Nobody knows more about a company’s prospects than its directors. Chief executives, finance bosses and other board members are privy to the kind of information that investors and analysts would give their right arms for, including the true value of their employers’ assets and future earnings potential.

Without an inside link and direct path into boardrooms, investors are left in the dark and forced to second-guess company secrets. One method that has proved to be particularly popular involves keeping tabs on the latest director dealings.

When a high-ranking employee buys or sells shares in the company he or she works for, it’s difficult not to read between the lines and assume that they’re revealing new information. Nothing screams confidence more than a director buying up shares, just as a decision by a board member to sell hints that all is not well.

Numerous ETFs and fund managers have attempted to build stockpicking models based on insider trades. Virtually every major financial website offers readers links to the latest transactions, too, driven by the same belief that director dealings offer investors the ultimate insiders’ guide to a company’s health.

If only it were so simple. Academic research dating back decades indicates that investors seeking to blindly mirror whatever directors are buying and selling will barely manage to break even. These studies, which drew upon vast amounts of company data, generally conclude that investors can generate abnormal returns, but will be left with empty pockets once transaction costs are calculated. In short, most empirical evidence shows that it works, but not enough to get excited about.

Only when these same academics applied certain screens did results begin to get more fascinating. By sticking to specific principles, rather than tracking every transaction, they discovered that director dealings do in fact trigger respectable share price returns.

Similar approaches have since been adopted on a commercial level. Bill Lattimer, insider analyst at Smart Insider, an equity research firm that specialises in monitoring director shares activity, claims that his firm has helped its clients to beat the market since 1999 by weeding out insightful insider transactions from a huge pile of useless ones.

In a busy month, Mr Lattimer says anywhere between 700 and 1,000 buys and 900 and 1,500 sells occur in the US. Drawing upon this wide amount of data, his firm identified just 8,400 interesting buy signals and 2,900 encouraging sell signals over the past 18 years. The outcome? Over an average period of roughly seven months, the buy signals that Smart Insider acted on registered an average absolute return of 9.6 per cent and outperformed the market by 5.4 per cent. Sell signals outperformed the market by 4.7 per cent.

“You really have to sift through the data to make it useful,” says Mr Lattimer. “Probably 90 per cent of the trading data is not helpful, so the key to really getting value out of it is cutting out that 90 per cent, finding the 10 per cent on a timely basis.

“We assume that all these insiders have the same information base, but there [are] really only some that know how to effectively use that information to buy and sell stocks in a timely manner.”

Professor Daniel Giamouridis and Citigroup’s Manolis Liodakis and Andrew Moniz came to a similar conclusion for UK stocks. “Following and reacting to some UK director trades can be very rewarding,” they wrote in a 2008 report commissioned by EDHEC Business School, titled: Some Insiders Are Indeed Smart Investors. “A long-only strategy generated an annualised absolute return of 23.5 per cent with a volatility of 20.4 per cent, assuming monthly rebalancing.”

Keen to discover how to master director dealings? Here’s a helpful guide on how to differentiate potentially significant buy and sell signals from the countless misleading ones.

Timing matters

Research shows that market reactions are particularly encouraging when directors buy or sell shares in periods surrounding reporting seasons. For example, if an insider tops up on a holding before his or her employer is set to update markets on its progress, most investors interpret this as a sign that good news is in store.

Don’t expect directors to start making moves immediately before an update is due, though. The UK regulator prohibits them from trading shares two months prior to annual and interim result announcements, or one month before publishing trading statements.

Because of these extensive blackout periods, some academics claim that post-announcement activity is more insightful. Result statements are generally big sentiment swingers, so purchases made after they’re published can often hint that the company’s future operating performance is rosier than the share price gives it credit for.

The three authors behind EDHEC Business School’s report believe this is particularly the case after companies initiate share buyback programmes. “Companies that announce a buyback and whose directors also purchase stock have a significant incremental performance of 3.8 per cent, indicating that directors’ purchases give credence to the management’s view that the company is undervalued,” they say.

The regulator also introduced rules designed to stamp out suspect insider trading activity ahead of updates not governed by specific time periods, such as profit warnings and takeover announcements. Directors are not permitted to buy or sell shares based on undisclosed inside information, such as news of a potential takeover, a loss of a big contract or other significant issues. That means that the controversial disposals orchestrated by high-ranking employees at Michael Page (PAGE) in 2011 and Iceland in 2000, both just weeks ahead of profit warnings, aren’t likely to occur very often.

Assuming that all directors are law-abiding, we can therefore assume that many of the most meaningful trades will occur at the start of closed periods, or just after they have finished.

Beware of confidenceboosting exercises

The above guidelines, and those set to follow, should stand investors in good stead, provided they also do their fair share of due diligence on the company and look out for the usual warning signs. Company directors are no fools. Most of them are aware that investors read a lot into director dealings and, as a result, will occasionally use the positive buzz they generate to mislead the public.

Directors, including the shamed founder of insurance outsourcer Quindell, have been known to build stakes to break a wave of negative publicity. Purchases send a reassuring message of confidence and lead investors to assume that the company’s shares are undervalued. In some cases, their intentions might be pure and full of conviction. However, if the transactions are small and the company appears to lack any kind of recovery potential, it would be safer to assume that the buying is a bluff.

“A lot of time you’ll see a cluster of insiders buy stock in unison over a few days, but they seem to be nominal amounts, relative to what these guys bought before,” says Bill Lattimer. “You can tell that they know that that transaction is going to hit the newswire and that people will end up buying stock in XYZ Corp.”

Data from Director Holdings’ website suggests that markets are growing wise to this type of behaviour. Over the past three months, the 20 biggest contrarian buy transactions have so far each led to further losses.

Scrutinise past transactions

Mr Lattimer offers a fairly straightforward secret to avoid falling into director dealing traps. The success of his firm’s outperformance of the market since 1999, he claims, can mainly be credited to one major factor: doing homework on the individual that’s buying or selling.

“When trades come in and we look at all the activity, probably the single most important thing we analyse is to look at that individual,” says Mr Lattimer. “Say John Smith buys stock. Then we’ll look at what has he done in the past. How many times has he bought stock before? How many times has he sold stock before?

“And then we’ll look at how successful he has been buying and selling stocks. If the guy has not been helpful in the past, there’s no reason to assume that this recent trade is necessarily going to be a helpful data point.”

Unfortunately, there are a number of potential drawbacks to Smart Insider’s strategy. Not every insider will have a long trading history, and the majority of those that do are likely to have a mixed track record.

In those cases, Mr Lattimer and his team widen their research to include any noteworthy changes in habit.

“Is the insider doing something unusual? Something that he hasn’t done before?” he asks. “And it may mean he’s spending significantly more than he has in the past, or making a larger sale than he has in the past. To some extent we’re looking for changes in behaviour. Is this guy showing conviction? Is he taking some risk? More risk than he has in the past?”

Infrequent traders are more informative

A lack of trading history may not necessarily be a bad thing. Finance professors Kaspar Dardas and Andre Güttler at the European Business School analysed short-term announcement effects for 2,782 companies from Austria, France, Germany, Ireland, Italy, the Netherlands, Sweden, and the UK between January 2003 and December 2009. One of their most interesting observations was that directors who seldom buy and sell stocks merit closer attention.

“If insiders, for instance, trade on a monthly basis, we expect the information content of these trades to be lower than for one single trade in a year,” they wrote.

This theory makes a lot of sense on many levels. As previously established, one of the biggest pitfalls of following director dealings is that they are occasionally used to fool investors, rather than communicate signals about a company’s health. Directors who rarely trade shares are presumably less eager to engage in such tactics.

It could also be argued that infrequent traders prefer to bet on sure things. Rather than buying and selling on a regular basis, this particular employee might be a calculated and risk-agnostic investor that only executes trades with maximum conviction. If he or she has been in a senior position at the company for a while and appears to possess these characteristics, you may want to highlight him or her as a reliable candidate worth keeping tabs on.

Size doesn’t always matter

Research on the influence of transaction sizes is mixed. In theory, investors are more likely to be put on alert if a director buys a million shares, rather than say 20,000. Mr Dardas and Mr Güttler at the European Business School discovered that cumulative average abnormal returns over the short term rise depending on the size of the deal, confirming that most investors do in fact place a lot of emphasis on how many shares are being bought and sold.

Investors with longer-term horizons, however, might be better off looking deeper into transactions. Rather than focusing on size, it may be shrewder to assess whether trades, big or small, alter the director’s stake significantly.

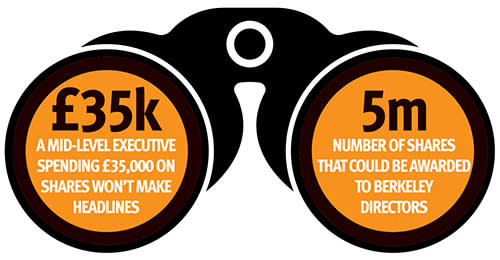

A mid-level executive spending £35,000 on shares definitely won’t make headlines, even though it more than quadruples his holding and puts a considerable dent in his take-home salary. Meanwhile, the chief executive across the road splashes out £1m on shares, most of which is probably not his, and gets press exposure all week, despite registering little change in his initial holding.

That leads to another interesting argument. Some academics researching the topic of director dealings claim that medium-sized trades trigger greater responses from investors than larger ones. The theory here is that the smaller trades are more informative because they’re designed to draw less attention. That could particularly be the case for directors keen to make a quick buck out of impending news without wishing to attract surveillance from the regulator.

Directors might approach this strategy by making small, but frequent trades. According to Director Holdings, the most active trader over the past month is Donald Strang, non-executive director at Primorus Investments (PRIM).

Over a one-week period, Mr Strang bought shares in the minerals exploration-focused company on five separate occasions. Whether he topped up nearly every day, rather than in one chunk, to fly under the radar is not clear. Yet his assertive buying streak does appear to suggest that he’s either confident about Primorus Investments’ future prospects, or keen to give the few investors that follow the stock the impression that he is.

Strength in numbers

Even more encouraging than one director making a number of purchases in quick succession is when several of his or her colleagues also get in on the act. Evidence shows that multiple trades by different employees over a short time period almost always leads to greater share price upside.

It’s not difficult to understand why investors love cluster trades. Multiple purchases send a very strong signal to the market that several directors share the same enthusiasm for the stock.

The opposite argument is valid for sells. Back in 2006, the founders of former FTSE 100 company PartyGaming announced big stock disposals. Those who promptly followed their lead would have avoided a catastrophe – a ban on internet gaming decimated the gambling website firm’s share price not long after.

Many will perhaps now be asking whether Berkeley’s (BKG) directors are sending similar signals. Over the past few months, chairman Tony Pidgley and chief executive Robert Perrins have been dumping their shares in the housebuilder at an alarming rate.

Brexit risks aside, trading appears to be relatively strong at the company. Could something fishy be on the horizon? The IC’s sector correspondent Jonas Crosland doesn’t seem to think so.

Jonas points out that Mr Pidgley and Mr Perrins both received 670,000 shares as part of a 2011 long-term incentive plan, which could eventually see them awarded as many as 5m shares each. He also expects cash-rich Berkeley to continue buying back shares.

Berkeley aside, most of the other active UK traders over the past three months have been buying shares. Directors at struggling Dixons Carphone (DC.) and Travis Perkins (TPK) have been particularly busy.

Directors at Berkeley, Dixons Carphone and Travis Perkins have been active over the past three months

Look beyond senior job titles

Most investors would agree that high-level executives have an information advantage over their lower-level peers. In terms of hierarchy, the chairman, chief executive and finance director are generally the three board members that call the shots and know most about the day-to-day fortunes of the company. The other executive directors rank next, followed by the non-executives, external directors who sit on the board but do not form part of the executive management team.

Based on that logic, most investors tend to pay closer attention to what the chief executive, finance director and possibly the chairman are up to. They also frequently ignore whoever doesn’t have access to board meetings, as well as new employees, regardless of their status.

New arrivals regularly feel compelled to buy shares upon joining the company, meaning they often build up opening stakes as an act of faith, rather than with real conviction. Staff that don’t attend board meetings are also easy targets to dismiss. However, it’s worth noting that a higher-rank colleague could occasionally let details of a sensitive nature slip to them, especially if they’re friends.

In fact, investors would be wrong to assume that the finance director, chief executive and chairman are the only employees with their fingers on the pulse. Anyone that attends board meetings is likely to be privy to all kinds of fascinating information. All directors are invited, so they should know a fair bit about what’s going on.

In a research paper published in December 2006, finance professors Jana Fidrmuc, Marc Goergen and Luc Renneboog revealed that abnormal returns in the UK are more likely to be triggered by purchases and sells made by non-top-level executives. These results have since been echoed by academics covering different markets across the globe, including the European Business School.

Mr Dardas and Mr Güttler say that only in France and Sweden is there evidence to suggest an obsession with insider hierarchy. “A possible explanation is that top insiders are closely watched by regulatory authorities and news media and do not want to attract attention by earning large profits with their company’s stocks,” they add.

This argument that high-level executives are more reluctant to trade at informative moments is particularly interesting when analysing trades made according to job title last year. Data from Director Holdings shows that non-executive directors were most active, roughly equalling the combined number of transactions orchestrated by chief executives, finance directors and chairmen.

Don’t completely disregard share options

Many insider trade observers have been quick to dismiss share options as irrelevant. These transactions, which involve presenting an employee with the possibility to buy shares at a discount or fixed stated price, make up a large chunk of director dealing activity each year.

If the purchase price of the options is significantly under the share price, as is often the case, investors shouldn’t pay them any attention. After all, who wouldn’t want to snap up shares at a huge discount?

However, investors can also use these occasions to ascertain whether directors are keeping hold of any shares. Look out for net retentions. Were some of the proceeds from option sales held and added to holdings?

Director sells are less reliable indicators

“Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise,” Wall Street legend Peter Lynch once reportedly said.

Mr Lynch’s take on director dealings has some backbone. Take Smart Insider’s data bank, for example. The firm identified a much lower amount of interesting sell signals than buy signals, despite the fact that directors tend to sell more than buy most months. Buy signals also outperformed the sell ones by quite a notable margin since 1999. We probably shouldn’t be surprised by these findings. Unless a director is keen to lose money, he or she will buy shares with the aim of generating a better return than cash. A director selling shares is open to wider interpretation.

Mr Lattimer believes sells are more frequent and generally less interesting because they are seen by employees as another way to get paid and compensated for their work. While some may sell because they view the stock as overvalued, an equal proportion will happily risk missing out on future returns just to satisfy their immediate desire for a larger house or sports car.

In the case of emergencies, such as an unexpected tax bill or nasty divorce settlement, directors are even more likely to cash in on their holdings, regardless of whether the company is flourishing and likely to re-rate.

The motive behind a director’s decision to sell shares is occasionally provided by the company when unveiling the transaction. Stories about Ferrari shopping sprees and other potentially damaging revelations aren’t likely to get mentioned though, which is why investors should seek to treat every explanation as spin and every blank motive with equal suspect. While historical evidence suggests that sells are often unreliable indicators, investors would be foolish to completely disregard every one of them as not insightful.

For example, Schroders’ (SDR) former chief executive and current chairman Michael Dobson recently sold 213,389 shares worth £7.4m – almost half of his former holding. The first logical explanation for this big sell-off is that, at 65 years of age, he’s attempting to build a nice retirement fund.

On the other hand, a sceptical investor could view this transaction as a sign that Mr Dobson has jitters about the company’s prospects and is keen to cash in after a strong share price rally. Is the £7.4m all owned by Mr Dobson and, if so, does he really require all that money to fund his retirement?

Almost every sell transaction can be questioned. Investors should debate whether the amount raised comfortably surpasses the potential price tag of whatever needs to be funded. They should also consider why the director didn’t explore other financing methods to bankroll his or her immediate needs.

Remember, as long as banks keep offering favourable loans and companies continue to pay executives generous salaries and pensions, plenty of these fund-raising efforts can probably be avoided.

Small-cap dealings aren’t alwaysas lucrative as they might appear

Over the years, academics have occasionally questioned each other over several points relating to director dealings. However, there’s one that they all appear to agree on.

Studies dating back decades have concluded that announcements by smaller companies trigger a significantly larger market reaction. One of the most logical motives for this disparity is that information from smaller companies is harder to come by. In the absence of analyst research and media coverage, investors regularly jump on any positive or negative indicators that they can get their hands on.

That, of course, means that investors targeting director dealings by smaller companies potentially risk getting caught out more often. A lack of context forces them to either sit tight, or take these trades at face value as signals of ill or good fortune.

The European Business School makes another important case against the validity of research indicating that small caps are the biggest beneficiaries of director dealings. “For countries with the strongest announcement returns such as Germany, Sweden, and the UK, the abnormal returns are substantially larger when the insider transactions are made in small firms. This, however, shows that the profitability of insider transactions cannot be taken for granted, since small-cap stocks are less liquid and have higher bid-ask spreads.”

Some sectors generatemore interest than others

The European Business School also notes that investors tend to be swayed more by director dealings from certain sectors. According to its research, markets react excitedly when insiders trade shares in healthcare, energy and IT companies, yet are notably less enthused by transactions that occur in consumer, financials, and materials industries.

These findings, which were supported by an earlier study by David Aboody and Baruch Lev titled: Information Asymmetry, R&D, and Insider Gains, suggest that capital intensive firms are a key source of director dealing speculation.

Like small-caps, heavy R&D spenders are often shrouded in more uncertainty than the average plc. Investors, mindful that expensive projects can make or break these companies, lean on director dealings as indicators of how they are likely to pan out.

This can be a good or bad thing. On one hand, it can give potential insight into uncertain prospects. On the other, it can lead to an expensive dead end, fuelled less by a director’s conviction in the stock and more by other, less significant motives.

Short-term traders could have a field day with this kind of information. Yet for the average buy-and-hold investor the outcome is more complicated, as share prices are likely to correct sharply if it later emerges that the transaction was a red herring.

It’s precisely for this reason that investors shouldn’t view insider trading as a foolproof indicator of where a company and its share price are heading. Only when accompanied by rigorous research into company accounts, results, trading updates and wider sector trends can director dealings really display their true worth.