Loaded with debt and facing a severe shortfall in rental income, shopping centre landlord Intu (INTU) has found itself with its back against the wall. The former FTSE 100 group, which owns Manchester’s Trafford Centre and Lakeside in Essex, is appealing to creditors to permit a standstill in repayments potentially until the end of next year, after warning that it was likely to breach its debt commitments at the end of June.

Yet Intu is further down a path that more companies are likely to find themselves forced to travel down. After a decade of soaring borrowing, companies are balancing repayment obligations with the strain placed on income streams by social distancing measures.

Although lockdown measures are gradually being eased, rental and other operating liabilities have been rolling up and many companies that have been forced to close will find that earnings lag behind once they do resume trading. That burden is heightened for companies that entered this crisis with high levels of debt.

“They need a certain amount of cash to reopen and the margin is unlikely to catch up with the accrued liability during the lockdown,” says Mark Fry, national head of restructuring and insolvency at BTG Advisory.

Alarm surrounding mounting corporate debt were sounded before Covid-19 reared its head. In October, the International Monetary Fund (IMF) warned that companies were sitting on a $19 trillion debt “timebomb” in the event of another global recession. In fact, the IMF said that almost 40 per cent of the corporate debt in eight leading countries – the US, China, Japan, Germany, UK, France, Italy and Spain – would be impossible to service if there was a downturn half as serious as that of a decade ago.

Just over five months since the first case of the virus was confirmed in Wuhan province in China, the Bank of England has forecast that the UK will this year suffer its worst economic contraction in history.

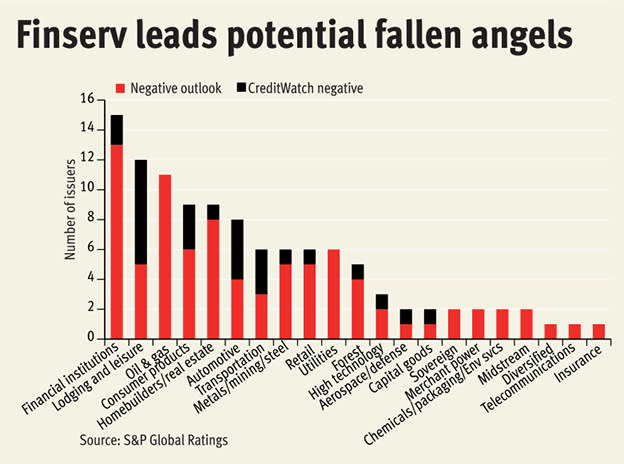

There has been a flurry of credit downgrades by ratings agencies in recent weeks as the perceived likelihood of companies defaulting on their debt obligations has increased. So far in 2020, the number of fallen angels – issuers downgraded to junk status from investment-grade – has already surpassed the total for 2019 and is at the highest level since the 2015 commodities rout, based on Standard & Poor’s (S&P) ratings actions. More recently, those include Rolls-Royce (RR.), which lost its investment-grade status after 20 years due to “prolonged weak profitability” and expectations of materially lower revenue from its engine service contracts.

That number looks set to rise much further. The number of potential fallen angels on S&P’s watchlist – issuers rated 'BBB-' with negative outlooks or ratings on CreditWatch with negative implications – had risen to a record 111 companies globally, including Ashtead (AHT) and International Consolidated Airlines (IAG) in the UK. Unsurprisingly, after financial institutions, the sectors topping the list are leisure and hotels, which have been forced to close their doors completely during lockdown, and oil and gas companies, which are wrestling with plunging demand.

Building a war chest

Over the past three months UK public companies have rushed to build cash buffers to meet finance and operating liabilities. Most have implemented cost-cutting strategies, including negotiating rental deferrals with landlords.

However, more companies could start to look at a more fundamental restructuring of their operations, says Mr Fry. “For businesses with high operational gearing that is harder,” he says. But saving options could include reviewing contracts that are onerous or where terms cannot be fulfilled or renegotiating salary terms with staff in return for bonuses or equity stakes, he says.

Cutting or postponing dividends has also become the norm rather than the exception in recent weeks, as has fully drawing down revolving credit facilities (RCF).

It would be questionable for a company not to have already fully drawn their RCF, says Alan Custis, head of UK equities at Lazard Asset Management.

“The concern is that if this continues for a period of time there will be fewer revolving credit facilities available to be drawn down, or that banks that might find themselves in greater degree of stress cut these lines of credit,” he says.

However, some companies, such as Relx (REL), have turned to debt markets to boost their funding positions. Indeed, issuance of investment-grade corporate debt is well above the same period last year, bolstered by corporate bond purchasing by central banks, which in the UK has taken the form of the Bank of England’s Corporate Covid Financing Facility.

Some companies that put lending facilities in place at the end of March or April have subsequently been able to raise funds in the bond market and cancel those facilities, says Linklaters partner Ian Callaghan.

The bond market is typically for longer-term funding in contrast to an RCF, he says. “However, an RCF gives the company the flexibility to repay and redraw to meet its working capital requirements so that it is not paying the full amount of margin when it’s not drawn down," he adds.

However, the strength of a company’s credit rating is likely to affect the appetite for its debt in the bond market. A lower rating may mean that it has to pay a higher coupon.

Others have turned to equity markets to enhance their liquidity and reduce leverage. However, that has resulted in many retail investors suffering dilution to their holdings after being excluded from most of the swathe of share placings that have taken place over the past two months. There is the danger that cash-strapped companies attempting to return to the market for further funding – or those yet to tap investors – may find a lack of those willing to stump up.

“If you’re going to raise money, history suggests you should do it sooner rather than later,” says Mr Custis. “When you’re raising money, you have almost got to go for the big bazooka,” he says, citing Informa’s (INF) raising of a whopping £1bn in April.

Last resorts

But for companies in dire straits, that may be creeping towards their debt covenants, more extreme action may need to be taken.

"If you’re looking at breaching covenants there’s clearly something pretty bad going on,” says Linklaters partner Jo Windsor. “You have generally got an issue with your earnings or underlying worth of your assets."

Some companies have managed to secure covenant waivers, giving them more breathing room. Last week Cineworld (CINE) managed to secure a waiver of the leverage covenant attached to its RCF for the June 2020 testing date and increased the leverage covenant at the December 2020 testing date to a net debt/adjusted cash profit multiple of nine. A day later waste management group Renewi (RWI) announced its net debt/adjusted cash profit covenant has been progressively increased to a multiple of six.

However, banks have been imposing new liquidity tests, says Mr Windsor. "When asked for waivers, lenders have been focusing on how much cash you have got at the moment. What is your liquidity position, what is your current cash burn, how long can you survive in the current market?"

There is also the possibility that more struggling companies will undertake debt-for-equity swaps in a bid to stave off insolvency, although retail investors would effectively see their holdings wiped out.

But as lockdown eases and more businesses resume trading, new challenges are likely to emerge. “The pool of cash available going forward after that will probably be more limited because there will already have been a number of asks on lenders," says Mr Windsor.

Watch for cash burn

The economic fallout of Covid-19 has placed a strain on the cash flows of most businesses.

If a business has historically been highly cash-flow-generative, one might look past current challenges, says Mr Custis.

“However, if you think that it is structural, [for example] a hotel chain, an office block owner or an airline, where you may have some concerns that there may be a structural shift in their business going forward, that’s where that historic cash flow might not be as important,” he adds.

Companies in some sectors, such as utilities, can support higher levels of debt as they are asset-rich and have a higher level of revenue visibility.

Ben Peters, co-manager of the Evenlode Global Income Fund, says he generally looks for companies to have net debt below two times adjusted cash profits and “certainly below three”. “It’s those companies that have got debt and cyclicality where you tend to see the biggest losses,” he says.

He also prioritises companies with higher margins, but those should not be achieved at the expense of necessary investments. For instance, consumer goods companies need to invest in marketing and sales to maintain brand strength, he says.

Red flags

We have screened the FTSE 350, FTSE All-Share and FTSE Aim All-Share indices for companies with high debt and meeting other criteria that may put them at risk of a liquidity squeeze and highlighted three below. The criteria are:

Net debt/Last 12 months Ebitda of 2.5 or more, or a debt/equity ratio of more than 150 per cent for real estate companies and 200 per cent for utilities.

Pre-tax profit coverage of finance costs by a multiple of less than five.

Negative free cashflow last year or forecast negative free cashflow this year.

A decline in operating margin over the past two consecutive years.

Companies at risk of a liquidity squeeze

| Name | Share price (p) | Operating margin (last FY) (%) | Operating income (last FY) (£m) | Pre-tax interest coverage | Free cash flow (last FY) (£m) | Criteria missed | |

| Dialight plc | 248 | 3.4 | -8.8 | 4.7 | -5 | None | |

| IQE plc | 38 | -3.3 | -19.3 | -2.9 | -23.7 | None | |

| FirstGroup plc | 57 | 0 | -105.9 | 0 | 145.1 | None | |

| Pendragon PLC | 9 | 0.3 | -117.1 | 0.3 | -81 | None | |

| TUI AG | 426 | 2.7 | 386.4 | 3.7 | 8.8 | None | |

| Aston Martin Lagonda Global Holdings plc | 54 | 3.2 | -14.8 | 0.5 | -101.1 | None | |

| DFS Furniture PLC | 169 | 4.1 | 32.5 | 4.9 | 17.6 | None | |

| Marston's PLC | 64 | 14.3 | 47.9 | 2.1 | -12.1 | None | |

| Severn Trent Plc | 2450 | 30.4 | 545.7 | 2.5 | -62.9 | None | |

| Superdry PLC | 139 | -5.6 | -84 | -37.5 | 22 | None | |

| Kape Technologies Plc | 197 | 9.9 | 3.3 | 4.2 | -2.6 | Op margin contraction | |

| Hilton Food Group plc | 1242 | 2.7 | 49.4 | 3.9 | -23.2 | Op margin contraction | |

| Kier Group plc | 83 | 1.9 | -215.5 | 3.1 | -118.6 | Op margin contraction | |

| Biffa Plc | 249 | 4.9 | 45.6 | 2.3 | 72.9 | Op margin contraction | |

| Capita plc | 35 | 5.2 | 10.1 | 3.3 | -84 | Op margin contraction | |

| Hyve Group PLC | 90 | 10.7 | 11 | 3.7 | 19.7 | Op margin contraction | |

| Mears Group PLC | 165 | 3.9 | 33.6 | 3.6 | 77.3 | Op margin contraction | |

| Renewi Plc | 25 | 5.6 | -72 | 3.7 | -39.9 | Op margin contraction | |

| Mitchells & Butlers plc | 188 | 14.2 | 296 | 2.8 | 119 | Op margin contraction | |

| Helios Towers Plc | 160 | 6.5 | 31.7 | 0.3 | -44.6 | Op margin contraction | |

| Whitbread PLC | 2544 | 24.2 | 410.7 | 3.4 | -138.5 | Op margin contraction | |

| Smart Metering Systems PLC | 608 | 14.5 | 20.5 | 2 | -68.2 | Op margin contraction | |

| Gym Group Plc | 177 | 18.1 | 21.5 | 1.8 | 31.5 | Op margin contraction | |

| Bilby Plc | 19 | 1.3 | -10 | 3.1 | -2.5 | Op margin contraction | |

| ZOO Digital Group plc | 65 | -4.4 | 1.1 | -3.2 | 0.5 | Op margin contraction | |

| Trakm8 Holdings PLC | 15 | -10.2 | -3.9 | -8.4 | -2.1 | Op margin contraction | |

| Loungers Plc | 134 | 6.7 | 9.8 | 0.7 | -5.2 | Op margin contraction | |

| Accsys Technologies PLC | 75 | 2 | 0.3 | 0.5 | -43.3 | Op margin contraction | |

| SSE plc | 1252 | 10.8 | 84.1 | 2.1 | -96.3 | Op margin contraction | |

| PPHE Hotel Group Limited | 1220 | 22.7 | 79.6 | 2.5 | -4.9 | Op margin contraction | |

| Hummingbird Resources plc | 29 | -4.1 | -4.4 | -0.7 | -5.7 | Op margin contraction | |

| Pennon Group Plc | 1146 | 22.9 | 319 | 3.1 | -59.3 | Op margin contraction | |

| Mulberry Group plc | 187 | -0.4 | -4.7 | -3.2 | -5.4 | Op margin contraction | |

| Studio Retail Group plc | 181 | 7.2 | 39 | 3.8 | -0.5 | Op margin contraction | |

| Stobart Group Limited | 54 | -5.8 | -25.2 | -1.7 | -39.6 | Op margin contraction | |

| Energean Plc | 541 | -8.8 | -76.1 | -0.1 | -708.3 | Op margin contraction | |

| Intu Properties plc | 6 | 3.8 | -1,834.10 | 1.1 | -112 | Op margin contraction | |

| AO World Plc | 139 | -1.4 | -18.3 | -10.8 | -39.9 | Op margin contraction | |

| Stanley Gibbons Group plc | 2 | -31.7 | -3.9 | -6.8 | -3.9 | Op margin contraction | |

| Source: FactSet | |||||||

Capita

Capita’s (CPI) net debt soared by more than two-thirds last year to £791m, excluding £563m in lease liabilities, equivalent to two times adjusted cash profits and at the top end of the group’s target leverage range. Of that debt, £233m is scheduled for repayment in June and September 2020. Analysts at Numis forecast leverage to be just below its key covenant limit of net debt at 3.5 times adjusted cash profits this year, at a multiple of 3.2, based on expectations of a 10 per cent organic revenue decline.

Capital preservation will be vital, but the group’s track record is poor on that front. Restructuring costs, increased investment in upgrading IT infrastructure and property contributed to a £61.3m free cash outflow in 2019. The outsourcer had already downgraded its adjusted free cash flow target for 2020 on the release of its 2019 full-year figures in March, but it has since scrapped all financial guidance. It has implemented a series of cost-saving initiatives, including halting some planned restructuring initiatives and uncommitted capital expenditure, saving £25m this year. The group has cash and undrawn facilities of £450m. Boosting liquidity via further disposals may also prove a tough ask as would-be acquirers are likely to want to hold on to cash. EP

Marston's

A month ago, it was unclear to investors in Marston's (MARS) if the pub group had enough liquidity to survive 2020. With its pubs closed since March and little sign of an end to lockdown, management was scrambling for a way to arrest cash burn, even after cutting pay, furloughing staff and cutting costs to a minimum. A proposed £70m extension of its bank facility, together with continued government support, seemed the best hope of making it to its September financial year-end without a punishing capital raise – or worse.

This extra liquidity still required covenant amendments from a widening pool of lenders from which Marston’s has now borrowed £1.5bn, on a pro-forma basis. Although much of this debt pile is long-term, that’s of scant consolation if you can’t make a penny. This year, analysts expect the group to generate operating cash flow of just £79m, which is barely enough to cover annual interest payments.

Then suddenly, a fortnight ago, came the deus ex machina: Marston’s signed a joint venture with Carlsberg to combine the companies’ brewing arms. In return for a 40 per cent stake on very favourable terms, the pub group announced it would receive a £273m cash equalisation payment. But while immediate liquidity concerns have been laid to rest, serious questions around leverage and future operating cash flow levels remain. AN

Pendragon

Pendragon (PDG) was allowed to open its doors to customers at the start of this month, after over two months of lockdown imposed by coronavirus. Covid-19 drove the car retailer into a first quarter underlying pre-tax loss of £2.3m, as doors remained closed during one of its key trading periods. But the picture at Pendragon was already pretty grim before the crisis, which would go some way towards explaining why over 40 per cent of votes cast on its directors’ remuneration policy were made in opposition at its AGM last month.

Pendragon’s balance sheet is one of a number of causes for concern. The retailer’s net debt averaged 3.8 times cash profits on average over its last financial year, and bounced from £91.6m in 2016 to £381.4m last year. The fragility of its balance sheet can be partly explained by the non-underlying charge of £97.7m it recorded, which included a £130.2m non-cash impairment of goodwill and long-term assets.

Pendragon has closed a number of underperforming sites and is reducing costs and raising capital elsewhere, having recently announced the sale and leaseback of its Stockport Porsche centre, for which it received £10.5m in cash. Consolidation with Lookers (LOOK) has been considered. But the parlous state of the car industry and Pendragon’s own problems, which include a frail balance sheet, mean that this is one to avoid. AJ