Building foundations

The chancellor, George Osborne, used this week's Autumn statement set piece to detail continued cuts to spending at the majority of government departments, while also signalling the government's ambition to fire up the UK's housebuilding sector. By doubling the housing budget to £2bn a year, coupled with loosening planning rules further and launching additional policies designed to help first-time buyers on to the ladder, the government wants to see an additional 400,000 starter homes built by 2020. Other notable announcements included a boost to defence spending, further funds for infrastructure, the scrapping of tax credit reforms and an additional stamp duty levy on buy-to-let house purchases.

Grey Friday?

Retail rumpus

The exported US tradition of Black Friday hits the UK today, with retailers hoping it will kick-start the Christmas shopping season. Recent consumer spending trends have weakened, with the opening half of November proving moribund, although shoppers may have delayed their spending for the end-of-month sales, and a number of key retailers are rowing back on their enthusiasm for an event that caused havoc in planning schedules last year. In the US, upwardly revised GDP growth figures of 2.1 per cent for the third quarter were bolstered by healthy consumer spending, adding to pressure for an interest rate rise next month. But Black Friday excitement was dampened a little this month with news that consumer confidence in the US has surprisingly waned, dropping to its lowest level of the year in November.

Euroboom?

Data hope

Economic activity in the eurozone is showing signs of a significant rebound with the latest reading hitting a four-and-a-half-year high. The composite Purchasing managers' index figures for the economic bloc showed further increases, to 54.4 for November, from 53.9 in October. But this expansion is being built on a stagnant pricing environment with many companies reducing prices and also reporting flat or falling input prices as commodity input costs remain in the doldrums. Thus, the European Central Bank, which recently reiterated its desire to encourage some inflationary pressures into the eurozone economy, is unlikely to be put off considering an expansion of its quantitative easing programme, with many commentators expecting news on this front as early as December.

Silver bullet

Defence spend up

Ahead of the Autumn statement the government laid out its plans for £178bn of defence spending over the next 10 years, an increase of £12bn, giving a boost to the share prices of a number of companies serving the defence sector. With security at the top of the agenda following the recent terrorist attacks in mainland Europe and beyond, the government is planning to increase the number of troops available at the expense of thousands of civilian jobs. Meanwhile, the Trident nuclear submarine fleet's replacement will now cost £31bn, up £6bn from previous estimates. It hasn't been all plain sailing for defence companies of late, though, with Rolls-Royce this week announcing a major strategic review following five profit warnings in two years.

Mortgage boom

New high

The UK's refound love affair with property shows little sign of abating. With mortgage rates remaining close to record lows, borrowers have been scrambling to lock in the best deals. The latest data from the British Banking Association showed gross mortgage lending of £12.9bn in October, up by more than a quarter from a year previously and the highest monthly figure since August 2008, as both new lending and remortgaging saw healthy activity, and this trend looks set to continue with little chance of an interest rate rise in the coming months.

Shot in the arm

Pfizer deal

The global pharmaceuticals industry has maintained its reputation as the home of mega-M&A deals with news that US giant Pfizer is planning to acquire Botox maker Allergan in a deal worth $160bn (£106bn), which will create the world's largest pharma company with combined annual sales worth more than $60bn. The deal has resurrected concerns in the US around so-called 'tax inversion' deals with Pfizer intending to redomicile to Ireland, where it will pay significantly less corporation tax.

Jim Slater

Renowned financier, small-cap investment specialist and some time Investors Chronicle contributor Jim Slater has died aged 86. A self-made man, Mr Slater first came to prominence through his Slater Walker investment vehicle in the 1960s and 1970s before it ran into trouble following the stock market crash of 1973. He later rehabilitated himself as a small-cap investing specialist and was renowned for applying his 'Zulu principle' to his investments and wrote investment columns for various publications over a 50-year period.

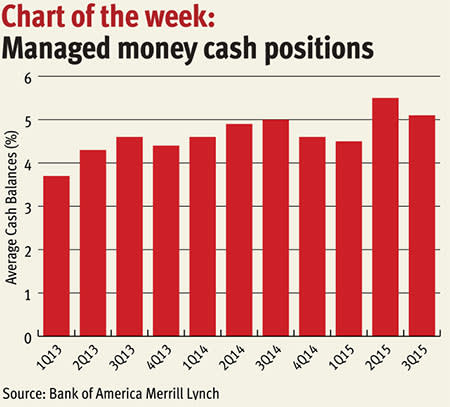

Managed money cash positions, which remained high through much of 2015, have pulled back in the final quarter of this year. Midway through the year, average cash balances hit their highest rate since the Global Financial Crisis, but with inflation expectations notably higher after the latest US payroll data there has been a step-up in exposure to equities.

The latest survey of fund managers’ sentiment from BoA/Merrill Lynch also indicates that concerns over a slowdown in China have abated to a degree, with local fund managers turning neutral on the country’s growth outlook – something of an improvement from attitudes through much of the past 15 months.

The eurozone and Japan remain the most favoured equity markets globally on the back of loose monetary policy, together with rising consensus on a US rate rise. The latter point is obviously further bad news for resource stocks, with market focus on QE and strong dollar trades.