The implications of the UK’s exit from the European Union are still unclear. That’s not an inspiring opening line, admittedly, but it’s true. We’re only a matter of days on from the Brexit vote at the time of writing, and City analysts are clamouring to decide what the upshot is for several of Britain's key industries. Here, the IC writers pitch in to give as much of an overview as is possible this close to the decision.

Financials: the immediate casualty

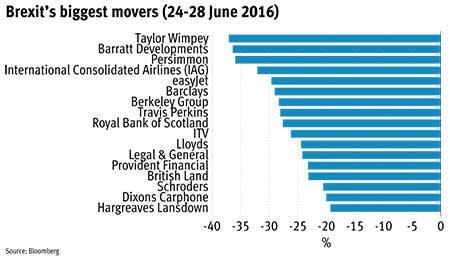

European banking stocks lost 22 per cent of their value in the two days of trading following the UK’s EU vote, inching closer to the all-time low hit during the financial crisis four years ago. Royal Bank of Scotland (RBS) shares fell to their lowest level since January 2009, while shares in Barclays (BARC) had to be momentarily suspended on Monday after falling more than 8 per cent, triggering an automatic stabiliser mechanism.

Lower for longer interest rates and the threat of weaker demand within the UK housing market mean investing in the UK banking sector has become riskier post-vote. However, we reckon there are opportunities for investors in the sector, albeit those with a slightly higher risk appetite. Lloyds (LLOY) remains our top buy pick of the mainstream banks. It does have the greatest exposure to retail mortgages and therefore a decline in the UK property market but it has a lower proportion of zero interest rate-paying current accounts, compared with competitors such as RBS. In a low interest rate environment the cost of interest it pays on current account deposits also falls. Therefore lower income is offset to some extent by lower funding costs. What's more, Lloyds shares now trade on one times its forecast tangible book value per share (TBVPS). This is compared with 1.3 times earlier this month.

The implications for interest rates raises questions over further quantitative easing and a tilt towards investment in alternative assets. George Osborne has urged that the UK economy is strong enough to withstand any reverberations from Brexit, but that didn’t stop benchmark UK interest rates falling below 1 per cent for the first time in history and the 10-year gilt yield dropping 8 basis points to 0.99 per cent. Low yields reflect widespread belief that the Bank of England will have to keep interest rates low or cut them lower – potentially bad news for pension funds and insurance companies that rely on the securities to meet future liabilities and are already struggling to deal with lower returns.

Encouragingly, some insurance groups - specifically Legal & General (LGEN) and Aviva (AV.) have come out fighting. L&G said its strategy is based on five key factors - ageing populations, globalisation of asset markets, creation of new real assets, welfare reform and digitalisation - all of which will be "substantially unaffected by the EU Referendum result". Similarly, Aviva said it had conducted "extensive analysis" of the possible implications of a vote to leave the EU and considers it will have "no significant operational impact on the company". HR + EP

Property: there's still a housing problem

One post referendum certainty is that the real estate and housing markets are unlikely to perform with any consistency because of the wide variety of companies making up the sectors. Companies with exposure to the London office market will face pressure generated by a potential shift by financial institutions moving jobs to the other side of the English Channel. How much this will affect capital values is open to debate, simply because supply constraints still apply. However, it seems likely that capital growth will decelerate or even stop, while rental income will grow more slowly. The good news is that nearly all property companies are significantly less leveraged that they were at the time of the financial crash. For overseas investors the attractions start to add up, especially since sterling’s dramatic fall.

The two bastions showing the greatest defensive qualities are providers of student accommodation and purpose-built medical centres. Neither is materially affected by the referendum – just 6 per cent of all UK students come from within the EU – and the demand for purpose built accommodation with a host of attendant facilities is unlikely to diminish.

Shares in housebuilders all received a big mark down mainly as a result of what could happen as opposed to what actually happened. It’s hard to see the extent of markdown being justified, given the huge imbalance between the supply of homes and demand. To justify the fall in share prices there has to be a material decline in demand, and as yet, it is still too early to identify whether potential buyers have changed their minds. But everyone has to live somewhere, which suggests that demand for new homes could be underpinned by growth in the private rented sector at the very least.

Three key factors appear to be behind the sharp fall in prices. The first is that, given the uncertainty, housebuilders are perceived to have shifted to much lower growth. The second worry is that higher inflation will push interest rates higher. The third is that there are concerns that the queue of buyers will dry up. Profit taking in housebuilders is understandable after their meteoric rise had stretched valuations, but the other two points are weak. Just this week, Redrow (RDW) announced that profits for the year to June will be at the top end of expectations, and pointed out that even after the referendum vote there was a queue of potential buyers at its latest sales site. This tends to suggest that the mark down in prices has been overdone, and we feel that even if margins are slightly eroded, the supply/demand imbalance will provide a major pillar of support. For investors reloading now, there is also the yield factor to consider, with dividends in some major builders touching 9 per cent. JC

Resources: gold is holding up

If there was a glimmer of hope in the turmoil which immediately gripped financial markets last Friday, it was gold. The price of the yellow metal sailed through the $1,300 resistance level in early trading, though investor flight to the safe haven contributed to significant increases regardless of the currency. For the first time since April 2013, sterling gold moved past £1,000 an ounce as the value of the pound plummeted.

This has provided some consolation for investors holding gold, which we made the case for a week ahead of the referendum. Further falls in sterling could boost momentum in the yellow metal, though some analysts have cautioned that the longer term uncertainty triggered by Brexit could be pared back in the form of a strengthened dollar. Despite this, analysts at ETF Securities have increased their fair value target for gold from $1,250 to $1,400, given the long shadow of uncertainty the result will cast over the Eurozone.

The surge in the gold price has inevitably been multiplied in gold companies’ share prices, as investors bet that profits for the dollar-earning sector will sharply rise. Randgold Resources (RRS) was the biggest riser in the stock market immediately after the referendum result, jumping 16 per cent on 24 June and is up by a quarter since the market closed last Thursday. Fresnillo (FRES) was similarly over-bought, rising by over a fifth by Monday and now sitting on around 50 times forward earnings. Despite posting similar re-ratings, smaller gold miners such as Acacia Mining (ACA) and Pan African Resources (PAF), still look like good value to us. AN

5012117031001

44483234001

Retail: plenty of bargains to be had

From an investors’ point of view, now might be the time to top up one's retail holdings. The outlook for consumer spending isn’t pretty, but it hasn’t been for most of the year. Ahead of the vote, consumers had started tightening their belts, sterling had already weakened against the dollar and sluggish Asian markets were weighing on luxury brands. However, this didn’t stop the vote's outcome from pushing the sector down a further 10 per cent on the day versus the All-Share Index’s 3 per cent dip.

Market movements over the last few days have left valuations pretty polarised across the board. Analysts at brokerage N+1 Singer said they expected some sub-sectors, like motor retailers, to be left relatively unaffected given their domestic tilt and the shares' consistent value offering. The main issue to consider is any adverse impact from the weakening of sterling and a possible slump in consumer spending - dare we say, another recession. Such concerns prompted EPS downgrades for stocks like Debenhams (DEB) and Halfords (HAL), although the currency situation could actually prove beneficial for naturally-hedged groups like Boohoo (BOO) and Walker Greenbank (WGB). Prices could also rise at companies where hedging isn’t part of the strategy, although this was likely to happen anyway thanks to the introduction of the National Living Wage last April. It's going to be a bumpy ride for investors in retail, but it hasn't been an easy year so far either. Those prepared to pick up a bargain could be justly rewarded if Britain is able to negotiate enough access to the single market to stablise retailers' operations there and underpin consumer confidence here. HR

Brexit blues for biotech but big pharma still pulls rank

Big pharma has historically been a defensive haven for investors. Demand for medicines will be the same despite Britain’s decision to leave the EU and as GlaxoSmithKline (GSK), AstraZeneca (AZN) and Shire (SHP) all trade globally sterling volatility is unlikely to cause any real concerns. What’s more, these companies remain pretty cash-generative and pay regular shareholder returns, defensive qualities which explains why they were among the few post-referendum risers.

For the larger companies with pots of cash and big banking facilities, funding isn’t a concern. But for many of the UK’s smaller companies – which rely on access to capital markets – the future’s more uncertain. While market volatility is eventually expected to calm down, more pressing are worries that several companies with links to British universities will no longer see the benefits of EU grants. Many companies recognised revenue in the last financial year from grant funding and in May science minister, Jo Johnson, made clear there was no guarantee that a post-Brexit government would be willing or able to make up any shortfall if the EU funds collapsed.

Small-cap biotech has been a big faller over the past few days. However, we still see long-term value in this section of the market. For listed companies with drugs in costly clinical trials, a little bit of EU funding isn’t going to make much difference. Ultimately the science is still exciting and there are number of companies – GW Pharma (GWP), Abcam (ABC) and Horizon Discovery (HZD) to name a few – which have great potential, regardless of Britain’s position in Europe. MB

Media: don't overlook the fundamentals

Media companies have been among the hardest hit by Brexit. Analysts expect the current uncertainty to weigh on advertising demand, tempering the growth outlook for television, radio, newspaper and magazine publishers. But investors should pay attention to each company's fundamentals. For instance, shares in ITV (ITV) plunged a fifth within hours of the referendum, as sellers overlooked the attractive rating, large dividend yield and the potential for a takeover offer. Shares in Daily Mail & General Trust (DMGT), Trinity Mirror (TNI) and Euromoney Institutional Investor (ERM) also fell sharply, which seems more justified given the fragile state of print publishing.

Meanwhile, UBM (UBM), ITE (ITE) and other events groups were relatively unscathed, as investors recognised that their focus on international diversification should help to insulate them from a potential downturn in Europe. We recommend investors take another look at companies’ intrinsic values, analyse how a Brexit could affect their prospects, consider broader industry trends and then make their decision to buy or sell. TM