Were Rotork (ROR) a racing driver, former commentator Murray Walker would have exhausted his book of superlatives to describe the valve control systems firm long ago. It's supplied oil companies, power stations and water plants for over 50 years and built a reputation for consistent returns during good times and bad. That certainly deserves a premium rating, but lately the gap has become impossible to justify and Rotork's share price looks overcooked.

- Defensive earnings

- Record order book

- Valuation looks stretched

- Tough comparatives

- Margins may have peaked

- Power market remains subdued

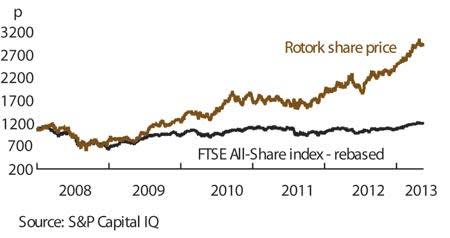

But the market has certainly bought the story. Having plunged below 600p in 2008, Rotork shares peaked last month at almost 3,100p and have doubled inside 18 months. The shares have begun to give up ground since, though, but still trade at a vertigo-inducing 24 times adjusted earnings forecasts for 2013. Last month's full-year results were no better than expected and earnings upgrades modest, certainly not enough to justify these multiples.

Clearly, the whole industrials sector has undergone a significant re-rating in recent months, yet equally resilient peers such as Halma and Spectris continue to trade at a 20-30 per cent discount to Rotork. It trades at an eye-watering 50 per cent premium to the wider sector, and looked at on an enterprise value (market cap plus debt, minus cash) to cash profits basis it's a staggering 75 per cent, according to broker Investec Securities. Using the five-year average premium of 55 per cent - and a rating still far higher than its closest peers - values Rotork shares at under 2,500p.

ROTORK (ROR) | ||||

|---|---|---|---|---|

| ORD PRICE: | 2,788p | MARKET VALUE: | £2.42bn | |

| TOUCH: | 2,787-2,789p | 12-MONTH HIGH/LOW: | 3,097p | 1,837p |

| DIVIDEND YIELD:* | 1.9% | PE RATIO: | 23 | |

| NET ASSET VALUE: | 310p** | NET CASH: | £59.9m | |

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2010 | 381 | 97.9 | 80.5 | 32.5 |

| 2011 | 448 | 113 | 93.0 | 37.3 |

| 2012 | 512 | 124 | 103 | 43.0 |

| 2013*** | 577 | 141 | 117 | 49.0 |

| 2014*** | 609 | 149 | 124 | 53.0 |

| % change | +6 | +6 | +6 | +8 |

Normal market size: 1,000 Matched bargain trading Beta: 0.8 *Excludes special dividends of 11.5p in 2011 and 2010 **Includes intangible items of £121m or 140p per share ***JP Morgan Cazenove forecasts | ||||

Of course, Rotork's safe-haven status demands recognition, but when risk appetite returns and cyclical plays are back in vogue investors could turn elsewhere. And backing up that aggressive rating with sufficient earnings growth will not be easy. True, according to broker JP Morgan operating margins have averaged 25.8 per cent over the past five years - twice the sector average - but they look to have plateaued, and a failure to revive them will disappoint the City. Focus, then, will be on the top-line to drive profits, yet there are potentially problems here, too.

Bettering last year's knockout first half when like for like sales grew by 17 per cent will be hard. According to broker N+1 Singer's calculations, growth slowed to just 7 per cent in the final six months of the year and a sluggish start to 2013 could threaten Rotork's rating. We'll find out at the AGM in two weeks. A further slowdown in power - about a fifth of the business - is the biggest risk after a spending hiatus in India cooled progress at the core controls division in 2012. There's been little sign of an uptick this year, either, and Investec has trimmed forecasts here.

Selling emergency shutdown valve actuators to the oil & gas industry has been much better business. With oil companies investing heavily in shale exploration, it generates over half Rotork's income and is the driving force behind the fast-growing fluid systems division. A downturn here would harm prospects, although admittedly that looks highly unlikely right now.

Advising a sell on Rotork is not a decision we've taken lightly and the merits should not be overlooked. The company enjoys enviable market share and is either number one or two in its niche markets. It grew revenue and earnings during the darkest days of the financial crisis and maintained margins, too. In fact, revenue has fallen just once in 20 years and organic growth has averaged 12 per cent over the past decade. All four divisions: controls, fluid systems, gears and instruments, had a record 2012. An extra £539m of new business flooded in, too, leaving the year-end order book up 15 per cent at £181m, a new high.