Motor tie-up

Fiat Chrysler Automobiles (FCA) revealed that it was pursuing a €32.6bn (£28.9bn) all-share merger with Renault, in a deal that would deliver annual savings of over €5bn and combined revenues of nearly €170bn. The combined business would be the world’s third-largest car manufacturer. FCA has proposed a 50:50 split in ownership between the Italian-American group and the French car giant. On an aggregated basis of 2018 results, the new entity would have operating profit of more than €10bn and net profit of over €8bn. The tie-up would avoid any plant closures.

M&G backs PFG

Takeover stalemate

M&G Investments became the latest shareholder to throw itself behind Provident Financial (PFG) and declare its intention to reject Non-Standard Finance’s (NSF) hostile takeover bid. M&G, which owns 1.7 per cent of Provident’s issued share capital, said it supported the sub-prime lender’s current strategy “and does not believe that a combination with NSF and subsequent break-up of the enlarged group will create value for Provident shareholders". NSF – founded by former Provident chief executive John van Kuffeler – secured just 53.5 per cent of shareholder support for its offer, despite mutual shareholders Marathon, Woodford Investment Management and Invesco voting in favour of the tie-up.

Waste deluge

Imports returned

Malaysia outlined plans to return around 3,000 tonnes of plastic waste to countries including Canada, the US and Saudi Arabia, following China’s lead in clamping down on levels of waste imports. The Southeast Asian country said it would return shipments of contaminated plastic to limit the “dumping” of waste in Malaysia from the rest of the world. Countries including Malaysia, Vietnam and Indonesia increased their share of plastic waste management after China banned imports in 2017, but have been overwhelmed by recycling materials.

Mortgage rebound

Demand picks-up

UK mortgage approvals reached the highest point in more than two years during April, according to figures from UK Finance. The total number of mortgages granted by the country’s main high street lenders rose to 43,000 from 40,600 in March, up 11 per cent year on year. Historically low interest rates have been supportive of mortgage demand but weakening economic growth has weighed on house price growth. Monthly mortgage approvals averaged around 40,000 a month in the three years to March 2019, according to UK Finance, down from 42,300 the three years to March 2016.

China retaliates

Mineral restrictions

China indicated that it might restrict the export of rare earth minerals to the US, in the latest escalation of the trade war between the two nations. China is the world’s largest producer of rare earths – a group of 17 minerals used in production for items including electric cars and wind turbines – and provides the US with around 80 per cent of its supply. The indication, which came from a notice by China’s National Development and Reform Commission, caused shares in some rare earth producers to spike.

OML chief sacked

Follows weak Q1

Old Mutual (OMU) revealed more details about the “material breakdown in trust and confidence” between board and chief executive Peter Moyo that led to the latter’s firing. According to the pan-African financial services group, the two parties fell out over the handling of third-party conflicts of interest which pre-dated Mr Moyo’s appointment as chief executie, but were previously considered manageable. Old Mutual added that the decision to terminate Mr Moyo’s employment was “neither the result of performance or financial misconduct”, but purely related to the conflict of interest. However, current trading looks rather choppy, as a first-quarter trading update made plain: negative “results from operations” in 2018 mean a three-year target to boost growth by two percentage appoints above GDP “will become increasingly challenging to achieve”.

Airtel IPO

Debt reduction planned

Airtel Africa announced its intention to float on the London Stock Exchange, with the hope of paying down its debt. The group provides telecoms and mobile money services across 14 countries in Africa; primarily in East, Central and West Africa. At the end of 2018, it was the second-largest mobile operator in Africa by number of active subscribers, according to research house Ovum. In October, the group raised $1.25bn in an initial round of pre-IPO funding, plus another $200m in January. Management is also considering a listing of its shares on the Nigerian Stock Exchange.

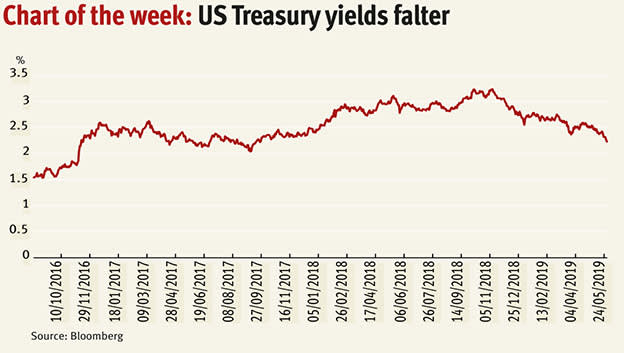

The benchmark 10-year US treasury yield fell to its lowest point in almost two years, as investors raised their bets on the Federal Reserve making two or more cuts before the end of the year.

The yield – which moves inversely to prices – fell to 2.22 per cent this week, its lowest level since September 2017.

The probability of at least two rate cuts in 2019 rose above 40 per cent, according to futures prices, against a backdrop of slowing economic growth and ongoing trade disputes.