One could be forgiven for assuming that three-and-a-half years of Brexit uncertainty brought about a barren period for dealmaking in the UK. There’s certainly been a dearth of initial public offerings (IPOs), although this was not entirely driven by political stalemate, as a series of botched high-profile listings scared would-be London Stock Exchange entrants away from the market.

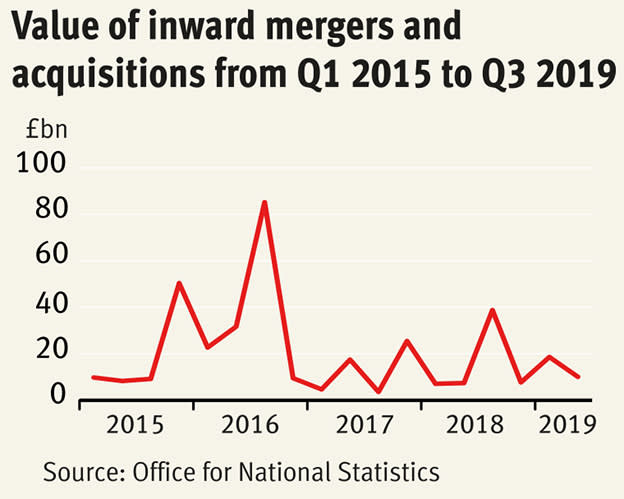

But UK merger and acquisition (M&A) activity has actually been resilient since June 2016. Last year, the UK was the most targeted country in Europe, the Middle East and Africa (EMEA) for mergers and acquisitions, with $220.9bn (£168.9bn) worth of deals, according to Refinitiv – far ahead of Germany, which sat in second place with $91.9bn. There has also been a strong flow of interest in UK small-caps, many of which are niche and tech-focused, and therefore sheltered from some macroeconomic headwinds. That partly explains the number of takeovers on Aim, which accountancy firm UHY Hacker Young says exceeded the number on the main market in both 2018 and 2019.

None of this is to say that the return to majority government won’t add momentum to M&A and generate further interest from prospective dealmakers. The ability to pass government legislation in parliament will allow Boris Johnson to pursue his agenda for a ‘global Britain’. Nor has Brexit risk evaporated, despite the UK’s departure from the European Union (EU) being now all but certain. The UK will have to leverage its competitive advantages in areas such as technology and life sciences in a post-Brexit world. “The new government’s vision of a post-Brexit Britain places great weight on a high-tech, high-skill, innovation-led economy which looks globally rather than to the EU for its trading relationships,” says Ben Higson, a partner at law firm Hogan Lovells. This could build interest in the likes of stem-cell technology business ReNeuron (RENE), as we detail among our selection of five potential takeover targets for 2020 below.

Acquirers are likely to find value among UK companies, too. Shortly before the December election, UK equities were valued at a 30 per cent discount to global peers, according to Schroders, which represents a 30-year low. The election was followed by a brief rally in UK equities, before mild concerns over the UK’s future trading relationship with the EU returned. The subsequent weakening of the pound, together with expectations that it will remain depressed against the dollar, should help to fuel foreign investors’ enthusiasm for UK companies.

Increasingly, those buyers are likely to come from private markets, according to advisory group Willis Towers Watson. Slowing economic growth notwithstanding, alternative investors’ record levels of unused cash – most notably the so-called 'dry powder' within private equity funds – is expected to lead to a spate of larger deals and corporate joint ventures in 2020. Then there is the recent underperformance in the shares of listed buyers in the 12 months following a deal, relative to global benchmarks, which could give private capital another edge on the boardrooms of publicly held companies.

The infrastructure and housebuilding industries look set for government investment, which would benefit companies such as residential property business Grainger (GRI). “There is a growing body of opinion that national governments should now be doing more to counter the slowdown with increased spending in areas such as infrastructure to take advantage of ultra-low borrowing rates,” says Sue Noffke, Schroders’ head of UK equities. “One particular equity market distortion resulting from the loose monetary policy of the past decade has been the outperformance of growth stocks versus ‘value’ stocks,” she adds. “Growth has become an increasingly sought-after commodity and as a result more highly priced.”

In this feature, we also consider as potential takeover candidates defence giant Babcock (BAB), which has been the subject of interest from support services group Serco (SRP), and drinks business Fevertree Drinks (FEVR), which is trading at a two-year low after a relentless share price charge that might have previously put off some would-be buyers. There’s been a pick-up in dealmaking activity in the luxury sector, most notably exemplified by LVMH’s (FRA:MC) acquisition of Tiffany, so we consider the takeover prospects for Burberry (BRBY) and Mulberry (MUL).

Along with its promising technology offering, cash-strapped ReNeuron is also likely to spark interest among small-cap-focused dealmakers. Last year saw a significant increase in the volume of M&A activity in the small-cap space, according to Brendan Gulston, co-manager of the LF Gresham House UK Micro Cap fund and Multi Cap Income fund. This was driven by low valuations. Smaller players have long been attractive to both larger listed companies and private equity. “You’ve got a small-cap discount to the FTSE 250,” he observes.

“You’ve then got a microcap discount to the small-cap space, and then you’ve also got a domestic earner discount to international earners.

“If you look at that from a microcap perspective it creates a triple effect of valuation discounts, which means that not only do you have these really interesting companies from a business fundamentals perspective, but actually they’re looking pretty cheap on a relative basis.” AJ

Five takeover targets

A fallen angel

Fevertree Drinks was once the toast of Aim, with a phenomenal bull run seeing its shares reach over 4,000p in 2018. The drinks mixers producer has since lost some of its sparkle amid fears that momentum is slowing. Even without the premium valuation, some might question the rationale of a multi-billion-pound takeover of a company that made a pre-tax profit of just £76m in 2018. But riding the gin boom, Fevertree has capitalised on premiumisation in the global spirits market to command market-leading positions both at home and abroad. Aiming to crack the US market, the tantalising international growth prospects make the group an outside takeover target. With the shares languishing around their lowest level in over two years, potential suitors could spot an opening.

The domestic market could be maturing and Fevertree warned in November that full-year revenue would fall short of expectations due to weaker UK trading. But the company remains ahead of the pack in off-trade (grocery and retail), fending off a rising number of premium mixer competitors. Meanwhile, international growth is accelerating. The transatlantic expansion is in its early stages and US revenue is expected to increase by 34 per cent in 2019. Fevertree could realise its US ambitions sooner and at lower cost if it were able to leverage the distribution network of an industry leviathan and create a national footprint.

Unilever (ULVR) and PepsiCo (US:PEP) were rumoured to be mulling approaches in 2018. While Unilever is increasingly focusing on its personal care business, Pepsi could still see the chance to gain an edge over rival Coca-Cola (US:KO) and its Schweppes products. Top spirits makers such as Diageo (DGE) and Pernod Ricard (EPA:RI) could complement their portfolios of premium alcoholic drinks with Fevertree’s premium mixers. Diageo has already demonstrated a taste for premium purchases with its $1bn (£770m) acquisition of ‘super-premium’ tequila company Casamigos in 2017.

That being said, a deal could still prove elusive. Despite the recent sell-off, Fevertree's shares are trading at 31 times forecast 2020 earnings, meaning Fevertree remains an expensive bet. Given the mixed track record of UK companies venturing across the pond, the US growth story is far from assured. Anheuser Busch Inbev’s (EBR:ABI) rocky path after taking over SABMiller also demonstrates how mega beverage tie-ups can fall flat. The level of risk and potential price tag may not be to everyone’s taste. NK

A suitor returns

Defence giant Babcock has received a couple of expressions of interest over the past few years from outsourcer Serco, which intended to create a £4bn defence goliath through an all-share merger. As far as we know, Serco is no longer interested in pursuing a merger with Babcock.

But Babcock, which has been maligned for a range of reasons including its corporate structure and the execution of some of its services, nevertheless retains unique defence engineering capabilities and a steady stream of orders from the UK government and its allies. There may be a party out there keen to cherry-pick from its assets, which carry out vital and lucrative work that includes frigate manufacturing for the UK’s Ministry of Defence (MoD) and submarine work for the Australian government. There may even be a group substantial enough looking to succeed where Serco failed. Given the deteriorating geopolitical landscape and with the government set to carry out a radical defence review, Babcock may be well-placed to capitalise on a surge in defence expenditure. In a speculative December buy tip, we suggested that Babcock’s turnaround may be worth buying into.

The company firmly rejects the criticisms of research firm Boatman Capital, which published a report criticising Babcock for a corporate structure and inter-company transactions that have created an “opaque” and “needlessly complex” system. Management may nevertheless choose to accept interest from external parties in a bid to slim down the business. UK defence businesses are prized and viewed favourably around the world. Air-to-air refuelling specialist Cobham (COB), which has also been through its fair share of problems, is entering the hands of US private equity company Advent International.

The tortured machinations of the Cobham deal, however, signal the difficulties that external interest in Babcock could encounter. Cobham’s takeover was met with opposition on grounds of national security and was reviewed by the government. Babcock is even more integral to the UK’s defence capability, and the transfer of assets such as its aircraft carrier manufacturing work into another entity (particularly if foreign) would probably prove incredibly challenging. The defence industry is a jewel in the crown of the UK economy. As attractive as some of Babcock’s assets are, it is unlikely that they could be taken without a serious fight. But as Cobham’s takeover shows, not impossible where there is a strong will to acquire strategically important companies. AJ

Growth in a barren sector

The UK’s development of private rental homes has lagged continental Europe and the US, a fact institutional investors are capitalising on by pouring money into the sector. Yet for global investors with multi-billion-dollar portfolios, which often take a top-down approach to asset allocation, could absorbing a specialist operator be a more expedient method of gaining exposure to the fast-growing sector? US commercial real estate group CBRE seemed to think so, launching a £267m bid for formerly UK-listed Telford Homes in July last year, a housebuilder that had accelerated its shift towards the build-to-rent sector following a slowdown in the London residential sales market.

For Grainger, the largest London-listed landlord, the decision to double-down its focus on the private rented sector (PRS) could make it a prime target. Last year the value of its private rental assets surpassed that of its portfolio of regulated tenancy homes for the first time, following the acquisition of the remaining 75 per cent stake in the GRIP real estate investment trust (Reit) that it did not already own. That means the group is forecast to earn more money from rental income than trading profits from selling vacated regulated-tenancy homes.

Historically low global interest rates, which central bankers show no sign of raising in the near term, have made investing in PRS assets more attractive for institutions in search of yield. Demand for rental homes is also expected to continue to rise, forecast to account for 22 per cent of UK households by 2023, according to research by the Office for National Statistics, up from 20.6 per cent in 2019 and 13 per cent in 2007.

However, any potential suitor would have to cough up a tidy sum for Grainger, with the group’s market value having risen by almost half over the past 12 months. In fact, the shares were valued at a 5 per cent premium to net asset value (NAV) at the September 2019 year-end, buoyed by the market’s expectation of further rental growth. Potential buyers could include Invesco or Hermes, US fund houses that already have some UK PRS exposure and are looking to increase the scale of their portfolio. Or European pension funds such as the Netherlands’ largest, ABP – fellow Dutch scheme PGGM has already set up a joint venture with Legal & General to enter the UK build-to-rent sector. There’s also the potential for a private equity (PE) group such as Carlyle to make a bid, particularly given the high level of dry powder within the PE industry that needs to be put to use. Blackstone has already done so by investing in affordable homes provider Sage Partnerships in 2018. EP

Luxury at any price

LVMH’s mega-deal to acquire Tiffany came as a surprise to many, prompting a jump in the share price of luxury groups across the world, including Mulberry, Burberry and Hugo Boss (ETR:BOSS). It would have been easy to dismiss the transaction as a standalone, capitalising on the jeweller’s poor recent performance. However, it was followed in short order by news that luxury conglomerate Kering was in talks to acquire Italian skiwear group Moncler.

The deal was the second-largest cross-border transaction of 2019, according to data from Refinitiv, valuing the jewellery group at $135 (£103) per share, or $16.2bn. It was seen as an unlikely candidate, as a 2019 Deloitte survey of private equity investors found that of the 70 per cent of investors who anticipated making an acquisition in the sector in 2019, 79 per cent ranked both apparel & accessories and cosmetics & fragrances as the most attractive luxury sectors for dealmaking in the year.

Should their convictions hold true into the new year, both Mulberry and Burberry could prove attractive targets, although for very different reasons.

Burberry is undergoing a renaissance under its new chief creative officer, Riccardo Tisci, hired away from LVMH’s Givenchy in March 2018. Under his direction, new product lines have flourished, accounting for 70 per cent of in-store sales at the end of September, compared with just 15 per cent in March. Returns on capital employed and margins are both strong, a sure sign of a brand’s strength. With more than a century of heritage and a strong position in the key Chinese market, the group would sit well in the portfolio of one of the sector's larger players.

Mulberry, on the other hand, was hit hard by the collapse of House of Fraser in August 2018, and has been working to reduce its reliance on the challenged UK retail sector. However, at its last update, the UK still accounted for 65 per cent of sales. A new owner with resources and international reach could expedite this transition, but they would need to convince Singaporean billionaire Christina Ong – whose company Challice owns a 56 per cent stake in the group – to sell. TD

Highly prized IP

There are clear parallels in the way in which the natural resources and pharma/biotech sectors have evolved, especially in terms of funding. Both industries are dominated by large multinationals, but they also rely on smaller players in the market to drive specialised areas of exploration in the case of the former, and research in the case of the latter.

The trouble is that these smaller players are often saddled with long lead times towards production, devoid of revenue and cash flows. It can take years before the success of their exploration and clinical efforts is formally confirmed. Companies can chug along on royalties, farm-ins and hurdle rate payments for a time, but at some point they will need to either crank up leverage (or tap the market) to go into production or, as is often the case, be acquired by an industry heavyweight.

These scenarios could eventually play out for a minnow such as ReNeuron, a £44m gene therapy specialist which we have previously described as having “highly promising technologies tempered by uncertainties linked to the funding imperative”.

The company is developing stem-cell technologies for use in therapies to combat chronic stroke disability and certain types of retinal degeneration. Clinical results have been positive, but the company’s management is attempting to shorten the overall time to market approval, thereby easing the capital imperative to a degree.

ReNeuron had net cash of £20.3m at the time of its September interim result, but it burnt through £7.48m in net cash during FY2019 with R&D expenditure up 22 per cent to £9.23m. We do not envisage any let-up in the capital demands given the clinical trials in prospect, but matters have been helped by the payment of half of the £12m upfront fee from Fosun Pharma for the potential commercial exploitation of the company’s therapies in China.

The agreement with Fosun, signed last April, could generate success-based milestone payments of £80m and double-digit royalties on sales, but it is hard to imagine that a $14.5bn (£11.2bn) group like Fosun wouldn’t be interested in incorporating ReNeuron’s intellectual property within its balance sheet further down the track.

Asia is currently the fastest growing region for pharmaceutical investment in the world – with M&A playing an increasingly prominent role. Gene-based therapies represent the new frontier in medical research, underpinning a new tailored approach to clinical applications, aided by the accumulation of massive new datasets across population groups. If ReNeuron’s technologies are eventually deemed efficacious by regulators, then Fosun may have to act quickly, because these technologies would not have gone unnoticed closer to home. MR