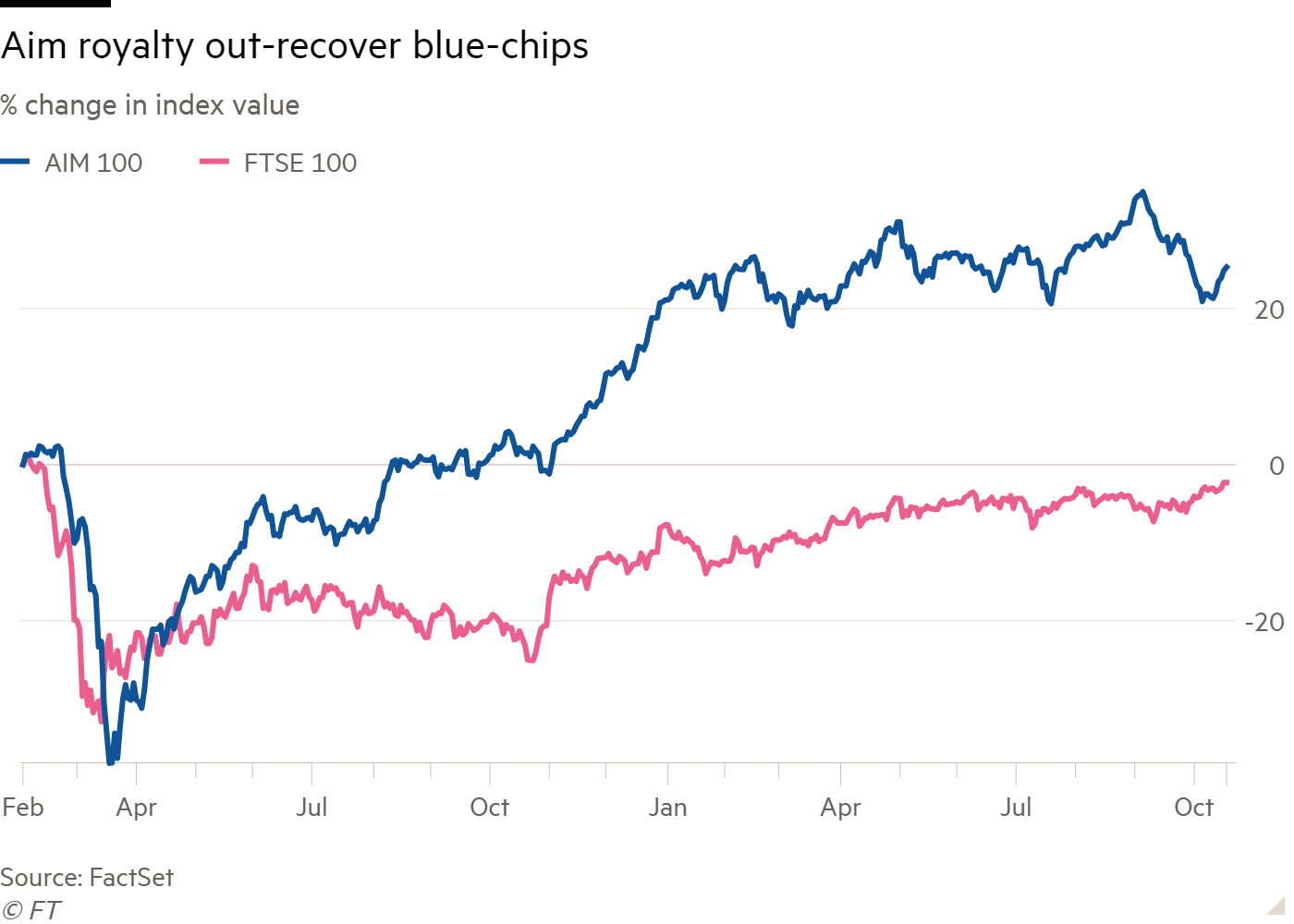

In periods of economic turmoil, the performance of Aim is expected to lag behind the main market. During the global financial crisis of 2007-08, for instance, Aim tanked against the FTSE. But as with much else with the Covid-19 pandemic, conventional wisdom has been turned on its head. Market expectations were rebuffed over the pandemic period with the Aim 100 Index significantly outperforming its main market cousin (see chart).

What has caused this reversal of fortunes? Aim has been helped by the high-growth nature of its listings and sectors, while the FTSE has been maimed by the over-representation of traditional industries such as banking which have struggled during the pandemic. Michael Timmins, a partner in EY’s transaction advisory services division, says Aim’s recent performance has been driven by its technology, healthcare and life science businesses.