Make or break

Representatives from the US and China began two days of talks this week, aimed at reaching a trade agreement before 1 March, after which President Trump has said he will more than double tariffs being applied to around half of all Chinese exports to the US. Ahead of the talks the National People’s Congress plans to rush through a law banning "forced" technology transfers and other illegal interference by Chinese officials in foreign-invested businesses, according to official news agency Xinhua. However, the US decision to unveil criminal charges against Chinese telecoms specialist Huawei – accusing the group of stealing American technology and breaking sanctions against Iran – may hinder talks.

Apple rallies

iPhone sales falter

Shares in Apple (US:AAPL) rallied in after-hours trading on release of the official first-quarter results, following January's rare revenue warning for its first fiscal quarter, which referenced lower-than-expected iPhone sales, and economic deceleration in China. While iPhone revenues fell 15 per cent year on year, revenue from other products and services rose 19 per cent. Management also noted the relative strength of the dollar and said that in January Apple has absorbed part or all of the currency movements in some locations, for some products, “as compared with last year”. Apple expects second-quarter revenues of $55bn-$59bn.

Ill-health

Margin contraction

There was more bad news for vets business CVS (CVSG) this week, after it warned that cash profits would fall “materially” short of expectations this year. The shares plummeted almost a third in response. The decline was largely due to a disappointing first half, which saw gross margins contract from 79.5 per cent to 76.2 per cent after a higher proportion of lower-margin farm sales during the period. Sales from farm practices now represent 8.9 per cent of group sales compared with 3.2 per cent this time last year. Employment costs are also on the rise as the group remains heavily reliant on locum staff.

Consumer caution

Borrowing slows

UK consumer borrowing rose at its lowest annual level since 2014 in December last year, according to data from the Bank of England, with shoppers splashing out less since the summer heatwave and football World Cup. Annual consumer credit growth rose by 6.6 per cent in December, down from 7.2 per cent the prior month, with credit card spending of just £100m – the lowest since September 2014. An end to the boom in new car finance also dampened the rate of credit growth last year.

May set for battle

Amendments approved

Prime minister Theresa May was given the green light by members of Parliament to attempt an unlikely renegotiation with Brussels over the Brexit withdrawal agreement. MPs voted 317 to 301 in favour of a government-endorsed amendment tabled by Conservative backbencher Graham Brady, which seeks to replace the Irish backstop with “alternative arrangements”. But senior figures across the European Union have already hinted that May is likely to encounter steadfast opposition to any revision of the deal. The EU’s lead Brexit negotiator, Michel Barnier, said that “the EU institutions remain united and we stand by the agreement we have negotiated with the UK”.

Ophir seals deal

Two-thirds premium

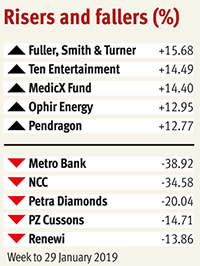

It's official: Ophir Energy (OPHR) has agreed to be acquired by Medco for 55p a share, in a deal that values the London-listed group at £391m. Although the offer represents a 66 per cent premium to Ophir's closing price on 28 December (the last date before Medco's possible interest was first disclosed), it will likely arrive as scant consolation to long-term holders of the business. On 12 January 2018, when there was still some hope for the Fortuna LNG development, Ophir's shares were trading at 72p each. In recommending the deal to shareholders this morning, chairman Bill Schrader said the offer "reflects the future prospects of Ophir's high-quality assets".

M&S gives in?

Ocado deal mooted

Rumours have intensified that online grocer Ocado (OCDO) is in talks with high-street chain Marks and Spencer (MKS) to start delivering the latter’s goods to homes across the country. It could mark the end of Ocado’s long-standing contract with high-end supermarket Waitrose, which ceases in September 2020. The Mail on Sunday first reported on negotiations, arguing that new M&S chairman Archie Norman is keen to kick-start grocery delivery for the beleaguered chain. Ocado will unveil 2018 full-year results on 5 February.

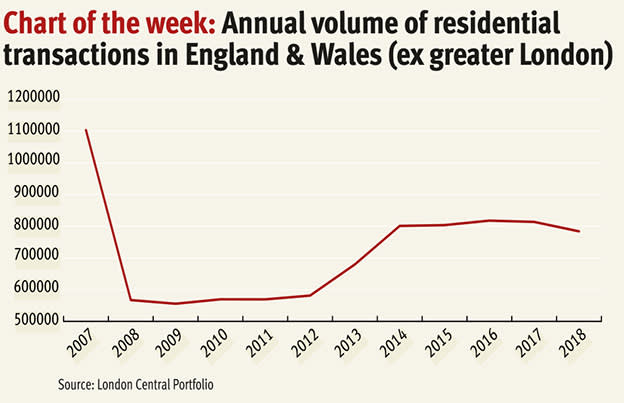

Residential housing transactions across England and Wales fell to their lowest level for five years in 2018, according to data from real estate investment advisers London Central Portfolio (LCP).

Excluding Greater London, just 783,913 transactions were completed last year, down3.7 per cent from 813,675 in 2017. They have not dipped below 800,000 since 2013, when 679,796 properties were exchanged.

Naomi Heaton, chief executive officer of LCP, highlighted that transaction levels have fallen since the introduction of additional-rate stamp duty in 2016. “Undoubtedly the uncertainty around Brexit is having a far more punitive effect than increased buying costs,” she added.