What’s the single biggest risk to equity prices? We usually consider two big threats ever present on the horizon: on the one hand a global downturn resulting in depressed corporate earnings, which means stocks fall even if earnings multiples are static; on the other the risk that central banks will hike interest rates too quickly, forcing up short-end yields, resulting in a repricing of riskier assets.

The good thing is that usually these don’t come together. If there is a downturn central banks can cut – although their supplies of monetary policy ammunition have not yet been fully replenished. If central banks are forced to hike, it’s because growth is strong and the economy expanding with corporate earnings on the rise. The US right now would seem to be a case in point as the Fed hikes just as earnings in the last quarter jumped an incredible 20 per cent on average.

What really scares investors is a combination of simultaneously soaring inflation and lower growth; leaving central banks forced to tighten in an effort to combat higher prices at precisely the wrong time for the economy.

So it is worrying that increasingly the chatter among investors is about the very real risk that we are heading towards just such a scenario – that is, stagflation; or more accurately a period of stagnant growth, higher unemployment and rising inflation that can only be tamed by higher interest rates, which of course is a disastrous cocktail for asset values, and leads to recession.

Arguably Britain is already going through a bout of stagflation, as growth has been clipped to almost nothing and consumer prices index (CPI) inflation – driven up by external factors such as sterling weakness and higher oil prices – has exceeded the Bank of England’s target for some time. Indeed, the Bank of England faces an uneasy task of balancing the risk of throwing the economy into reverse by raising rates when growth is so lacklustre, against the risk of letting ‘bad’ inflation get out of control, hitting consumer demand and making people poorer.

But Britain, with its unique Brexit circumstances, is not the only country potentially eyeing a period of higher inflation and lower growth. Across the eurozone and the US, in particular, we can see the stars aligning for a nasty bout of stagflation.

But why has this dirty word of economics reared its head again? The world has been enjoying an unprecedented period of synchronised growth as corporate earnings, especially in the US, have soared while inflation in developed economies has been held in check despite the best efforts of central banks. All this points to the economy and equity values remaining supported. Nevertheless, whispers of stagflation have in recent months grown much louder and now fund managers say stagflation is the single biggest risk to equities.

Two arguments

The defining stagflation period was that experienced in the US in the 1970s. The era was characterised by slower growth punctuated by periods of recession and persistently high inflation that eventually hit 13 per cent in 1979.

Two schools of thought exist around its cause. Classical Keynesian economists point to the bad inflation created by the oil price shock of the time pushing up prices on not just gasoline but every consumer good, ultimately forcing the Federal Reserve (Fed) to cause the 1980-82 recession to tame it.

The other, as defined by Milton Friedman, was that inflation could only be explained by an expansion in the monetary base – you could only get inflation if you had more money sloshing around in the system. This view, though radical at the time, is now central to our understanding of monetary policy today. “There has never been inflation without an increase in the quantity of money,” he said. His views are not without their doubters and, if anything, the massive expansion in the money supply under quantitative easing (QE) has proved his views don’t always hold true.

And there are differences. In the 1970s higher inflation expectations had become entrenched by expansionary monetary policy by the Fed. Part of the problem was that the Fed lost credibility in terms of its ability to fight inflation, which meant inflation became unanchored – no one knew how high or how quickly it would rise. That does not seem to be the case today, although the removal of stimulus could create the right conditions for just such a scenario.

Indeed, anchoring works both ways and central banks have anchored inflation expectations for a decade. They provided stability and liquidity in markets; and through forward guidance we were told exactly where yields – and therefore inflation – should be. With the end of QE, inflation expectations could once again become unanchored, free to float off wherever the tide of market expectations take them. Certainly, central bank policy has evolved considerably from the 1970s – they have far more tools and flexibility now than then – but they cannot do anything but tighten if inflation starts to race away.

Today the Fed accepts that inflation will run above its target – despite rates being historically low it cannot afford to step on the gas too quickly. The acceptance by the Fed of higher inflation above its target level this year could be argued as evidence that the central bank is once again faced with the prospect of allowing inflation to run higher to prevent the economy from sliding into recession.

Another thing that is different today is the pressure on wages from big labour – unions had far more bargaining power back in the 1970s to demand higher wages as corporates increased prices, creating a vicious inflationary spiral.

The other difference is that the 1970s inflationary period came shortly after the collapse of Bretton Woods and the unpegging of the dollar from gold, which was a seismic shift in the global monetary system of an order that will not be repeated today. Or will it?

QE time bomb?

In economics, it can be broadly said that the more you do something, the less impact it has at the margins. In many ways that can explain the end of QE.

The monetary policy experiment of the past decade is coming to an end because it’s stopped working. Following the great financial crisis, interest rates were slashed to the bone and QE was unleashed to boost aggregate demand and underpin growth. Now QE has already stopped in the US and the Fed has raised interest rates seven times in two years, while the European Central Bank plans to wind down purchases to zero by the end of the year and is tentatively talking about raising rates in 2019.

In many ways QE has worked – the US, Japan and Europe are enjoying a period of synchronised growth along with the rest of the countries tracked by the Organisation for Economic Co-operation and Development (OECD). Major economies appear to be on a surer footing than at any time since the great financial crisis. Time therefore to exit the experimental phase of monetary policy and ‘normalise’.

But as we exit this – and it is worth stressing that the US, Europe, Britain and Japan are all at different points in the cycle and face their own unique set of problems – can we be sure that the economies of the west are in such good shape?

QE, and ultra-low rates by design, stimulates asset prices by effectively pricing everyone except the central bank out of safe haven government bond markets, reducing the cost of money. This is supposed to stimulate growth and achieve the central banker’s remit of full employment and inflation at or around 2 per cent.

But loose monetary policy favours capital over labour. Hence we have seen wages depressed and equity valuations soar while inflation has languished. While we certainly see structural changes in the labour market and reduced worker bargaining power, unwinding QE at the same time as unemployment is at historically low levels could hand labour the advantage again.

Despite their efforts, inflation is low by historic standards and is a long way below where it was in the 1970s. But by pursuing a policy that explicitly stokes prices for so long, central banks might have left us sitting on an inflationary time bomb that, coupled with a late-cycle slowdown in growth, may quickly turn into stagflation.

Importantly, despite headline rates of price growth looking pretty weak for a number of years, inflationary pressures are building. There are signs of inflation in freight-related industries reaching historic highs, usually a good indicator of rising input prices. The New York Fed’s underlying inflation gauge – a pretty good indicator of where inflation really is – raced up to 3.3 per cent in May, its highest level since July 2006.

In June, core personal consumption expenditures (PCE), the Fed’s preferred gauge of inflation, finally reached 2 per cent on an annual basis for the first time in six years. But consumer spending slowed – a classic sign of a stagflation trend: core prices should only be rising if consumers are spending more.

All this before we even factor in asset, property and rent price appreciation, which by some analysis indicates we are already in a stagflation environment. Finally, rising oil prices – a phenomenon from the 1970s – is also a concern. Any jump in oil prices – which have tripled from around $25 a barrel to $75 since the start of 2016 – stokes inflation and weighs on growth.

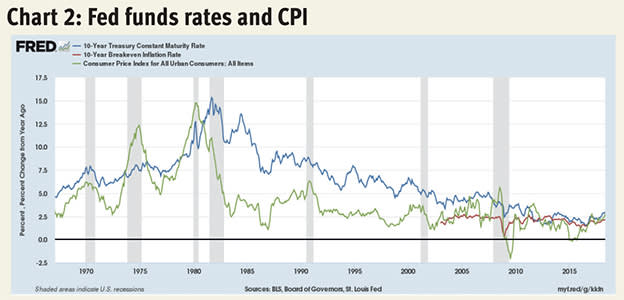

In terms of QE it’s a simple argument. QE and low rates boosted growth and asset prices. Lower yields actually had the effect that inflation stayed low, which may sound counterintuitive given that central banks have been buying bonds by the boat load in order to stimulate inflation. Nonetheless, the yield-inflation relationship is key to our understanding of why stagflation may be coming – yields rise with inflation expectations. Monetarists have to accept that the expansion of the monetary base in the US and Europe has not really led to inflation; but the reduction of stimulus may well do so. QE tried to boost inflation, but did the exact opposite.

Now as central banks remove stimulus, they exit the bond market and yields must rise as demand dries up. At the same time, if we assume that QE was good for growth, then its removal will be bad, depressing risk sentiment and asset prices. So if the QE era was defined by rising asset prices, a recovery in growth rates, very low inflation and falling unemployment, then it makes sense that the anti-QE era could be one of falling asset prices, falling growth, higher inflation and rising unemployment.

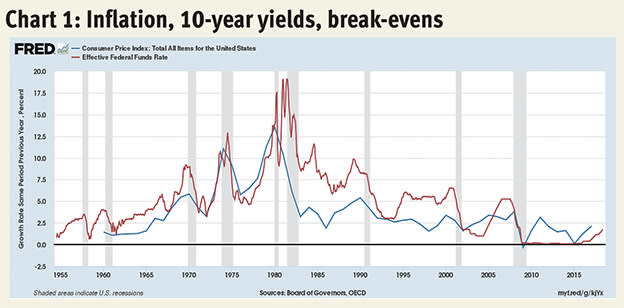

It’s no surprise to see inflation starting to come through at last – we have been wondering when it would happen – because the relationship between yields and inflation is hard to argue with. It’s not perfect, as chart 1 (above right) shows, but it certainly indicates how lower inflation periods correspond with periods when yields are lower. And as we are about to discuss, the period of low yields in the 1960s created the conditions for 1970s stagflation.

Stagflation 70s style: A retro look we don’t like

Alan Greenspan, the former chairman of the Federal Reserve, believes we are heading towards stagflation. His predecessor, Paul Volcker, hiked rates to 20 per cent to tame inflation. That scenario today is unthinkable, but this in itself highlights the risks we face. Coming back to what’s bad for equity prices, if the Fed funds rate were to reach just 5 per cent – three percentage points above today’s levels – it would be disastrous for equity prices based on current valuations. The Fed has said it’s comfortable with letting inflation run a little above target, which some see as an admission it has little control now over prices.

According to Mr Greenspan, we’re moving towards “a major increase in long-term interest rates… that has a very important impact… on the whole structure of the economy”.

Mr Greenspan argues that raising interest rates too quickly will fuel inflation. He says: “We are dealing with a fiscally unstable long-term outlook in which inflation will take hold... and I think we’re getting to the point now where the breakout is going to be on the inflation upside. The only question is when.”

What set us up for stagflation in the 1970s was a period of zero real rates in the 1960s (see chart 1) and a boon in government spending. Back in the 1960s the US enjoyed a tight labour market and no real price pressures, just as now.

Real long-term interest rates – argues Mr Greenspan – are abnormally low and will need to come back up. Coming back to the earlier argument about QE, the current situation is not dissimilar to that of the 1970s. A decade of central bank liquidity has fuelled asset prices and kept a lid on interest rates to the point where they have turned negative. Real rates of return are well below historic norms and, as long as you believe in mean reversion, this situation will need to be corrected. The unwinding of central bank stimulus creates the environment for such a correction and this poses problems as growth is starting to slow at the same time. The argument is that growth rates in the US and elsewhere appear to have peaked and we are now in a classic late-cycle phase. Fiscal stimulus has elevated growth rates, but its impact will prove fleeting. On earnings calls you increasingly hear executives talking about having reached a peak in demand. M&A activity – which tends to spike towards the end of the cycle – has soared in 2018. Mega deals are a classic sign trouble is coming. Consumption rates are also spiking, another sign that we’re towards the end of the cycle.

Recessionary warning lights are starting to flash red. In particular, the flattening yield curve in the US Treasury market is greatly concerning for investors. When the curve inverts – ie when short-term yields trade above longer-dated counterparts – it’s usually a pretty good indicator that a recession is about to happen. It’s a well-worn argument, but for good reason – it generally holds true. In Europe, GDP estimates and survey indicators show growth is slackening, albeit from the high point in 2017.

Structural unemployment is an area that is often overlooked in the stagflation debate and one that is too large to examine here in great detail. But this phenomenon occurs when traditional industries fail and jobs are lost. The process has happened periodically for years, but we see a looming threat from artificial intelligence (AI), robotics and big tech in general that could sweep away white collar jobs wholesale. If we see an acceleration in structural unemployment in the coming years it could help create the conditions for a prolonged period of stagflation.

Tariffs + Higher Oil prices = stagflation

While economic and monetary conditions are tinder dry, the stagflation spark could come from a global trade war. At present it remains to be seen whether the US, China and EU hunker down for a full-blown conflict, but the omens don’t look promising. Tariffs have been imposed by the US, and retaliation by China, European nations and others followed.

Trade tariffs are a significant risk factor for stagflation. In short, they raise prices for consumers by imposing taxes on imports, and they suppress growth as trade contracts. This produces what we could call ‘bad inflation’, ie the type of inflation that is not driven by increased consumer demand and higher wages from improved productivity. In one recent Bank of America Merrill Lynch survey, 87 per cent of fund managers said protectionism would boost inflation and stagflation.

Tariffs on the US auto sector alone could shave 0.1 percentage point off GDP in 2019 and raise prices by thousands of dollars per vehicle. In the US auto sector capacity utilisation is already quite high by historic standards (around 80 per cent), so substitution effects (where consumers simply plump for a different brand not affected by tariffs) will not be great. Moreover, the multiplier effect of the vast supply chain network that supports the auto sector shows how tariffs on one part of the economy can drive up prices in many other areas. US automakers will see their costs rise as well.

Then we add in oil. It has been widely argued that an oil price shock was the catalyst for the 1970s bout of stagflation. This shock led to cost push inflation, driving the prices of everything else higher. Lately we have seen oil prices triple from around $25 a barrel. Monetarists like Friedman may dispute it, but the monthly economic data clearly shows CPI inflation rates rise when energy and oil prices climb.

In the US at least, the long-term monetary conditions are there – the monetary base has expanded thanks to an extended period of exceptionally low rates. The medium-term economic conditions are there – we are clearly in a late-cycle phase with demand having peaked already. And the short-term triggers are maybe there – a full-blown trade war that raises prices at the same time as oil has jumped – could tip the economy into a period of stagflation.

Europe, however, may be heading for another fate entirely: Japanisation.

Turning Japanese?

While economic indicators are arguably pointing towards stagflation in the US, the picture in Europe is much more debatable. Indeed, the continent may be heading towards a period of Japanisation, instead of stagflation.

Japanisation is characterised by a period of stagnating growth and an ageing population that holds down yields and inflation, as Japan has suffered for at least two decades on and off. This goes to the heart of whether western economies face a structural deficit as their populations age and productivity gains become harder to win, or if the current cycle can be turned around (stagflation is bad, but not as bad as Japanisation).

The point is neither Japanisation nor stagflation is good economics. Inflation can be good and bad, but disinflation can also be good and bad. The real problem is stagnation, and in both the US and Europe there are risks that this will occur. Perhaps it will be when millennials realise that Facebook creates no real productive value to the economy. Or perhaps populism will result in a resurgence in labour productivity and real wage gains, creating a golden era for GDP real income growth. Either way, we’re not getting any younger and some unfashionable trends from the 1970s that we thought we’d left in the past may come back into vogue.