad look at the real estate market and pointed out the uncertainty over valuations generated by a possible (then) vote to leave the EU. Our view at the time, which we shall repeat, is that life goes on, and that property values will continue to be fundamentally governed more by the various factors that influence what remains a highly diverse sector rather than by any temporary hysteria over Brexit. And indeed, the health of the real estate sector remains inextricably linked to the health of the economy, which has been far more resilient than politically-motivated pre-Brexit warnings suggested.

Yet it is true that the face of the real estate market has changed to some extent, in part due to the risk aversion factor adopted by many investors as the Brexit negotiations twist and turn. However, as the process continues on its weary way, the fog masking the ultimate nature of Britain’s exit will slowly start to dissipate, and so should the defensive discount on asset values seen across the property sector.

Of course, no-one can predict what the exit terms will comprise, but the consensus view suggests that changes will not be radical: with no majority to play with, the government will find it near-impossible to walk away from negotiations with a so-called hard Brexit. More likely is a compromise agreement that will include passporting rights for UK-based financial institutions. If this were to be the case, then the discounts currently applied to the London office market would clearly be overdone.

If it’s possible to put Brexit to one side for a moment, it becomes clear that many sectors of the real estate market are doing a lot better than expected, although it is also true that some are in better shape than others. According to property adviser Knight Frank, total returns in 2017 were 11.2 per cent, and although expected to be lower at 7 per cent this year are well above the consensus 4 per cent forecast last November.

Activity is likely to be supported by continued interest from overseas investors, who in 2017 were responsible for 85 per cent of all transactional volume in the central London office market, while both UK and overseas investors have been busy in UK regional areas. Retail property owners have suffered mixed fortunes as some adapt better to disruptive changes to consumer behaviour – although the bloodbath on the high street has not materialised. But returns on the industrial side were much healthier, topping 20 per cent in 2017. Returns this year are still expected to be strong, albeit at a much reduced 10 per cent. Much of this will come through higher rents.

There are plenty of factors that could derail these expectations, though. As well as Brexit, there is a risk that the pace of economic growth could slow, although current evidence points to just the opposite. This is not the time to refresh on recent history, but it is very important to point out that anyone of voting age under 30 doesn’t know what a real economy is like. A sustained period of low inflation; the unknown long-term effects of quantitative easing, and the prospect of the UK running a budget deficit for a quarter of a century are all factors that seem to be the norm, whereas even 10 years ago they were not. And as the last week on the markets has shown, it has already become apparent that the path back to normality might have a dampening effect on the valuations of asset classes such as equities and property.

There is also a measure of non-Brexit-related political uncertainty; no-one is factoring in the chance of a Labour government should scrutiny on Mrs May prompts a snap general election. If that happens, then all bets are off – although as veteran investor Nick Leslau recently wrote in trade bible Property Week, the sector's balance sheets "have never been better braced for bad news", with low leverage and cheap borrowing.

Retail and urban logistics: diverging fortunes

These two go together because as some more traditional parts of the retail sector have suffered, so the demand for retail distribution centres has increased. This is an inevitable consequence of the shift in consumer spending habits away from conventional outlets and more towards internet shopping. Retailers are having to adjust by establishing not only a network of major distribution centres, but also a web of smaller warehouses to cater for the last-mile delivery increasingly demanded by customers.

Looking first at the retailers. Planning applications for new shops have fallen for the ninth consecutive year, down 55 per cent since the financial crash, according to peer-to-peer lending platform Lendy. At the same time, vacancy rates have risen to 12 per cent. As well as the shift in consumer buying habits, retailers may also be thinking twice in the light of Brexit and delaying decisions on new store openings. A total of 118 retail businesses went to the wall in 2017, up 28 per cent on a year earlier, while even some of the bigger operators such as Debenhams issued profit warnings and announced plans to close stores, notably Marks and Spencer.

That's unsurprisingly making life very tough for retail park and mall owners, whose shares have dramatically underperformed their logistics-focused peers. One response has been to bulk up, as Hammerson (HMSO) and Intu (INTU) intend to do with their £3.4bn merger announced at the turn of the year. The deal will create the UK's largest property company, with large retail assets such as the Bullring in Birmingham and Bluewater in Kent, but will need to generate noteworthy major synergies to stand still in a challenging market.

For the big-box landlords such as Tritax Big Box (BBOX) and smaller hub specialists such as LondonMetric (LMC) the changing market dynamics are better news, as retailers adapt and more fully embrace multi-channel models. So, while the occupier take-up of big boxes of over 100,000 sq ft fell by more than a third in 2017, this failed to tell the whole story because there is over 7m sq ft of space currently in the hands of solicitors. In fact, the average take-up of space in the past five years was around 18.8m sq ft per year, compared with 15.5m for the previous five years. On top of this, yield compression and rents forecast to grow by over 4 per cent this year suggest that this sector will outperform both retail and office sectors for the next four years.

Offices: tightening supply

After some savage negative revaluations in 2016, last year saw a recovery in office values, but shares in the major office landlords were still trading at a significant discount to net asset value (NAV). A common theme running through London landlords is risk reduction. Giants such as British Land (BLND) and Land Securities (LAND) have been steadily building out their development arms, cutting back on loan-to-value ratios and limiting development to assets on a largely pre-let basis.

This all makes sense given that investor sentiment is pencilling in far worse than is actually happening. In fact, by selling mature assets at a premium to book value, the development arm is being financed without recourse to more fundraising. And in the case of British Land, the management team has adopted a far more sanguine view on the outlook, taking advantage of the share price weakness to buy back some of its own shares.

Other predictions of London turning into a dustbowl city have been neatly kicked into touch by the likes of Derwent London (DLN), where rents on its portfolio of London offices have continued to rise against a backdrop of falling vacancies and strong demand from technology companies, a sector it's actively targeting and which saw record levels of investment in 2017. And only last month it took delivery of the first Crossrail site to be delivered to a developer just a year before the new rail link opens. This is a potential gold mine comprising 209,000 sq ft of offices, 36,000 sq ft of retail space and a 40,000 sq ft theatre all sitting over the top of Tottenham Court Road station.

However, even including such attractive locations, investment in new office space is likely to be weaker than in recent years, and this in itself could help to underpin rental values in central London. Meanwhile, demand from small and medium-sized enterprises looking for space in and around London shows no signs of abating, which has seen shares in Workspace (WKP) nearly doubled in the past 18 months. The small office landlord is receiving more than 1,000 enquiries every month, yet its shares still trade at a discount to NAV.

And there is plenty happening outside London, too. The large regional hubs such as Manchester, Birmingham, Bristol and Leeds are enjoying something of a renaissance for several reasons. In crude terms, the regions are playing catch-up with London, and the yields on offer are attracting significant overseas investment. A scarcity of decent office space is driving rents higher, and that shortage was exacerbated by a dearth of new construction in the wake of the financial crash, and, more recently, a steady erosion in office space as more are converted for residential use after recent changes to planning laws. However, the pace of this activity began to slow in the second half of 2017, as office owners switched their focus back to strengthening demand from business customers.

Residential: institutional interest

That's also good news for residential property owners, bringing a further constriction of residential supply that's supporting house prices. Until fairly recently, there has been no obvious conduit between housebuilders on one side and institutional money on the other. But interest rates have been a key driver in prompting institutions to seek other ways of earning a decent return without climbing up the risk ladder. The continued and chronic imbalance between supply and demand for homes at the more affordable end of the scale has given rise to growing interest in the build-to-rent sector, and a host of real estate investment trusts have been springing out of the woodwork to join a handful of builders who are already tapping in to institutional funds.

New Reits on the block include PRS REIT (PRSR), which floated in May last year. Just recently it announced a second round of fundraising intended to raise around £250m, as well as securing its first debt financing of £200m. The initial fundraising of £250m, together with the new debt facility, will deliver around 3,100 new rental homes. But this is just the tip of the iceberg. Two developments have been announced in Croydon by Greystar Real Estate Partners and Henderson Park that on completion will comprise the world’s tallest modular towers – 44 and 38 storeys. These will be constructed offsite, and the whole project will take just 24 months to complete.

Publicly quoted companies getting in on the act include Telford Homes (TEF) and Watkin Jones (WJG). The attraction here is that building apartments for rent is financed by the investor on a forward funded basis. As an example, M&G Real Estate provides financing through the whole construction operation, leaving Telford with virtually no working capital requirements and minimal risk.

Some property companies continue to battle against headwinds, notably Capital & Counties (CAPC). While its Covent Garden assets are performing well, there are still problems with its 70-acre site in Earls Court where sales have been painfully slow in the face of concerns over London house prices – recent reports suggest WHAT. The latest development there is that the company is in discussions with the local authority to bring forward an enhanced masterplan for increasing the number of homes to be built.

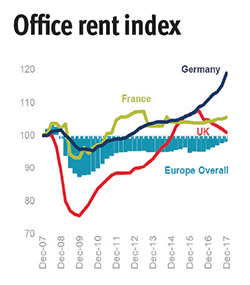

One sector that is well represented in terms of shares that can be bought in London is the German residential and commercial sector. Rent controls that made new construction unrealistic have led to a chronic imbalance between demand exacerbated by an influx of immigrants and a lack of new apartments. Companies such as Phoenix Spree Deutschland (PSDL), Summit Germany (SMTG) and Sirius Real Estate (SRE) are also benefiting from a lack of decent office space as well, and both sectors offer considerable reversionary value yet to be crystallised.

| Rents on the rise | |||||

| Offices | Rents (£/sq ft) | Change Q-on-Q (%) | Change Y-on-Y (%) | Prime yield (%) | Change Y-on-Y |

| London (West End) | 110 | -2.20% | -8.30% | 3.25% | 0 bp |

| London (City) | 67.5 | 0.00% | -1.50% | 4.00% | -25 bp |

| Birmingham (City Centre) | 33 | 0.00% | 3.10% | 5.00% | 0 bp |

| Bristol (City Centre) | 32.5 | 4.80% | 14.00% | 5.25% | 0 bp |

| Cardiff (City Centre) | 25 | 0.00% | 0.00% | 5.75% | 0 bp |

| Leeds (City Centre) | 30 | 0.00% | 11.10% | 5.25% | 0 bp |

| Manchester (City Centre) | 33.5 | 0.00% | 3.10% | 5.00% | 0 bp |

| Newcastle (City Centre) | 23.5 | 2.20% | 2.20% | 5.75% | 0 bp |

| Edinburgh (City Centre) | 33.5 | 0.00% | 1.50% | 5.50% | 0 bp |

| Glasgow (City Centre) | 29.5 | 0.00% | 0.00% | 5.50% | 0 bp |

| Source: Cushman Wakefield, Q4 2017 | |||||

| Logistics | Rents (£/sq ft) | Change Q-on-Q (%) | Change Y-on-Y (%) | Prime yield (%) | Change Y-on-Y |

| London (Heathrow) | 15 | 0.00% | 7.10% | 4.00% | -25 bp |

| Birmingham | 6.75 | 0.00% | 3.80% | 5.00% | -25 bp |

| Bristol | 8 | 0.00% | 0.00% | 5.25% | 0 bp |

| Cardiff | 6 | 0.00% | 4.30% | 5.25% | -50 bp |

| Leeds | 6.75 | 0.00% | 0.00% | 5.25% | -25 bp |

| Manchester | 7.5 | 7.10% | 7.10% | 5.00% | -50 bp |

| Newcastle | 5.5 | 0.00% | 4.80% | 5.50% | -50 bp |

| Edinburgh | 8.5 | 6.30% | 13.30% | 6.00% | -25 bp |

| Glasgow | 7.5 | 0.00% | 15.40% | 6.25% | -50 bp |

| Source: Cushman & Wakefield, Q4 2017 | |||||

| FTSE 350 Reits compared | ||||||

| Name | Ticker | Price (p) | Market cap (£m) | 1-year price change (%) | NAV (p) | Premium/Discount (-) |

| Assura | AGR | 60.4 | 1,439.41 | 6.97 | 45.3 | 33% |

| Big Yellow Group | BYG | 850 | 1,347.51 | 20.57 | 640.8 | 33% |

| British Land | Blnd | 635.6 | 6,272.93 | 4.54 | 939 | -32% |

| Derwent London | DLN | 2870 | 3,199.33 | 10.22 | 3582 | -20% |

| Great Portland Estates | GPOR | 619 | 2,022.46 | -5.78 | 813 | -24% |

| Hammerson | HMSO | 466.6 | 3,705.86 | -17.42 | 771 | -39% |

| Hansteen Holdings | HSTN | 134.9 | 557.07 | 18.65 | 132.5 | 2% |

| Intu Properties | INTU | 207.8 | 2,815.77 | -23.38 | 385 | -46% |

| Land Securities Group | LAND | 937.7 | 6,952.64 | -10.58 | 1,466 | -36% |

| Londonmetric Property | LMP | 171.7 | 1,197.12 | 14.24 | 155.7 | 10% |

| Newriver Reit (Reg S) | NRR | 297.5 | 901.27 | -5.57 | 297 | 0% |

| RDI Reit | RDI | 35.45 | 675.37 | -7.66 | 41.4 | -14% |

| Safestore Holdings | SAFE | 499.8 | 1047.06 | 32.05 | 329 | 37% |

| Segro | SGRO | 554.6 | 5562.23 | 21.51 | 504 | 10% |

| Shaftesbury | SHB | 952.5 | 2926.94 | 6.01 | 952 | 0% |

| Tritax Big Box Reit | BBOX | 141.2 | 1925.4 | -0.42 | 133.3 | 6% |

| Unite Group | UTG | 764.5 | 1841.23 | 24.31 | 669 | 14% |

| Workspace Group | WKP | 948.5 | 1553.7 | 23.02 | 1014 | -6% |

| Source: Thomson Reuters Datastream | ||||||