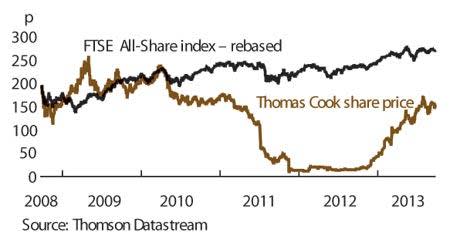

Two years ago Thomas Cook (TCG), the world's oldest travel firm, was more chaotic than a heavy night on a Club 18-30 holiday. It only narrowly avoided bankruptcy, but the turnaround since Harriet Green took the helm has been sensational, and the recovery story remains compelling. Brutal cost cutting got the City onside and a huge refinancing has significantly strengthened the balance sheet. Yet, with more savings under every stone and earnings rising fast, we think it inevitable that Cook's rating will catch up with rival TUI Travel (TT.), implying at least another 38 per cent upside for the shares.

- Earnings growing fast

- Second wave of cost savings to come

- Balance sheet in better shape

- Profit upgrades expected

- Director share buying

- Restructuring execution risk

- Slow start to winter season

We like TUI and recently tipped the shares. Cook is coming from behind and represents a riskier play but with more upside potential. Ms Green has already shut hundreds of high-street travel agencies, ordered thousands of job cuts and hived off unwanted assets. Cook has also received £431m from a placing and rights issue, part of a £1.6bn refinancing package agreed in the spring. Analysts expect that will almost halve year-end net debt to about £400m, and a new £691m bank facility and €525m (£441m) bond with maturities from 2017 provide valuable breathing space.

Cook is one year into a three-year turnaround plan targeting £400m of savings, about £170m of which will arrive this year. The savings target has been rising and could continue to do so. Ms Green told us there are hundreds of projects that could deliver even more, and a second wave of more structural savings could be flagged as early as the full-year results on 28 November. That makes targeted UK operating margin of over 5 per cent (from 1.7 per cent on a last-12-month basis in Q3) more realistic and could drive earnings upgrades. Non-core asset sales worth up to £150m should also help sentiment.

Upgrades could be substantial. Cook told analysts recently that little business integration had taken place in the UK since the merger with MyTravel in 2007. Cook wants more than half its holidays sold online by 2015, up from 35 per cent, and new products like upmarket 'concept' hotels are expected to generate over £500m of annual revenue inside three years. Bookings of these higher-margin deals rose 38 per cent this summer.

THOMAS COOK (TCG) | ||||

|---|---|---|---|---|

| ORD PRICE: | 145p | MARKET VALUE: | £2.11bn | |

| TOUCH: | 144-145p | 12-MONTH HIGH/LOW: | 171p | 13p |

| FORWARD DIVIDEND YIELD: | nil | FORWARD PE RATIO: | 13 | |

| NET ASSET VALUE: | 17p* | NET DEBT: | £452m | |

| *Includes intangible assets of £3.2bn, or 222p a share | ||||

| Year to 30 Sep | Turnover (£bn) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2010 | 8.89 | 248 | 20.4 | 10.8 |

| 2011 | 9.81 | 175 | 11.7 | 3.75 |

| 2012 | 9.49 | 12.7 | -3.23 | nil |

| 2013** | 9.29 | 105 | 6.85 | nil |

| 2014** | 9.68 | 219 | 10.9 | nil |

| % change | +4 | +108 | +60 | - |

Normal market size: 10,000 Matched bargain trading Beta: 2.1 **Credit Suisse estimates, adjusted PBT and EPS figures | ||||

Already the impact on Cook's results has been dramatic. Despite spending £42m more on fuel, the company made a small, underlying, third-quarter operating profit compared with a £45m loss in the previous year. Nine-month losses narrowed to £197m from £301m and, on a last-12-month basis, cash conversion moved to within a whisker of the 60 per cent target versus just 11 per cent in 2012.

Admittedly, the slower start to winter bookings flagged in a recent year-end trading update shook out some investors. But we think they've made a big mistake. We already knew demand had tailed off after the summer heatwave and unrest in Egypt, and it is still early days. Cook is skilled at managing capacity and average prices have risen "strongly" everywhere. Travel restrictions to Egypt and its Red Sea resorts have now been relaxed, too, and in the midst of a cyclical upswing it is telling that consensus forecasts remain unchanged.

Cook shares trade on 12.8 times EPS estimates for 2014, but earnings are tipped to surge by another 40 per cent in 2015, implying a rating just 9.2 with more sharp earnings upside beyond. Analysts at Jefferies say that kind of growth easily justifies a rating equal to TUI, which currently trades on an enterprise-value-to-cash-profits multiple of 6.7 times, compared with just 6.1 times for Cook. That implies a 200p target price for Cook and 38 per cent upside. Finance director Michael Healy is clearly convinced. The man with the inside track last month spent £25,000 on shares at 137p.