After struggling to integrate its 2016 acquisition of online retailer Worldstores, home furnishings group Dunelm (DNLM) is firmly back on the front foot and shareholders look set to benefit from rapid online sales growth following the successful transition to a new digital platform.

Strong recent trading and earnings upgrades

New digital platform in place

Online business growing rapidly

Margins strengthening

Weak wider market

High valuation

Dunelm operates a network of 171 superstores across the UK, alongside a made-to-measure manufacturing centre in Leicester, two distribution centres in Stoke on Trent and five home delivery network sites spread across England.

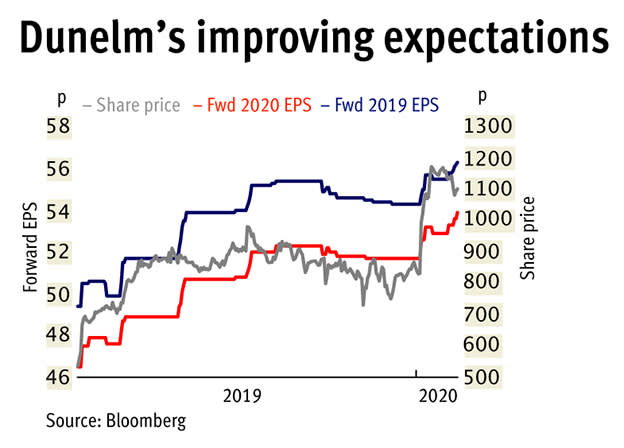

While a nervous market was spooked by reports of “mixed” first-quarter trading, the second quarter, which includes the all important Christmas period, has put fears to rest. The group reported store like-for-like sales up 2 per cent for the first half. But the online business was the real star, growing 33.2 per cent over the period and taking overall like-for-like growth to 5.6 per cent. Total sales growth was even better at 6.0 per cent thanks to the opening of a new superstore in the period, and three more are planned to open in the second half. The progress made by Dunelm over the past year has led to a string of broker EPS forecast upgrades (see chart), which have helped push the shares higher and made Dunelm one of the most interesting ideas generated by our IC Alpha Momentum screen.

The smooth transition to a new online platform, which is faster, more flexible and can handle more traffic than the old one, marks a major step forward for the group’s growth strategy. Online is still a relatively small part of overall sales at 15 per cent of the first-half total. But management is planning to accelerate online expansion, adding more than 6,000 new online-only products in the year. Over Christmas, the new platform hosted more customers than the previous system would have been able to deal with. The group is now rolling out click-and-collect capabilities to its entire store network, which will drive customers into physical outlets.

The retailers who are performing best in the current trading environment are those that have strong online offerings and are able to make them work in tandem with their physical store networks, through options such as click-and-collect. From this perspective, Dunelm now appear to be ticking the right boxes. Free cash flow has also more than recovered since the Worldstores acquisition, reaching £154m in the 2019 financial year and enabling a special dividend payment of 32p a share. In addition, improvements in sourcing and reduced promotional activity helped the group to improve margins across all product categories. Gross margins rose from 48.0 to 49.6 per cent last year and continued to make progress in the first two quarters of the current year.

| Dunelm (DNLM) | |||||

| ORD PRICE: | 1,082p | MARKET VALUE: | £2.2bn | ||

| TOUCH: | 1,081-1,083p | 12-MONTH HIGH: | 1,206p | LOW: | 669p |

| FORWARD DIVIDEND YIELD: | 2.9% | FORWARD PE RATIO: | 19 | ||

| NET ASSET VALUE: | 92p | NET DEBT: | 14% | ||

| Year to 29 Jun | Turnover (£bn) | Pre-tax profit (£m)* | Earnings per share (p)* | Dividend per share (p) | |

| 2017 | 0.96 | 109 | 42.9 | 26.0 | |

| 2018 | 1.05 | 102 | 40.0 | 27.0 | |

| 2019 | 1.10 | 126 | 49.8 | 28.0 | |

| 2020* | 1.14 | 139 | 54.7 | 29.0 | |

| 2021* | 1.20 | 147 | 57.9 | 31.0 | |

| % change | +5 | +6 | +6 | +7 | |

| Normal market size: | 2,000 | ||||

| Beta: | 0.77 | ||||

| *Peel Hunt forecasts, adjusted PTP and EPS figures | |||||