IC TIP UPDATES:

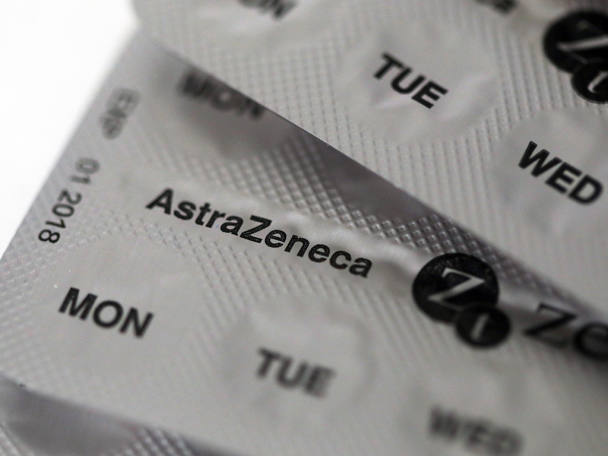

AstraZeneca (AZN) has revealed that Phase III of a trial it dubbed NEPTUNE – which combined immunotherapy drug Imfinzi with medicine tremelimumab – was no more effective than regular chemotherapy at treating advanced lung cancer. The results of a previous trial had also shown that Imfinzi on its own and in combination with tremelimumab had not met the primary endpoints of improving overall survival results compared with chemotherapy in patients with stage IV lung cancer. Sell.

Despite receiving shareholder approval, the merger of OneSavings Bank (OSB) and Charter Court Financial Services (CCFS) is yet to complete. But the mortgage-focused lenders have synced the release of their half-year results, both of which show loan growth, a slight deterioration in the net interest margin, and a pick-up in their respective loan-loss ratios. Shares in both groups are consequently down, despite chunky rises in their respective dividends. Both are under review.

Shares in Hostelworld (HSW) fell more than 9 per cent in early trading after the online booking platform reported a 9 per cent decline in revenue to €38.8m (£35.5m) during the first half, while adjusted cash profits fell 14 per cent to €8.9m. Gross bookings under the core Hostelworld brand fell from 3.8m to 3.7m, and net of cancellations, brand bookings fell from 3.7m to 3.4m. Chief executive Gary Morrison said booking demand over the peak summer season had been “somewhat lower than anticipated”, but said the company has made good progress in its ‘Roadmap for Growth’ strategy. Our buy tip is under review.

KEY STORIES:

Hansteen (HSTN) reported a 5.4 per cent adjusted total shareholder return during the first half, including dividends paid. The value of the property portfolio rose 1.8 per cent, although selling European assets to Blackstone meant that normalised income profit declined 17 per cent. The multi-let urban landlord completed 373 new leases and renewals at 4.7 per cent ahead of estimated rental values at December 2018.

With the previously announced contract delays and cancellation of the M4 Corridor project, Costain’s (COST) underlying operating profit has fallen by 9 per cent to £21.2m for the six months to 30 June. The margin has improved by 0.5 percentage points to 3.5 per cent. Statutory pre-tax profit has more than halved to £8.4m, adversely impacted by a £9.7m exceptional charge relating to previous remedial works where the sub-contractor is no longer in operation. Although the group remains in a net cash position this has declined by 47 per cent to £40.8m. The interim dividend has been cut by over a quarter to 3.8p. Shares are up almost 11 per cent this morning.

OTHER COMPANY NEWS:

Experian (EXPN) has announced the acquisition of Look Who’s Charging (LWC), a provider of “transaction enrichment and categorisation technology” to banks in Australia. LWC will be reported within the EMEA/Asia Pacific business-to-business segment under the data division. The deal is for an undisclosed sum. Shares are up almost 2 per cent.