- The scientific instruments maker has been boosted by demand for Covid-19 tests and is also working on more than 250 projects to develop treatments and vaccines

- Beyond the pandemic, the group is well-positioned to benefit from rising healthcare spending, in particular on new technologies such as gene therapy

Long-term structural growth drivers

Near-term Covid-19 boost

Analyst upgrades

Fund manager pick

Cyclical exposure

Premium valuation

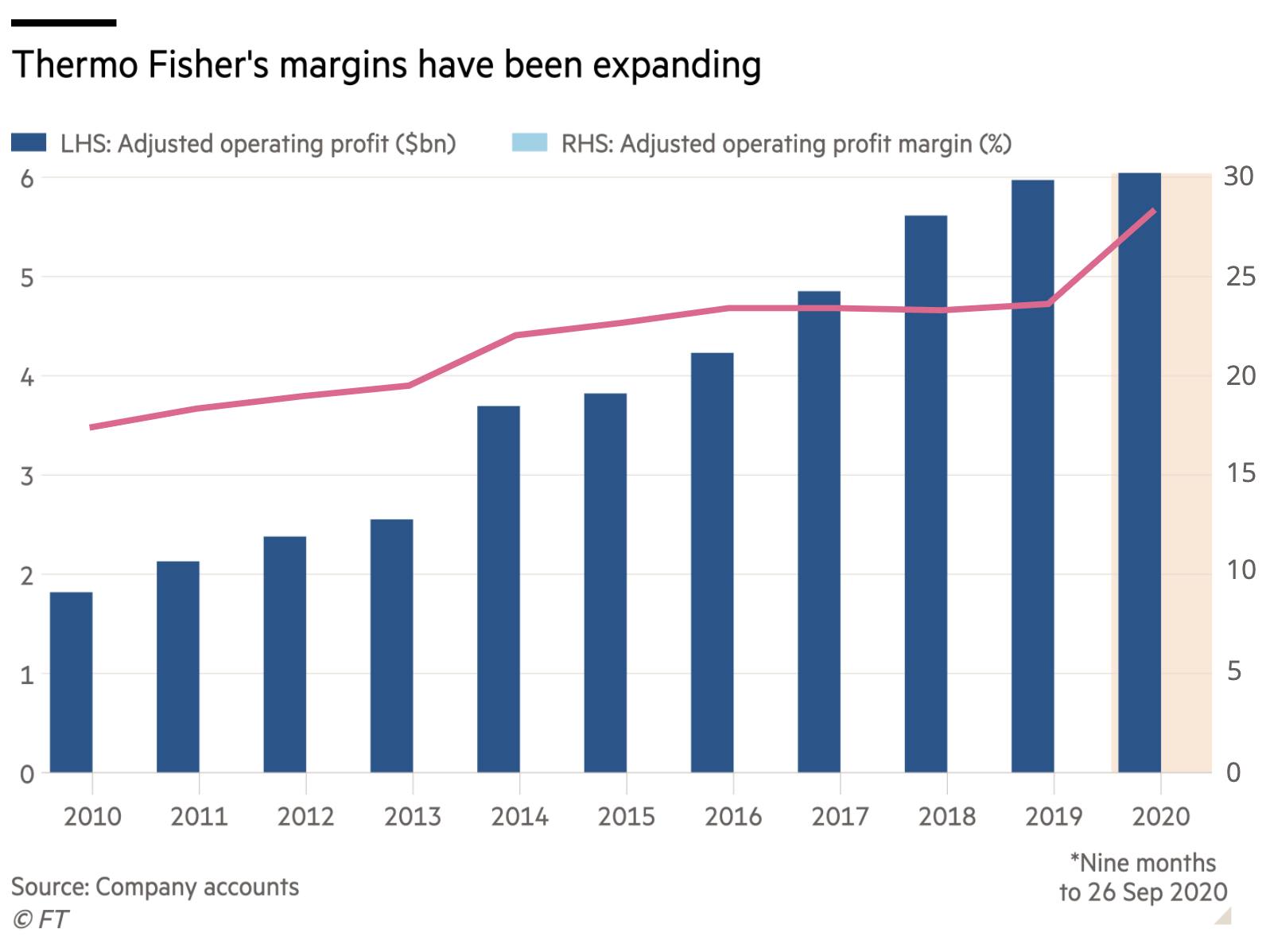

Thermo Fisher Scientific (US:TMO) may not be a household name, but it is a giant in the world of scientific research. The group provides everything from basic laboratory equipment to specialised machines that can decode genetic sequences. Leading positions in its end markets have been underpinned by an expanding global footprint and focus on product innovation – it spends $1bn (£770m) on research and development (R&D) each year. This technological edge has enabled high margins (see chart), which have translated to a rising return on equity (ROE), a key measure of quality and profitability. Adjusted ROE advanced from 9.6 per cent in 2010 to 22.6 per cent at the end of September.

Readers of our Ideas Farm may be familiar with Thermo Fisher as a popular choice among fund managers. It is a top 20 holding of Baillie Gifford’s Monks Investment Trust (MNKS) and James Budden, director of marketing and distribution at Baillie Gifford, calls Thermo Fisher “a growth stalwart in the Monks portfolio”. He points to the long-term picture, with “bio-scientific advances made over the last 20 years permeating into new drug development, diagnostic testing and new technologies, all of which will require more analytical equipment, testing consumables and customised software”. Biotechnology, in particular, should be a key future growth area as scientists and doctors look for novel ways to treat diseases such as cancer. Thermo Fisher already provides a wide range of services for cell and gene therapy. The group should also benefit from a number of additional structural growth drivers, including rising regulation and demographics – ageing populations and their associated chronic conditions should spur increased healthcare spending.

Serving customers across the pharmaceutical, diagnostics, academic and industrial sectors, Thermo Fisher is tapping into an addressable market estimated to be worth $165m. With 16 per cent of its revenue coming from industrial clients, it does have cyclical vulnerability. But almost 80 per cent of its total sales are recurring and more than two-fifths are derived from the pharma and biotech sector, which should prove more resilient to recessionary conditions. The group provides end-to-end services to pharma customers – “from molecule to medicine” as it likes to say – assisting from the research stage all the way through to production.

Covid-19 boost

Thermo Fisher has seen disruption to customers’ activities from the pandemic, in particular impacting sales of analytical instruments and routine diagnostic tests. But this has been more than offset by demand for Covid-19-related products. Capitalising on the need for testing capability, the group mobilised quickly at the beginning of the pandemic and its first Covid-19 test was granted emergency use authorisation by the US Food and Drug Administration (FDA) in March. This ‘polymerase chain reaction’ (PCR) test detects the presence of coronavirus to determine if somebody is currently infected and the results are available within two hours. Thermo Fisher increased its production capacity from 5m tests per week in early April to 20m by October and analysts at Wolfe Research project that Thermo Fisher and competitor Abbott Laboratories (US:ABT) will together account for over a fifth of global testing capacity by the end of this year.

Expanding further into the testing space, the group launched two Covid-19 antibody tests last month – which can establish if somebody has previously had the disease – and it is also rolling out combination tests in the US and European Union that can distinguish whether a person has coronavirus, influenza or ‘respiratory syncytial virus’ (RSV). Complementing this capability, Thermo Fisher sells the equipment to process Covid-19 tests and recently introduced a system that can analyse more than 6,000 tests a day.

The group pulled in $3.5bn of pandemic-related revenue in the first nine months of the year and is guiding to a further $1.75bn of Covid-driven sales in the final quarter. Analysts at Cowen Research believe this could be a conservative estimate as we enter the peak flu season, which will require further testing to distinguish Covid-19 from other respiratory infections. Reflecting the high demand for tests, Thermo Fisher enjoyed a bumper third quarter, with revenue from its life sciences division more than doubling year on year to $3.4bn. The life sciences business already enjoyed higher margins than the rest of the group, but its adjusted operating profit margin surged from 34.5 per cent to 54.9 per cent in the three months to 26 September – that compares to 32.9 per cent for Thermo Fisher as a whole. This meant that the group’s overall adjusted operating profit also almost doubled to $2.8bn, coming in 40 per cent ahead of analysts’ expectations. The better-than-expected tailwind from Covid-19 has prompted brokers to revise their forecasts upwards.

Revenue growth from Covid-19 testing won’t last forever, but may prove more durable than one might first think. In the absence of a treatment or vaccine, testing demand is likely to persist well into next year, particularly as governments increasingly focus on improving ‘test and trace’ systems to allow their economies to reopen. Even if a vaccine becomes available, it will take time for it to be distributed and administered en masse.

Thermo Fisher is prepared for the next phase of the pandemic, however. It is currently working on more than 250 of its customers’ Covid-19-related projects, helping to develop therapies and vaccines. The group’s products and services span the entire development cycle from culturing the cells needed to make a vaccine, through to supporting clinical trials, scaling up manufacturing and distribution. It anticipates that its vaccine/therapy activities will bring in around $1bn of revenue over the next couple of years, although analysts at JPMorgan reckon that figure could be a lot higher if customers receive regulatory approvals and volumes are scaled up.

More growth to come?

Thermo Fisher has spent $700m so far this year to increase its capacity and meet Covid-19 demand, but it believes that its increased scale and capital expenditure won’t go to waste once this crisis abates. “At some point, the therapies and vaccines related to the pandemic will unwind,” says chief executive Marc Casper. “You'll then see us able to backfill the capacity because it's perfectly useable”. Mr Casper says the group has already received commitments from some large customers to use the additional capacity for other products. Having deepened existing customer relationships and picked up new clients during the pandemic, Thermo Fisher is looking to turn these into long-term growth opportunities and increase its market share.

The group already had a good track record of organic revenue growth, but momentum has been turbocharged in 2020. Organic revenue jumped by 34 per cent in the third quarter, with 31 percentage points of this coming from Covid-19-related products and services. It is guiding to 19 per cent organic growth for the full year and while analysts are predicting a return to more normal levels from 2021, it is nonetheless impressive that Thermo Fisher will continue to grow against such tough comparators.

The group does use acquisitions to help propel growth, having spent $39bn on 68 businesses since 2010. This includes the $13.6bn purchase of Life Technologies in 2014, which became the foundation of the group’s life sciences division. It tried to purchase molecular diagnostics company Qiagen (US:QGEN) earlier this year for $11.5bn, but Qiagen’s shareholders voted against the deal – that’s despite Thermo Fisher upping its offer and Qiagen lowering the threshold for the deal to pass. While the failed takeover attempt is disappointing, it’s not a particular cause for concern – Thermo Fisher operates in a fragmented industry, meaning there should be plenty of room for further consolidation.

The high level of M&A activity has fed through to the balance sheet, however. The group was sitting on a hefty $13.6bn net debt pile at the end of September, although this was 12 per cent lower than the December year-end position and equivalent to 1.6 times adjusted cash profits (Ebitda). The debt is largely long-term and Thermo Fisher has no near-term debt maturities. Meanwhile, it has been historically good at generating free cash flow, producing $2.3bn of free cash flow in the third quarter of this year.

Thermo Fisher’s shares are up almost 50 per cent so far this year and are hovering around an all-time high. The valuation is therefore fairly pricey at 24 times consensus 2021 earnings with an enterprise value-to-operating profits ratio of 22. But it’s not so demanding when you consider that the group offers both near-term Covid-19-driven growth and a positive long-term outlook. It lifted its R&D spending by a fifth in the third quarter as it looks to position itself for the post-pandemic era. As global investment in diagnostics, therapies and vaccines increases, Thermo Fisher is well-placed to capitalise on the future direction of healthcare.

| Thermo Fisher Scientific (US:TMO) | |||||

| ORD PRICE: | 48,055ȼ | MARKET VALUE: | $190bn | ||

| TOUCH: | 48,051-48,059ȼ | 12-MONTH HIGH: | 49,071ȼ | LOW: | 25,021ȼ |

| FORWARD DIVIDEND YIELD: | 0.2% | FORWARD PE RATIO: | 24 | ||

| NET ASSET VALUE: | 8,030ȼ* | NET DEBT: | 42% | ||

| Year to 31 Dec | Turnover ($bn) | Pre-tax profit ($bn)** | Earnings per share (ȼ)** | Dividend per share (ȼ) | |

| 2018 | 24.4 | 4.51 | 1,112 | 68 | |

| 2019 | 25.5 | 4.98 | 1,234 | 75 | |

| 2020** | 31.0 | 7.38 | 1,850 | 88 | |

| 2021** | 32.9 | 7.98 | 2,025 | 99 | |

| % change | +6 | +8 | +9 | +13 | |

| Beta: | 0.6 | ||||

| *Includes intangible assets of $39bn, or 9,752ȼ a share | |||||

| **Bank of America forecasts, adjusted PTP and EPS figures | |||||

| £1 = $1.29 | |||||

Last IC View: None