Momentum investing is often characterised as a strategy that comes unstuck when the market experiences wild swings. This is because momentum is simply a strategy of backing shares that have been rising and avoiding those that have been falling, and when markets experience wild swings, trends often change dramatically.

But in practice a lot depends on the type of swings the market experiences, the timing of portfolio reshuffles, and the specific timeframe used to assess share price momentum. In the case of my blue-chip momentum screen, we can certainly judge it to have lucked out during the recent turmoil. The top 'long' picks from three months ago have soared, while many of the shorts have been slaughtered. With volatility picking up again at the time of writing, we may get a chance to see if it can get lucky again.

A key reason for the strategy’s recent success is that the last reshuffle was made near the market trough on 23 March and many of the stocks that were judged to be a strong bet during the crisis have continued to prove popular. This latter point seems quite lucky as often strong rebounds of the type markets have recently experienced are characterised by investors flocking to the worst hit stocks in anticipation that they will benefit most from a recovery.

While we have briefly seen some of the worst hit parts of the market recovering strongly in the week or so leading up to the recent market setback, more generally the upswing has benefited the biggest and best companies. Against this general narrative, there have been some sharp changes in sentiment towards certain stocks and this is reflected in the long picks for the coming three months. The nature of the recovery may be a reflection that it is mainly a response to central bank efforts to boost 'liquidity' rather than actual optimism about the real economy. Hopefully this will be the next stage if the recent setback can be overcome.

However one reads the runes, one thing is clear: the longs picks from last quarter have done extremely well and the shorts have done terribly. In fact, the accompanying table does not do justice to just how badly the shorts have performed as shares in hospital owner NMC were suspended after the company went into administration. It will only be after the long administration process that we will know whether there is any value left for shareholders. Until that point, I’m not able to include performance data in my assessment of the shorts. For illustrative purposes only, though, if we were to assume a total loss of value for NMC shareholders the performance of the shorts would go from a positive 4.2 per cent (excluding dividends) to negative 6.2 per cent for the period.

3-month performance

| Capital returns only (15 Mar - 12 Jun 2020) | |||

| LONGS | SHORTS | ||

| Polymetal International plc | 24.7% | NMC | * |

| Scottish Mortgage Investment Trust PLC | 35.2% | Carnival Corporation & Plc | 9.3% |

| Pennon Group Plc | 9.4% | Centrica plc | -0.4% |

| Rentokil Initial plc | 10.7% | Royal Dutch Shell plc | 20.5% |

| United Utilities Group PLC | 3.3% | The Royal Bank of Scotland Group plc | -9.2% |

| Spirax-Sarco Engineering plc | 16.4% | Whitbread PLC | -8.3% |

| Ocado Group plc | 65.5% | Royal Dutch Shell plc | 19.4% |

| Fresnillo Plc | 46.0% | easyJet plc | 2.3% |

| London Stock Exchange Group plc | 17.2% | WPP plc | 10.9% |

| Severn Trent Plc | 5.9% | ITV plc | -6.8% |

| LONGS | 23.4% | SHORTS | 4.2% |

| FTSE 100 | 14.5% | FTSE 100 | 14.5% |

*See text

Source: S&P CapitalIQ

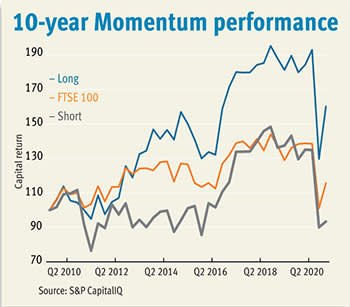

Performance over different periods

| Price performance | |||

| Long | Short | FTSE 100 | |

| Since 15 June 2007 | 114% | -20% | -9.3% |

| 10-yr | 60% | -7% | 17% |

| 5-yr | 7% | -8% | -9.0% |

| 3-yr | -11% | -30% | -18% |

| 1-yr | -11% | -28% | -17% |

Source: S&P CapitalIQ

The longs and shorts are listed in the accompanying table and I’ve provided a brief appraisal of the narratives propelling the longs in the accompanying write-up.

Q3 Momentum stocks

| LONGS | SHORTS | ||||||||||||

| Name | TIDM | Price | Market Cap | 3mth Mom* | NTM PE | DY | Name | TIDM | Price | Market Cap | 3mth Mom | NTM PE | DY |

| Flutter Entertainment plc | LSE:FLTR | 10,750p | £18.6bn | 68.8% | - | - | Rolls-Royce Holdings plc | LSE:RR. | 328p | £6.3bn | -31.8% | - | - |

| Ocado Group plc | LSE:OCDO | 1,958p | £14bn | 65.5% | - | - | Meggitt PLC | LSE:MGGT | 290p | £2bn | -29.3% | 13 | - |

| BHP Group | LSE:BHP | 1,667p | £168.3bn | 58.2% | - | - | International Consolidated Airlines Group, S.A. | LSE:IAG | 276p | £5.5bn | -21.4% | - | - |

| DCC plc | LSE:DCC | 6,702p | £6.6bn | 58.1% | 20 | 2.2% | HSBC Holdings plc | LSE:HSBA | 380p | £77bn | -18.4% | 14 | - |

| Fresnillo Plc | LSE:FRES | 794p | £5.9bn | 46.0% | 36 | 1.5% | Lloyds Banking Group plc | LSE:LLOY | 32p | £22.6bn | -15.7% | 14 | - |

| Rio Tinto Group | LSE:RIO | 4,596p | £77bn | 40.4% | 11 | 7.6% | Melrose Industries PLC | LSE:MRO | 119p | £5.8bn | -15.3% | - | - |

| Anglo American plc | LSE:AAL | 1,825p | £23bn | 36.7% | 13 | 4.8% | Land Securities Group plc | LSE:LAND | 620p | £4.6bn | -10.7% | 14 | - |

| Scottish Mortgage Investment Trust PLC | LSE:SMT | 726p | £11bn | 35.2% | - | 0.4% | The Royal Bank of Scotland Group plc | LSE:RBS | 119p | £14.4bn | -9.2% | 24 | - |

| Antofagasta plc | LSE:ANTO | 868p | £9bn | 34.0% | 69 | 1.6% | Informa plc | LSE:INF | 461p | £6.9bn | -9.1% | 17 | - |

| Hikma Pharmaceuticals PLC | LSE:HIK | 2,305p | £6bn | 33.4% | 18 | 1.5% | Whitbread PLC | LSE:WTB | 2,364p | £4.7bn | -8.3% | - | - |

| AVERAGE | - | - | - | 47.6% | 28 | 2.8% | AVERAGE | - | - | - | -17.9% | 16 | - |

*to 12 June 2020

Source: S&P CapitalIQ

THE LONGS

Flutter Entertainment

There’s been a rather dramatic turn in sentiment towards Flutter Entertainment (FLTR) since I last ran my blue-chip momentum screen. While the international gaming group’s shares avoided inclusion in last quarter’s short portfolio, they were not exactly being billed as winners having registered a 27 per cent drop in the three months to 15 March (the date of the last screen).

Three months ago, investors felt spooked by the group’s exposure to sports betting, which has indeed been hit by the abandonment of sporting events. Added to this concern was Flutter’s eye-watering debt levels, which swelled on 5 May when the group completed its merger with US gambling group Stars – a company with about £4bn of borrowings of its own.

The key thing that has changed, though, is increased investor enthusiasm about Flutter’s prospects in the US. The group started to make major inroads into the rapidly de-regulating US market with the acquisition of FanDuel in 2018 and Stars puts it in a strong position to be a leading player in what could prove a huge market. Importantly, while lockdown may have hit the group’s sports-related businesses, it has prompted a massive uptick in other forms of online gambling, such as poker and casino games.

The group reported a 10 per cent rise in second quarter sales overall, highlighting the picture of a company seizing opportunity from the jaws of adversity. The company has also taken advantage of the rekindled enthusiasm for its stock by raising £813m with a placing equivalent to 5.5 per cent of the shares in issue at 10,100p. This slightly takes the edge off debt levels, with broker Numis forecasting year-end net debt of 2.8 times cash profit.

While there is lots to be encouraged by, Flutter is working in a fast-moving regulatory environment. There are attempts to scale back deregulation in the US and a major Democratic win in November’s election could change the trend. Meanwhile, fears of increased problem gambling during lockdown has led a number of countries to introduce legislation to curb the worst online excesses. These rules may prove sticky even as lockdown eases.

Ocado

Online grocer Ocado (OCDO) is another company using a recent share price surge to boost its balance sheet. The group has raised a cool £1bn by selling new shares worth £650m along with £350m of convertible bonds.

Given Ocado is lossmaking, its investment case is all about its perceived potential. The coronavirus has boosted hopes by making more consumers start shopping for groceries online. Many such shoppers are expected to continue to shop over the internet once lockdown is lifted.

While Ocado does operate as an online grocer in the UK through its joint venture with Marks & Spencer, its main allure is as a technology provider to international supermarket clients. The money recently raised will go towards efforts to exploit this opportunity in a market the group believes could generate fees of up to £26bn. Specifically, Ocado is creating a network of more than 50 fulfilment centres to service its “solutions partners”.

Ocado is a marmite stock and many analysts and commentators (including within the pages of this magazine) have found much to be sceptical about. Nevertheless, share price momentum is something that Ocado certainly can boast, even if profits are more ellusive.

DCC

Marketing sales and distribution company DCC (DCC) is another company that has experienced a sharp reversal in sentiment. The nerves being displayed by investors in March were understandable. A number of the group’s core businesses look vulnerable to the coronavirus, such as distributing: petrol to forecourts; liquefied petroleum gas to corporate and industrial customers; and technology to retailers and businesses. To compound fears, DCC’s margins are wafer thin, individual working capital items (stock, debtors, and creditors) are gargantuan compared with profits, and the company has been spending heavily on acquisitions over recent years.

But DCC’s full-year results in May were a cause for celebration. While there were areas of weakness due to the coronavirus lockdown, some of the group’s units were trading strongly, such as its healthcare and domestic fuel operations. Cost-cutting also helped. What’s more, the chief executive’s encouraging words on prospects were matched with a small uptick in the dividend.

There remain questions about how the group will endure a potentially drawn-out recession and the long-term implications of the switch to renewables. However, for now the wind appears to be in the group’s sails.

Hikma Pharmaceuticals

The past three months have been something of a tale of two halves for Hikma (HIK). The period started strongly as investors flocked to the stock as a likely coronavirus beneficiary. While the company does not produce medicines directly used to combat the virus, some of its key products, such as opioids, have been used to help patients suffering severe effects. A potential slowdown in drug approvals could also support its generics business and the company has some exciting new products due for launch relatively soon.

But the shares’ momentum has waned since the group told investors it was trading in line with expectations. This scuppered hopes of imminent upgrades. That said, there are positive trading trends, and a better-than-expected performance this year should not be ruled out.

Scottish Mortgage Investment Trust

The £10bn market-capitalisation investment trust Scottish Mortgage (SMT) has been a big winner during the coronavirus crisis to date. Its long-sighted, tech-focused investment approach means it holds shares in many companies that are expected to be big winners from the crisis. This is both because these companies' services are in increased demand, and also because the trends powering their success may well be accelerated by recent events.

Miners

The miners that make half of the list of Longs – BHP (BHP), Fresnillo (FRES), Rio Tinto (RIO), Anglo American (AAL) and Antogasta (ANTO) – broadly offer exposure to copper, iron ore and silver. The prospects for copper and iron ore (steel production) have been reassessed in light of China’s reopening and encouraging signs from that critically important market. What’s more, as investors look to the 'building back better' agenda, which is being widely touted, it seems there is added impetus for the electrification of energy supply and the consequent need for more copper. Meanwhile, silver has benefited from the strong link between its price and that of gold. Gold’s status as a safe haven asset has prompted very strong upward price movements.

Commodity prices can also be seen as beneficiaries of heightened inflation expectations sparked by the extreme monetary response to the crisis (huge amounts of quantitative easing). While few expect any imminent pick-up in inflation given the severity of the economic shock, many see the potential for inflation to take off in a few years' time, especially if central banks start to look towards even more unconventional policy tools, such as so-called helicopter money. Real assets, such as commodities, are generally regarded as a good bet in inflationary environments.

Due to the large fixed cost bases and heavy capital needs of miners, their profits and share prices are extremely sensitive to the price of the metal they dig out of the ground. As such, the shares of many companies in this sector have seen very strong rises.