Copper’s bull case is simple and compelling, but it has shed followers during 2019, as the red metal has disappointed due to weakening Chinese demand. This makes our recommendation of copper miner Antofagasta (ANTO) as a Tip of the Year a contrarian choice, but the potential for sentiment towards copper to improve, coupled with the protection offered by the miner's solid fundamentals, means we think the shares look an interesting pick for 2020.

Cheap copper production

Debt coming down

Los Pelambres upgrade

Copper price weakness

Protests in Chile

The big idea for copper bulls is that there will soon not be enough copper to meet demand as supply is likely to be flat or falling by the mid-2020s. But the medium-term supply/demand argument has lost out to lower Chinese manufacturing growth and the interminable US/China trade talks. The view of Australian bank Macquarie reflect the creeping skepticism. While noting “insufficient mine supply”, the banks analysts do not expect any major uptick in copper prices until 2023.

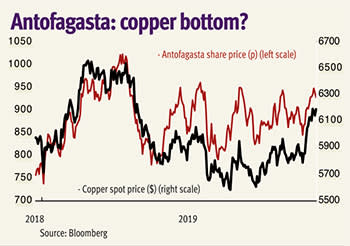

However, a lot of pessimism is already priced into the copper, which was reflected in a December price fillip on the announcement of a "phase one" US/China trade deal that most commentators found underwhelming. Indeed, 2020 could finally prove a year when it may be more likely that surprises for copper are on the upside, ranging from trade talk breakthroughs, an improvement to the dour global economic outlook, and increased electric vehicle production in Europe. Meanwhile, the quality of Antofagasta's mining operations and the strength of its balance sheet has made it relatively resilient to copper price gyrations over the past year (see graph).

Asset quality is critical in maintaining cost levels. Antofagasta can give itself a tick on costs in the first nine months of 2019, dropping the per-pound (lb) net cash cost from $1.42 to $1.17 thanks to higher production and improved byproduct (gold) prices.

The company’s largest mine, Los Pelambres, has been at the centre of this improvement. Antofagasta cut its cost by 8 per cent between the first nine months of 2019 and 2018, to 88¢/lb, and increased production 5 per cent despite mining some lower-grade deposits. The mine won’t have a smooth run into 2020, however, with the unrest in Chile knocking off 10,000 tonnes (t) from its forecast production because of damage to infrastructure outside the mine and protests blocking an access road.

The other three operations were unaffected, but a strike at Antucoya has seen a 4,000t reduction in production there. Centinela, the second largest mine, saw good year-on-year copper production increases, but the real highlight was the gold byproduct uptick year to date. The mine accounted for the entire increase in the company's gold output in the first nine months of the year from 120,000 ounces (oz) to 226,000 oz.

Looking beyond this year’s numbers, production will get a boost through the $1.3bn expansion of Los Pelambres. This multi-year project will add 60,000t a year to the 2018 performance of 358,000t, taking the company to over 800,000t a year overall. The ramp up will begin in 2021.

| Antofagasta (ANTO) | |||

| ORD PRICE: | 928.0p | MARKET VALUE: | £9.1bn |

| TOUCH: | 928-928.2p | 12-MONTH HIGH: | 1,026p |

| FORWARD DIVIDEND YIELD: | 1.1% | FORWARD PE RATIO: | 31 |

| NET ASSET VALUE: | 740ȼ | NET DEBT: | 6% |

| Year to 31 Dec | Turnover ($bn) | Pre-tax profit ($bn)* | Earnings per share (ȼ)* | Dividend per share (ȼ) | |

| 2016 | 3.62 | 0.29 | 34.7 | 18.4 | |

| 2017 | 4.70 | 1.67 | 76.1 | 50.9 | |

| 2018 | 4.69 | 1.12 | 51.5 | 43.8 | |

| 2019* | 4.89 | 1.24 | 54.7 | 19.1 | |

| 2020* | 4.52 | 0.88 | 38.6 | 13.5 | |

| % change | -8 | -29 | -29 | -29 | |

| NMS: | 2,000 | ||||

| BETA: | 2.04 | ||||

| *JP Morgan forecasts, adjusted PTP and EPS figures | |||||

| £1 = $1.3 | |||||