In the early 2000s, Stagecoach (SGC) was a pioneer of on-demand transport. The company previously operated a ride-sharing service, dubbed Yellow TaxiBus, in Scotland on both fixed route and door-to-door services. The transport company said it was "extremely popular with customers" and a viable value-for-money option for local authorities to improve transport links in both urban and rural areas. Stagecoach believed the service could also boost social inclusion by allowing residents of more remote areas easier access to transport, and help discourage urban dwellers from driving, thus easing city congestion.

Perhaps Stagecoach was too ahead of its time. The service closed after two years of operation after it was deemed commercially unsustainable. The services were more difficult to use than today’s variety. Back then it operated as a 'phone and go' service, since smartphones and apps weren't mainstream. As such, calling a driver 'centre' proved more tedious than booking a driver with just a few taps on a screen or clicks of a computer mouse.

Technology may have caught up in the meantime, but that doesn’t mean companies have succeeded in finding profitable strategies to capitalise on modern-day transport trends. The most ubiquitous name when it comes to on-demand transport is Uber, but don't assume it's profitable. Last year, Uber Technologies reported $50bn-worth (£37.8bn) of total bookings for its ride-hailing and food-delivery services and a 43 per cent increase in full-year revenue to $11.3bn. But it also reported a $1.8bn loss before taxes - albeit a slight improvement on the $2.2bn loss in 2017. Fierce competition has put pressure on Uber to lower prices, and gig economy sceptics have argued that drivers should be paid more.

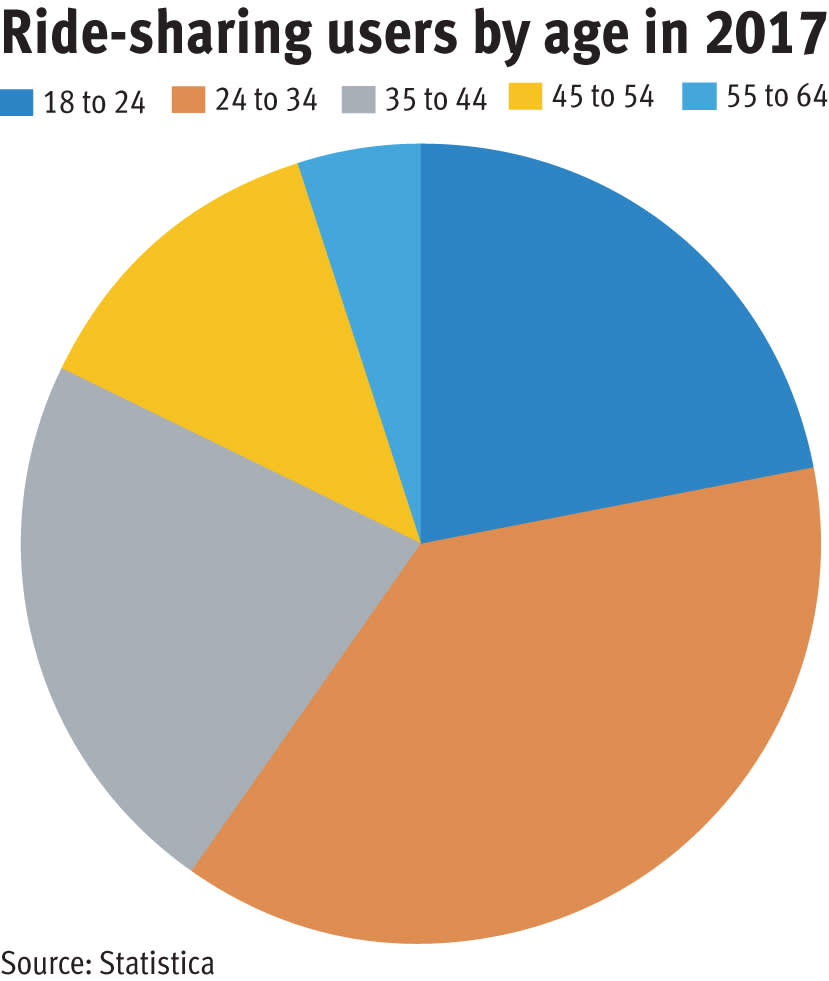

While escalating losses look discouraging, there’s no doubting Uber has changed the way people get around. In 2017, those aged between 25 and 34 made up 37.7 per cent of total trips on a ride hailing service, which lends support to the idea that millennials are less keen to own a car than previous generations. At the same time, smartphones have made access to ride-sharing services and readily available transport options easier than ever, while environmental concerns make driving less appealing.

Now it seems UK-listed transport companies are keen to get in on the action, especially since the revenue projections are so impressive. Companies have branched out from traditional transportation options like bus services and railway lines, choosing instead to explore options in demand responsive transport. And while profitable monetisation of these services could still prove challenging, it's unlikely to prove more difficult than running a commercially viable public transport route.

The new frontier

Not coincidentally, Stagecoach is making its way back into the on-demand transport market. The company has worked with Prospective Labs – consisting of researchers at UCL, Cambridge University and the Alan Turing Institute – to consider possible locations within its UK bus network for on-demand services. It’s now in the proof-of-business-concept phase, agreeing that its technology platform will be operated by Moovel, a mobility business co-owned by German automotive companies BMW (BMW) and Daimler.

Meanwhile, Go-Ahead (GOG) is using subsidiary company the Oxford Bus Company to offer PickMeUp – an on-demand ride-sharing mini-bus service – in Oxfordshire. The service operates similarly to Uber pool, where customers use an app to share their location and destination, before the service picks them up and works out the best way to get them and other passengers to their desired location.

Go-Ahead just added another two vehicles to the fleet, bringing the total in operation to nine. And since the service launched last year, it has more than 21,000 registered riders, with an average of 3,000 passengers per week, delivering 88,000 rides so far. Chief executive David Brown said the company is "committed to developing the future of transport", adding that on-demand services are part of the solution to tackle congestion and pollution in cities such as Oxford. Next, Go-Ahead is partnering with Transport for London (TfL) to offer a similar service in Sutton.

As part of its Spanish operations, National Express (NEX) has also diversified its business with an expanded mini-cab service, linking up with local taxi companies – mainly in Madrid – to operate Uber and Cabify concessions. This is part of the company’s strategy to offer door-to-door journeys in major Spanish cities, allowing services to be bought alongside bus and coach tickets in the booking process. Chief executive Dean Finch said he believes there are "strong growth" opportunities in the Spanish mini-cab business. The company does not operate the cabs directly, but instead sells or rents the licences to drivers. During 2018, the number of licences it allocated to drivers increased from 120 to around 400.

In North America, FirstGroup (FGP) is looking at ways to work with ride-sharing companies to provide Disabilities Act-compliant transportation. It has an ongoing pilot project in operation offering paratransit customers the option to use ride-sharing if it’s an easier or better option than traditional transit services.

Vehicles of the future

Demand responsive transport has changed the way people travel, but it could also change the designs of the vehicles themselves. Steve Stewart, head of communications at Stagecoach, identified "vehicle structure" as another possible area for innovation. So far, most on-demand services use traditional vehicles. But he reckons this area is worth exploring, although more research is needed on how newer technologies might meet customer needs.

One such area is self-driving, autonomous automobiles. For example, Stagecoach recently announced an autonomous bus trial in Manchester in partnership with bus manufacturer Alexander Dennis Limited (ADL) and technology company Fusion Processing. The CAVstar system uses multiple sensor types including radar, laser light measuring device LIDAR, optical cameras and ultrasound, along with satellite navigation to detect and avoid objects. So far trials have been within bus depots, but Mr Stewart says the group aims to have in-service trials in place by 2020. Drivers will still be on board to supervise the system.

FirstGroup is also looking towards autonomous vehicles. In the UK, the company is working on a 'Mobility as a Service' (MAAS) trial using self-driving vehicles as part of a demand-driven service at Milton Park business park to reduce reliance on single or low-occupancy vehicles. FirstGroup has also tested autonomous vehicles in California. First Transit trials have focused on testing the performance of autonomous vehicles in winter conditions on public roads in the hope of demonstrating the viability of this technology.