- Public documents and comments show extent of blue chip reliance on wage subsidies

- Differing boardroom approaches to refunds highlight the governance challenge

- New UK government advice highlights governance risk to companies plotting a return to the dividend register

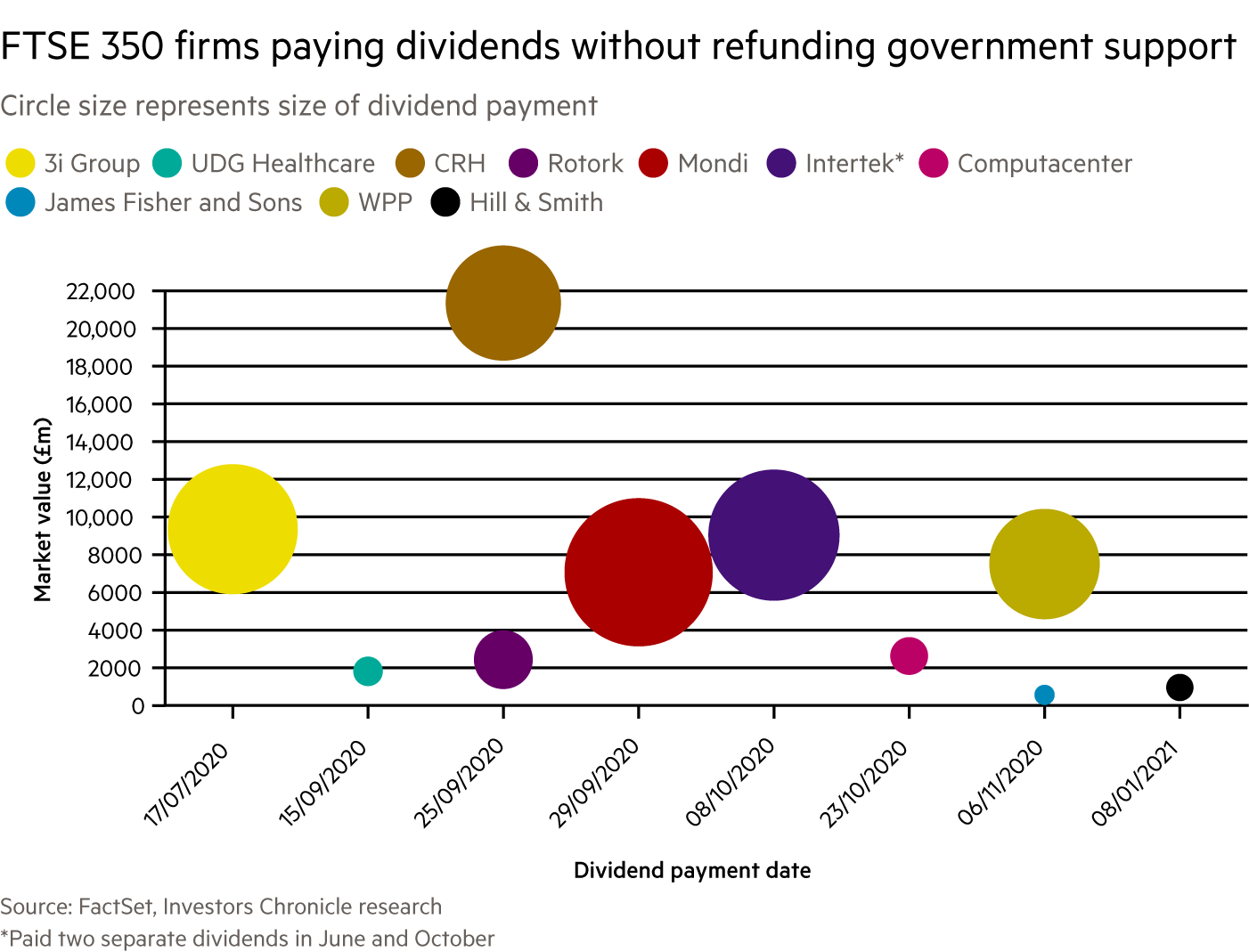

A handful of FTSE 350 groups that accessed furlough support schemes during the Covid-19 pandemic have declared at least £877m in dividends without refunding all wage subsidies received, an Investors Chronicle review of public documents and comments has found.

Companies including building materials group CRH (CRH) and quality assurance specialist Intertek (ITRK) have each paid shareholder distributions of more than £100m after using – and then deciding not to refund – the UK government’s job retention scheme or similar programmes in other countries.

Other recent FTSE 350 dividend payers on the record as having received and kept furlough support include Hatfield-headquartered services firm Computacenter (CCC) and marketing giant WPP (WPP).

In prioritising shareholder distributions, the companies have not broken any conditions set out in the furlough support schemes. Yet the unprecedented state and corporate sacrifices made this year have highlighted questions of stakeholder accountability and what it means to be a good corporate citizen. In July, consultancy Mazars warned companies that unreasonable use of the UK’s furlough scheme could “impact on the long-term success of the business given the reputational damage that could arise”.

Highlighting the balance boardrooms are now trying to strike, kitchen retailer Howden Joinery (HWDN) this week said it would repay the £22m it received under the UK’s Coronavirus Job Retention Scheme (CJRS) before it considered paying dividends in 2021. The FTSE 350 constituent also cited its cash position and recent trading performance in flagging plans to pay £8m-worth of business rates waived by local councils this year.

The group is not the first to link strong liquidity – a proxy for the ability to pay dividends – to ethical choices over the use and retention of wage support. In May, Pets at Home (PETS) chief executive Peter Pritchard told Retail Week that companies with strong cash buffers faced a “moral judgement” about whether they should access the furlough scheme.

However, the issue is complicated by the ranks of companies whose cash generation and day-to-day business operations proved more resilient than initially feared at the start of the pandemic. In recent weeks, large listed employers including housebuilder Taylor Wimpey (TW), engineering firm Weir Group (WEIR) and bookmaker William Hill (WMH) have announced plans to refund furlough funds claimed when the CJRS scheme was introduced at the start of the first lockdown in March.

Other businesses that made use of the furlough scheme are now facing a decision whether to reimburse wage subsidies or preserve as much cash as possible amid the profound uncertainties accompanying a second wave of lockdowns.

Nonetheless, data collected by the UK treasury suggests many have offered to pay back the emergency wage subsidies. By September, 80,433 employers had volunteered to return more than £215m to the government after claiming grants from CJRS, according to HMRC. This is of increasing importance to the growing number of UK companies that accessed government support and are now plotting their return to the dividend list. Between April and June, shareholder payouts dropped by more than half, according to Janus Henderson.

Those seen to be passing wage support directly to shareholders also risk being accused of having their cake and eating it.

“It’s completely unacceptable,” says Simon Youel, head of policy at advocacy group Positive Money. “These companies are supposedly needing this support because they are going through a particularly rough time…but it seems when it comes to their reporting season they are willing to pay out dividends rather than preserve capital.”

In a possible sign of growing UK government recognition of the issue, the treasury has said it expects all large employers to renounce dividend payments when using its new Job Support Scheme, although it does not plan to make this legally-binding. The original furlough scheme placed no such obligation on big businesses, and a small number have risked the reputational damage from taking advantage of what many saw as a government oversight.

Of all the companies yet to confirm the repayment of money claimed from the CJRS, Intertek has made the biggest pay-out. The product-testing group – which used furlough schemed in the UK, France and Italy – handed £115m to shareholders in June, topping this up with a £55m dividend in October.

A spokesperson for Intertek did not respond to questions around possible repayment, but said the group remained open throughout the pandemic to deliver “uninterrupted, mission-critical services to our 300,000 plus clients, both private and public, who rely on our industry subject matter expertise to operate safely”.

Another large dividend payer is listed private equity group 3i (III), which distributed £168m to shareholders in July after majority-owned portfolio company Audley Travel claimed £2.4m through the CJRS.

A spokesperson for 3i emphasised that no staff have been furloughed at the cash-rich parent company, and that Audley Travel should be considered as a standalone business. “3i is very supportive of Audley and its team and is likely to provide significant financial support to help the company and limit redundancies over the winter,” she added.

Other multinational FTSE 350 dividend payers have made use of similar schemes outside of the UK, where there may be less risk of reputational damage in not repaying furlough funds.

Packaging giant Mondi (MNDI) also handed shareholders a combined £218m in September, according to IC calculations. The packaging group did not respond to a request for comment on whether it planned to refund money claimed from two short-term work schemes outside the UK.

WPP, which has also paid dividends since the pandemic struck, also used wage subsidy schemes outside the UK. A spokesperson said money obtained from these schemes amounted to less than 1 percent of global staff costs.

Computacenter said it would repay the £1.1m received under the CJRS, though this makes up just a fifth of the total grant income claimed from European governments. The company paid a £14m interim dividend last month.

This contrasts with valve manufacturer Rotork (ROR), which has repaid all furlough support claimed under the CJRS and in any other country where it has been possible to do so.*

In announcements to investors, the companies stressed the robust financial positions that underpinned their decisions to pay or restart dividends. Yet by appearing to prioritise dividends so soon after asking for state support, some companies risk raising concerns around governance and board-level decision-making.

“It is the same type of short-term thinking that has led to quite a lot of [crises and company insolvencies],” said Alex Chapman, senior researcher at the New Economics Foundation, a think-tank. He said it was up to responsible investors to recognise “the reputational risks that go with making decisions that appear unfair and appear to abuse public money”.

Another UK-listed company – albeit outside the blue-chip index – that will not be returning furlough cash is Redde Northgate (REDD), whose chief executive Martin Ward told us that the payment of a £16.2m final dividend would help the commercial vehicle lease group “support all stakeholders”.

Explaining a decision not to repay furlough support at the group’s full-year results in September, Mr Ward drew a distinction between the economic benefit his company had received and the purpose of wage subsidies, which he said were only intended to preserve jobs.

*This article has been corrected to reflect that Audley Travel is majority-owned by 3i. A Rotork spokesperson subsequently stated that the company has refunded all furlough support in all cases outside the UK wherever it has been possible to do so, rather than most cases, as initially stated.