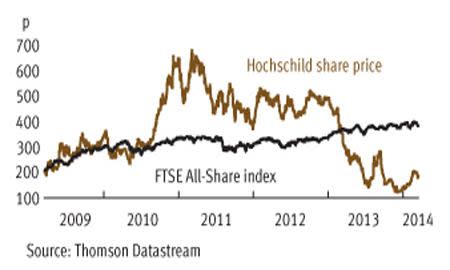

We initially became concerned about the rating for Hochschild Mining (HOC) in the wake of last April's collapse in precious metals prices. With unavoidable - and weighty - capital commitments and falling sales receipts, we felt that market sentiment would invariably weigh on valuations for the Latin American miner. Since we expressed our reservations on the release of Hochschild's half-year results (sell, 227p, 21 Aug 2013), its share price performance has been volatile, and is currently 22 per cent down from our August call. But with the company's enterprise value representing 22 times consensus forecasts for operating profits over the next 12 months, and at a 25 per cent premium to book value, there's reason to think that Hochschild could lose further support, particularly in light of the cancellation of its full-year dividend.

- Capital commitments

- Cancellation of dividend

- Silver surplus predicted

- High rating

- Cost-cutting

- Inmaculada project on track