Aerospace and defence engineer Senior (SNR) has confirmed that it anticipates a hit to its aerospace margins this year, following Boeing’s decision to cut its monthly production of 737 Max jets from 52 to 42. Boeing made the call to lower production after aviation regulators grounded the jets in response to a crash in March, its second in six months, which killed all 157 people on board. Senior supplies airframe and engine components across seven customers for the Max, including Boeing, engine supplier CFM International and Spirit Aerosystems.

Senior had been preparing to cater to a planned Boeing production ramp-up to 57 Max jets a month. Earlier this month, a Senior spokesperson told Investors Chronicle that “there are no changes to our production schedule” following Boeing’s cut. Senior chief executive David Squires has since updated that the company had not yet received scheduled changes at the time of comment, and that it has now started to see the effects of Boeing’s reduction “trickle through”.

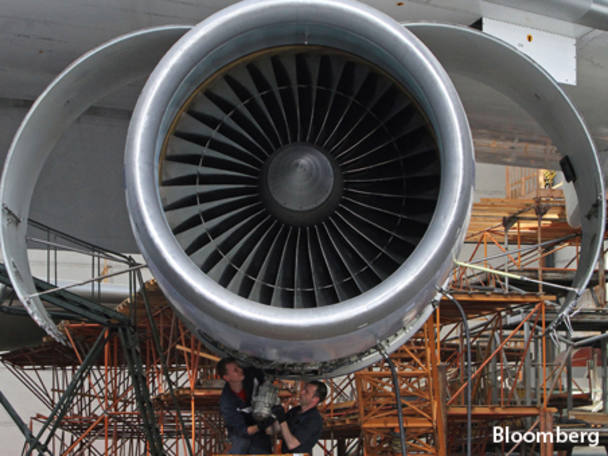

The Max’s engine-related customers have not followed Boeing down to 42 jets a month, and Senior will provide the likes of CFM, a joint venture by Safran Aircraft Engines and General Electric, with the parts they need to supply 52 jets each month. Boeing has not disclosed how long its anticipates operating at a reduced schedule, so Mr Squires said that Senior has made some assumptions for the year. Senior expects the interim schedule to continue for “several months, and then [go] back up to 52 by the end of the year”, he says.

The company has earmarked its Aerospace AMT division, the largest business in its structures division, as the section of the group likely to be most impacted by the Boeing crisis. AMT has secured a high level of new content on the Boeing 777X, and is accordingly incurring new costs associated with product introduction and industrialisation. As a result, it is less able to absorb the probable impact of the Max cuts than Senior’s other businesses.