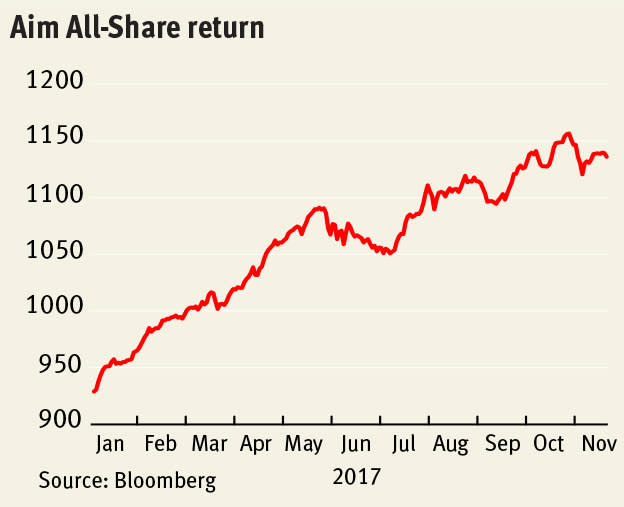

“Welcome to Aim. Where ideas take off.” So says the London Stock Exchange of the UK’s Alternative Investment Market (Aim). This flight analogy isn’t without foundation. One year ago, the Aim All-Share index was up 16 per cent on 2016’s opening price. As we write, it has risen over 20 per cent since the start of 2017.

That said, flights regularly endure turbulence. As we look to 2018, Aim remains a stockpicker’s market. Investors must be prepared to take a gamble on an inherently risky model; arguably even more so when considering smaller companies.

Still a 'junior' market?

Aim is a financial petri dish of sorts, providing a specialised growth culture for fledgling and fast-expanding companies. Shareholders can also benefit from this growth, often accompanied by exposure to emerging investment themes. Not to mention the fact that some Aim portfolios qualify for specific tax relief.

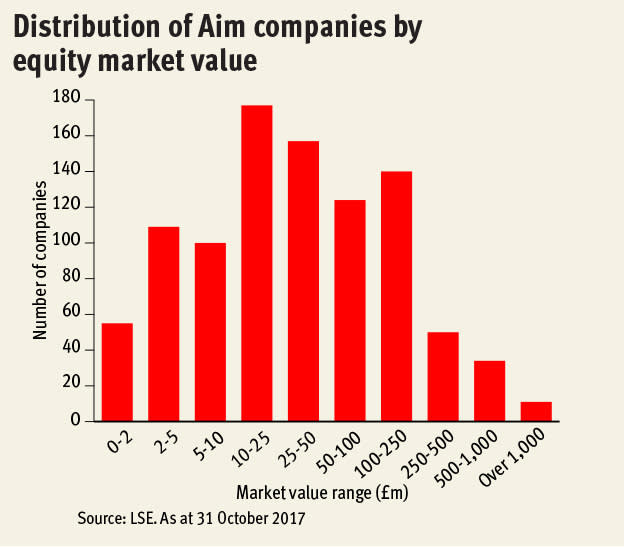

However, Aim’s composition has transformed since its 1995 inception, with more change seen in 2017. Alongside tiny businesses, the exchange hosts giants such as Asos (ASC), with its £5bn market cap. In fact, as at 31 October 2017, more than 50 per cent of Aim constituents had a market cap of at least £25m. And fundraising has skyrocketed, passing the £100bn mark for the first time in January. This begs the question: as we approach the year-end, is Aim still truly a ‘junior’ market? And with such a varied membership, are Aim’s listing criteria still appropriate?

Regulatory reform?

As if in answer, the London Stock Exchange (LSE) set the ball rolling in July with its Aim Rules Review. Aim’s current lighter-touch rules offer flexibility, while enabling smaller entities to undertake initial public offerings (IPOs). But this move from the LSE may well have inspired confidence in those who fear illiquidity or indeed the potential for corporate governance failures.

Among other proposals, the paper asks for feedback on introducing a minimum fundraising threshold for applications, along with a minimum free float (shares in public hands). Such reforms might benefit investors, sorting Aim’s wheat from the chaff. However, they might also prohibit small, up-and-coming businesses from listing.

Among the flotations, deals and scandals on Aim in 2017, we’ve also seen the development of high-potential mini sectors. Collectively, these events help to guide our outlook for 2018.

Success stories and emerging ‘mini-sectors’

- Retailers

As we approach the new year, larger companies on Aim can provide a useful insight into where smaller peers might end up. Boohoo (BOO) joins fellow retailer Asos among those companies with the largest market caps on Aim. But this niche isn’t restricted to larger operations: smaller apparel businesses Quiz, (QUIZ), Footasylum (FOOT) and Sosandar (SOS) all listed on Aim in the second half of 2017. Footasylum, the largest of the three, has a market cap of just over £200m. Even so, investors may hope for comparable growth and more flotations to come. For now, Christmas trading might help to clarify the newcomers’ potential.

- Listed law

Burford Capital (BURF), meanwhile, is the leader by market cap in another burgeoning corner of Aim: law and legal services. Burford itself provides funding for litigation. But within the market’s wider legal arena, we see another emergent subsector: challenger law firms.

Analysts at N+1 Singer were prescient when they said in May, “we remain convinced that we will see more legal services businesses using a listing over time”. In August, law firm Gordon Dadds (GOR) joined Aim via a reverse takeover. And in November, Keystone Law (KEYS) underwent an IPO. Neither of these companies are substantial in size – the former has a market cap of around £40m, while Keystone’s is £60m. Their peer Gateley (GTLY), which was the first law firm to float on Aim in 2015, is larger.

Trevor Griffiths at N+1 identifies profile-raising as one advantage of such a listing; outside of the ‘magic circle’ of elite firms, businesses seek other ways to set themselves apart from the competition.

Keystone’s growth looks encouraging: revenues increased by over 20 per cent each year for the three years ending January 2017. And it does things a little differently – its lawyers are self-employed, with no fixed salary. They receive between 60 and 75 per cent of fees after the company itself has been paid. For Mr Griffiths, “this is where the legal profession meets the gig economy”. With three flotations in close succession, we reckon there’s room for more firms to join the market in 2018. Watch this space.

- Disruption through automation

Automation continued to develop as an investment theme on Aim during 2017, as it did on various markets – its popularity exemplified by Blue Prism’s (PRSM) escalating share price. The robotic process automation specialist, which now has a market cap of £900m, revealed in a recent trading update that full-year revenues would exceed consensus expectations. That said, the group is still lossmaking.

Investors are understandably wary of tech stocks with stratospheric valuations, particularly after the dot-com crash at the start of this century. Nonetheless, automation does appear to be a seriously disruptive force across multiple industries. We expect such technologies, enabled by artificial intelligence (AI), to keep transforming businesses of all sizes as we move into 2018. Marketing is just one area innovating through AI: mobile advertising specialist and IC buy tip Taptica (TAP) uses machine learning to target media more accurately.

- Subtitles subsector

Looking elsewhere on Aim, companies offering localisation services to the entertainment industry have also performed well this year. At the larger end of the spectrum, Keywords Studios (KWS) represents the potential upside for such a stock. With a £900m market cap, the group’s offering includes translating video games and voice-overs, and player support for the video games industry. And in chief executive Andrew Day’s words, the company achieved “stellar performance” in the six months to 30 June.

Meanwhile, minnow Zoo Digital (ZOO) has a market cap of just £36m, but its shares are up more than 400 per cent in the year to date. The company looks likely to see continued momentum in 2018, buoyed by its cloud-powered dubbing and subtitling platforms. But this is not a stock for the faint-hearted; the shares trade on a sky-high forward multiple.

Risky business

This year has driven home just how lucrative some Aim holdings can be. However, it also offered stark reminders of the unpredictability of such investments, and the enhanced high risk/high reward wager of buying into smaller companies.

In May, shares in RedX Pharma (REDX) were suspended when the small-cap biotech group fell into administration, having failed to repay a loan to Liverpool County Council. Following resumption of trading, the share price dipped again – taking the year-to-date decline to over 40 per cent.

Meanwhile, 'internet of things' enabler Telit Communications (TCM) has had a rough few months. Low points included the resignation of former chief executive Oozi Cats following evidence of an indictment against him in the US, and – more recently – the news that adjusted cash profits for the 2017 financial year are expected to be “materially below” bosses’ previous guidance.

These are just two examples. But, for us, such scenarios underscore concerns around the regulation and governance of Aim companies. As we look to 2018 and signs of possible trouble ahead, our views will be shaped partly by the outcome of the aforementioned LSE review. Whatever happens, we expect a greater onus to be placed on transparency around financial stability and management’s experience.

Survival of the fittest

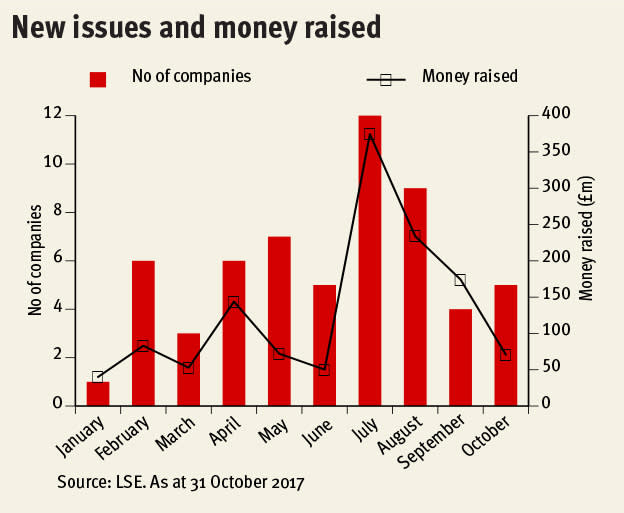

Including those already cited, 58 companies joined Aim during the year to 31 October – via IPO, reverse takeover and readmission. Reflecting the diversity of companies floating on the exchange, billion-pound Alfa Financial Software (ALFA) listed in June, while ‘minnow’ fishing retailer Angling Direct (ANG) floated in July. And indicating that the more mundane concepts in life can prove the most interesting, Strix (KETL) – a manufacturer of kettle safety components – listed in June and is now an IC buy tip with attractive income potential.

There were also 83 cancellations, including 17 reverse takeovers and four transfers to the main market – representing the beginning of a new chapter. However, not all companies can endure public life. We questioned Stanley Gibbons’ (SGI) survival this time last year. The collectibles business remains listed, although its Guernsey subsidiary was recently granted an administration order. We think the group needs a willing buyer, or this could be its last mention in the IC Christmas issue.

Ongoing investment themes

We’ve explored only a few of the themes on Aim that will feed through to 2018. Ultimately, the market reflects real-life events. With new data privacy rules coming into effect next year, cyber-security exemplifies another trend among many worth monitoring. Meanwhile, an increasingly cashless world signals heightened demand for mobile payments businesses.

‘Real life’ in the UK is, of course, also synonymous with pre-Brexit uncertainty. Applying further pressure to Aim, this year Nasdaq First North became the first exchange outside of the UK and Ireland to be given ‘growth market status’ by Britain’s HM Revenue & Customs. This could provide an alternative to shareholders, and businesses, looking outside of London. Like its constituents, Aim must fight to guarantee its future upside.