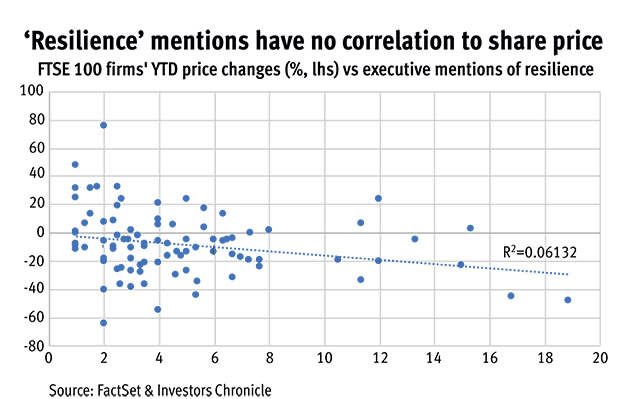

- References to 'resilience' on corporate earning calls have more than doubled this year

- Investors Chronicle analysis has found that this does not correlate to market valuation resilience or earnings resilience

Last week, the good people at dictionary punters Merriam-Webster said they were “excited to announce” their Word of the Year. It’s arguable whether the winner – ‘pandemic’ – should elicit any excitement eleven months into 2020, if it ever did. But there’s no denying the Covid-like speed with which these three syllables have infested the English lexicon.

Had Merriam-Webster confined its survey to the business world, ‘resilience’ would have been a strong front-runner. This year, references to corporate resilience on earnings calls with FTSE 100 executives more than doubled, based on an Investors Chronicle survey of FactSet-compiled meeting transcripts.

Since the start of the year, there have been an average of five references to resilience on each of the 277 such calls. As with the virus itself, the second wave of the buzzword has been more intense, with 62 per cent of all resilience mentions falling between July and November.

Like the virus, it is also widespread: just seven FTSE 100 firms failed to mention resilience on earnings calls this year, either because they chose not to, did not hold earnings calls, or – as with gold miner Fresnillo (FRES) – because profits have surged rather than held their ground.

There also appears to be evidence of handful of super-spreaders. On average, this year has seen almost 17 mentions of resilience in earnings calls with the management team of Royal Dutch Shell (RDSB). The oil and gas giant also takes the prize for the highest number of ‘resilient’ mentions on any single earnings call, clocking an impressive 40 on its first quarter results day on 30 April.

“We are taking decisive actions to improve our resilience in the shorter and the longer term, both in the underlying business and our financial performance,” said chief executive Ben van Beurden (pictured), in one of ten references to resilience in his opening remarks.

Not to be outdone, rival BP (BP.) notched up the second and third highest tallies, and has made more references to resilience on average than any other FTSE 100 constituent, at 19.

Of course, the definition of resilience varies with context. ‘Balance sheet resilience’ implies an ability to weather a period of negative cash flows. ‘Earnings resilience’ might be invoked to convince doubtful markets that the business model is robust. ‘Employee resilience’ has been frequently used this year to communicate both internally and externally.

Given the context, one can understand executives’ use of defensive language. When markets were in freefall in March, many wondered how some of the largest corporations might survive the coming months. Though the panic has receded, it’s important not to overlook or dismiss the need to project a sense of measured calm in times of severe strain.

However, plot the frequency with which FTSE 100 executives referred to resilience against their share price moves so far this year, and you will find no correlation (see chart). Just three of the ten companies which referred to resilience at least ten times per earnings call have seen their market valuations hold ground.

Neither does the regularity of the mantra correlate with positive forecast earnings growth between 2020 and 2021, per FactSet-compiled consensus figures.

Still, if the objective of buzzword over-use is to shift the narrative, then it may be working. A brief search of the Investors Chronicle archive finds this writer has used the word resilient or resilience – albeit not always in the positive sense – at least 60 times so far in 2020, equal to the five previous years combined. It’s clearly a theme that many of us have dwelt on – consciously or unconsciously – since the pandemic hit.