Specialty materials group Versarien (VRS) operates a mature thermal and aluminium products business alongside its racier graphene and plastics division, which sells pioneering graphene products under two brands: Nanene and Graphinks. In the financial year to the end of March 2018, sales from the divisions were roughly equal, but graphene is where the company has firmly directed its attention. The company is the first ‘Verified Graphene Producer’ approved by the Graphene Council, a global community. And it is announcing collaborations across the world.

Exciting technology

Interest from Chinese government

Minimal turnover

Small graphene market

Funding uncertainty

Director share sale

The global graphene market is small, though. Its size was estimated at $42.8m (£33.1m) in 2017, according to GrandView Research, and is only forecast to be worth $563m by the end of 2025.

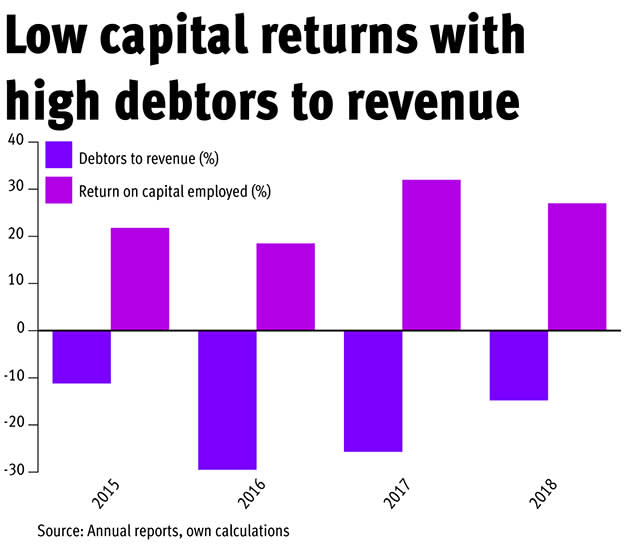

Versarien, an apparent leader, was founded in 2010 and raised £3m with its Aim float in early 2013. Since then it has regularly tapped investors with a series of tiny fundraisings to tide it over: £5.2m raised in September 2018 at 145p; £2.9m at 18p in November 2017; £1.5m in March 2017 at 15p; and £1.1m in July 2016 at 10p. The company has also used invoice discounting (borrowing against outstanding invoices) to help fund operations; such liabilities stood at £1.1m at the end of 2018. A stronger financial position and more evidence of the company’s ability to raise decent amounts of money would give us more faith in Versarien’s ability to commercialise its technologies. Hopes of major commercial potential led to a share price surge in late 2017, but turnover has remained diminutive and sales in the world’s largest graphene market, North America, were minimal in the 2018 financial year.

The company has since established a North American facility, but a dampener has been put on the news by the revelation that the operation's chief, Patrick Abbott, is subject to criminal proceedings. Versarien says it was aware of these allegations. Mr Abbott has denied any wrongdoing and contests the allegations.

Versarien frequently updates the markets with news of new partnerships and deals, many of which are purely research-focused. But such deals can easily slip. For example, Versarien announced a supply agreement last year with US infrastructure giant AECOM and said it would provide a further update by the end of the first quarter in 2019 – but this has not been forthcoming. On Twitter, chief executive Neill Ricketts put the lack of news down to “a variety of reasons outside of either our control or that of the customer or even their customer”.

The company has announced a large number of research agreements with Chinese public bodies and companies. Here, it has suggested it could raise equity to fund its ambitious growth plans, potentially offering the Beijing Institute of Graphene Technology (effectively, the Chinese government) a stake of up to 15 per cent in Versarien in return for funding for its new Chinese subsidiary. This is only based on a term sheet, but Mr Ricketts has said that Versarien would like the deal done before its September annual meeting. Given the extent to which Versarien's investors need to rely on the hope of commercialisation at the moment, it was disappointing that Mr Ricketts sold 307,970 shares at 136p on the day of this announcement (15 April), pocketing just shy of £420,000, although he remains the largest shareholder with 15m shares.

| VERSARIEN (VRS) | ||||

| ORD PRICE: | 122.5p | MARKET VALUE: | £189m | |

| TOUCH: | 121-124p | 12-MONTH HIGH: | 192.5p | LOW: 63p |

| DIVIDEND YIELD: | nil | PE RATIO: | na | |

| NET ASSET VALUE: | 5.3p* | NET CASH: | £3.3m | |

| Year to 31 Mar | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

| 2016 | 4.4 | -1.8 | -1.7 | nil |

| 2017 | 5.9 | -2.2 | -1.9 | nil |

| 2018 | 9.0 | -1.6 | -1.0 | nil |

| % change | +53 | -173 | -47 | - |

| Normal market size: | 10,000 | |||

| Beta: | 0.61 | |||

| *Includes intangible assets of £2.7m, or 1.8p a share | ||||

| No analyst forecasts available | ||||