Advertising revenue at major media businesses looks set to be under renewed short-term strain if recent company updates are anything to go by.

Scottish broadcaster STV (STVG) recorded a 2 per cent fall in national TV advertising sales in the first quarter of 2016, and management expects a flat second-quarter performance. In March, Downton Abbey broadcaster ITV (ITV) warned first-quarter advertising revenues from its key channels would be flat, after rising 12 per cent over the same period in 2015. And radio broadcaster Wireless Group (WLG) - formerly UTV - stomached a 6 per cent decline in radio revenues in Great Britain last year.

Newspaper publishers have also faced advertising declines, partly due to the migration of spend from print to television, digital and other media. Trinity Mirror (TNI) flagged a tough advertising backdrop for its regional titles, especially national advertising in urban areas. The Daily Mirror publisher also highlighted lower ad spending in the supermarket, telecoms, motors and entertainment sectors. The upshot was a 17 per cent slump in underlying print advertising revenues in the year to 27 December.

Similarly, Daily Mail and General Trust (DMGT) has blamed retailers - especially supermarkets - for advertising volatility in recent months. The media titan's print ad revenues slumped 12 per cent in the first quarter to 31 December, and management expects total media turnover to grow 2 per cent at most this financial year.

But all five companies are offsetting national advertising weakness with growth elsewhere. STV is on track to deliver digital and regional advertising growth of more than a fifth in the first half of 2016, while ITV continues to gain audience share and should benefit from the upcoming Euro 2016 football competition.

Wireless capitalised on its talkSPORT station's popularity with advertisers by hiking spot prices in 2015. And both Trinity Mirror and DMGT are growing digital advertising revenues by around a fifth annually.

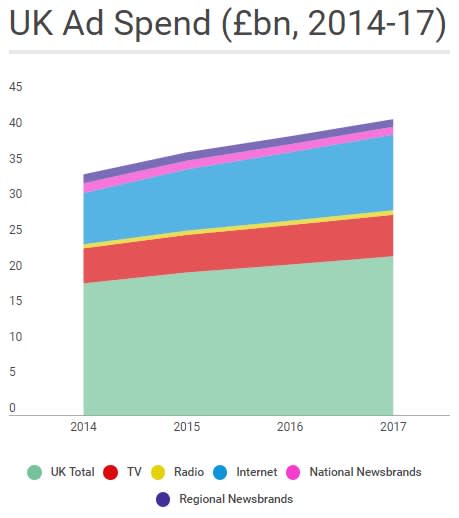

Broker Liberum expects the national TV advertising market to grow by 2 or 3 per cent in 2016. Industry data from the latest Advertising Association/Warc Expenditure Report (below), pegs growth at closer to 6 per cent. It points to higher expenditure on TV, internet and radio advertising and further spending declines for national and regional newspapers.