Representing the crème de la crème of the UK legal market, ‘Magic Circle’ and ‘Silver Circle’ firms have historically attracted the brightest graduates, the most experienced senior lawyers and some of the highest-paying clients. Many of these businesses today operate as limited liability partnerships (LLPs). Within this model, partners typically receive a share of the remaining profits after all other company expenses have been paid. A real incentive for employees to rise through the ranks.

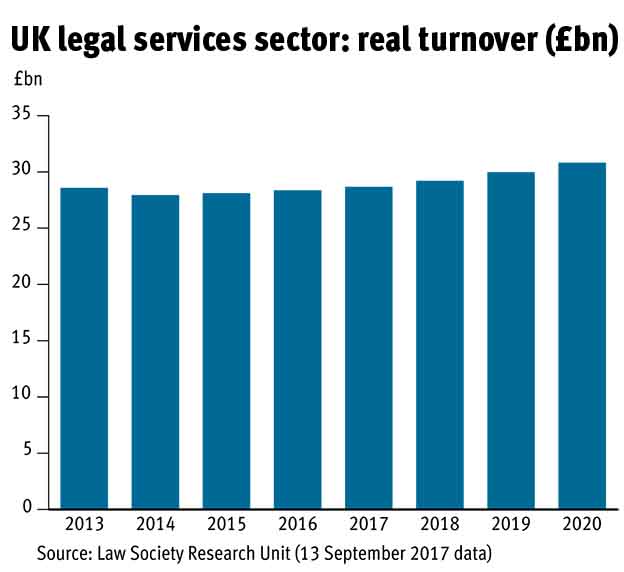

Beyond the ‘circles’ exist various other law firms – regional, specialist, high street – collectively representing a very fragmented sector. Against this backdrop, how do smaller, lesser-known firms targeting the legal middle market stand out? How can they compete for clients and recruits, particularly as the Law Society projects only modest growth in turnover over the next three years? It’s likely that lawyers will have to work even harder (or offer discounts) to procure new business.

Going public is one solution, as demonstrated by three firms since 2015: Gateley (GTLY), Gordon Dadds (GOR) and Keystone Law (KEY). Thanks to the Legal Services Act, effective from 2011, UK law firms can adopt an ‘Alternative Business Structure’. This means they can accept investments from external (non-lawyer) parties.

Thus, as we suggested in our Aim Christmas feature, a new mini-sector has emerged on London’s junior market – a ‘public circle’ of sorts. Each of the aforementioned law firms had their own reasons for becoming plcs, but it’s fair to say that profile raising is a universal consequence of any flotation.

Of course, some may perceive a conflict between law firms’ ability to service clients, while keeping shareholders happy. Others may argue that public status creates greater transparency, and allows junior employees to invest, too. It’s possible that partners might feel more engaged in a firm’s future, if they can expect to earn dividends in retirement. In any case, the recent spate of listings has shone a spotlight on this new market segment – raising the question: are legal services a worthwhile investment?

The Public Circle

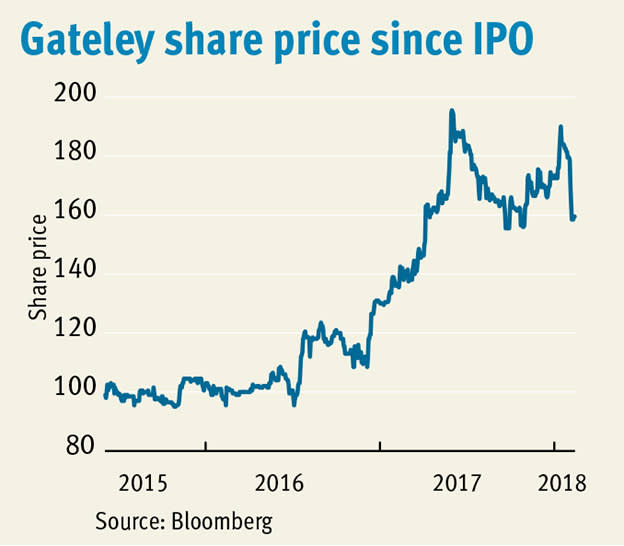

Gateley was the first UK law firm to IPO in June 2015, raising £30m on admission. The group already had a long history when it joined Aim. And it was profitable: in the decade prior to listing, the firm achieved annual compound revenue growth rate of 14.3 per cent and operating profit of 14.8 per cent.

So why go public? Gateley’s directors sought further growth – both organic, and via acquisitions. They also seemingly acknowledged that the traditional partnership model might not appeal to younger lawyers. Indeed, at the time of listing, management aspired to “alignment, through share participation, of employees’ goals with those of the business, aiding retention of staff and adding to Gateley’s recruitment appeal”.

Senior lawyers seemed to admire the model, too. Six new partners were hired from competitors in the six months to October 2017, which in turn helped to drive a 16 per cent uplift in work in progress. Meanwhile, first-half revenue rose by a comfortable 10 per cent to £38.6m.

That said, pre-tax profits stayed flat at £4.2m, reflecting the investment needed to boost staff numbers and expand its offering. Investors don’t seem overly concerned: today the shares are up roughly 70 per cent on Gateley’s admission price.

Consolidating the middle market

When Gordon Dadds joined Aim in August 2017 via a reverse takeover, management saw a “significant opportunity for consolidation within the UK legal services market”. Gordon Dadds is the holding company for Gordon Dadds LLP, “an acquisitive law firm” and businesses including Prolegal – “acquiring and managing smaller law firms”. The group focuses on the “challenged” middle market, where it sees firms facing pressure on prices, significant debt and the need for greater scale.

LawTech

To integrate these newly acquired businesses within the larger firm, Gordon Dadds has a centralised technology and regulatory platform. Encouragingly, this cloud-based system, based in Cardiff, has received investment from the Welsh government.

We think the group is on to something: PwC’s Law Firms Survey 2017 says “an increasing number of firms are viewing technology not just as a means to boost efficiency, but also as a way to reimagine how legal services are delivered”.

Longer-term, artificial intelligence might play a more significant role in the law. The Law Society says that by 2038, the sector’s total employment could fall by 20 per cent due to automation. For now, tech is good news for lawyers, but it’s worth remembering the potential disruption.

‘Gig’ lawyers

“Dispersed” law firm Keystone’s IPO last November reflects the increasing extent to which we live in a ‘gig’ economy, where people receive payment for the hours they choose to work.

Keystone’s lawyers – spanning 23 services areas – are self-employed. They work from their own offices, but – similar to Gordon Dadds’ structure – they can access Keystone’s centralised back office. Rather than receiving fixed salaries, lawyers earn between 60-75 per cent of fees after the firm itself has been paid for any work done.

Bosses believe Keystone has the potential to scale fast, thanks to strong cash generation and the absence of fixed overheads.

The Big Wig

For those not ready to take a punt on the listed law firm model, Burford Capital (BURF) offers a rather larger investment proposition, and a rather longer track record: £2.6bn and over eight years, respectively. The litigation finance specialist’s pre-tax profit rose by a whopping 142 per cent to $135m (£97.1m) in the six months to June 2017, buoyed by its investment in the lawsuit brought by the Petersen Group against Argentina.

In July last year, the company also announced a portfolio financing arrangement with British law firm Shepherd & Wedderburn. At the time, Burford’s managing director in London, Craig Arnott, said that such portfolio finance can help UK law firms be “nimble and innovative to attract clients”.