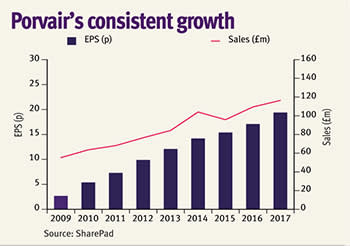

In December, specialist filtration business Porvair (PRV) announced that it expected to beat its expectations for is financial full-year, as a strong period for its aerospace and industrials work drove 13 per cent revenue growth. The group has a consistent growth record that is supported by regulatory-driven demand and a tendency for its systems to be designed into products, which keeps customers locked in and provides recurring ethical ESG revenues. While weak industrial markets continue to depress the overall sector’s performance, we think Porvair offers dependable growth at an attractive valuation relative to peers.

High barriers to entry

Good exposure to ESG trends

Healthy balance sheet

Consistent growth

Exposure to US-China tariff war

Can be hard to win new business

Porvair supplies bespoke filtration products and environmental technologies into three key markets: aviation and general industry (about 40 per cent of revenue), laboratories (30 per cent), and for the purification of molten metal (30 per cent). Maintenance schedules require the replacement of filters, and recurring sale of these consumables account for around 80 per cent of Porvair’s revenues. It's contracts are typically agreed for around seven to 10 years.

The length and bespoke nature of these contracts can make business difficult to win from competitors. But on the flip-side, once Porvair has designed a filter for a customer’s product, replacing it with another company’s product could necessitate changes in accreditation across their supply chain. A third of Porvair’s products are patented, which strengthens its barriers to entry. So assuming the product is up to standard then, it is therefore hard for Porvair to lose business. The importance of meeting high regulatory and operational standards means the performance and reliability of filters in these markets is often more important than price. That they are compulsory for end users also means that sales should be resilient even in the face of a market downturn, a thesis that is supported 21 per cent revenue growth at its most recent half-year results despite the US-China trade war having a small impact on its microelectronics profits.

Porvair reported an improvement in its margins at its half-year thanks to several large aerospace & industrial orders, which include sizeable orders for gasification spares. A feature of Porvair has been its consistent growth rate, but irregular repeat orders for these spares are likely to make the group’s future growth a bit more lumpy.

Porvair has invested £42.4m over the past five years in bolt-on acquisitions and capacity extension in the UK, US, Germany and China. Despite the consistent investment in growth, the group's balance sheet remains strong, with a full-year 2019 net cash position of £3.9m, and importantly, underlying return on invested capital has remained consistently robust, coming in at 15 per cent last year.

Forecast growth rates in its end markets are attractive at a steady 4 to 6 per cent. But Porvair has a habit of beating broker forecasts and also stands to benefit from a tightening of regulation as the international focus on environmental, social and governance (ESG) factors increases. Indeed, the shares are a favourite among ESG investors, with some of its top holdings including specialist fund managers such as Impax Asset Management which holds around 3 per cent of the shares. Ongoing growth in ESG investment mandates and growing concerns surrounding water contamination and sustainability therefore make Porvair an ideal pick both for the return-seeker and the ethical investor.

| Porvair (PRV) | |||||

| ORD PRICE: | 613p | MARKET VALUE: | £281m | ||

| TOUCH: | 615-613p | 12-MONTH HIGH: | 640p | LOW: | 403p |

| FORWARD DIVIDEND YIELD: | 0.9% | FORWARD PE RATIO: | 24 | ||

| NET ASSET VALUE: | 202p* | NET CASH: | £3.20m | ||

| Year to 30 Nov | Turnover | Pre-tax | Earnings | Dividend | |

| (£m) | profit (£m)** | per share (p)** | per share (p) | ||

| Year to 30 Nov | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) | |

| 2016 | 109 | 10.1 | 17.1 | 3.80 | |

| 2017 | 116 | 11.7 | 19.4 | 4.20 | |

| 2018 | 129 | 13.5 | 22.8 | 4.60 | |

| 2019** | 145 | 14.8 | 24.9 | 5.00 | |

| 2020** | 153 | 15.1 | 25.5 | 5.50 | |

| % change | +6 | +2 | +2 | +10 | |

| NMS: | 3,000 | ||||

| BETA: | 1.13 | ||||

| *Includes intangibles of £68m or 148p per share | |||||

| **Peel Hunt forecasts, adjusted EPS and PTP figures | |||||