How will global fossil fuel use change in the coming decades? Here is the broad consensus: coal, with limited political support, high unit costs and high-carbon emissions, will fade, contrasting with oil, which continues to see demand grow, albeit at a slower pace than recent decades. Meanwhile, supportive environmental policies and strong growth in the supply of shale and LNG will lead to a surge in the use of gas.

This consensus does not extend to the speed of these changes, and where renewable energy sits in the mix. Oil and gas companies will point to International Energy Agency (IEA) forecasts, which assign 75 per cent of all energy use to fossil fuels, even in 2040. Renewable groups and environmental campaigners will point to the failure of past projections to account for the falling costs of alternative energy sources, and the fact that wind and solar have achieved grid parity across much of the globe.

Peabody collapses

Nonetheless, this month has already presented a leading exhibit for the first of these fossil fuel trends. On 13 April, Peabody Energy (US:BTU) - America's largest coal miner, and the largest private coal company in the world - filed for voluntary bankruptcy. Ostensibly, the move was billed as a plan to reduce its overall debt level, bring down fixed costs and improve operating cash flow, while continuing to operate under the protection of the court, but many saw the writing on the wall for the Missouri-headquartered company a long time ago. From 2012, short positions started to mount in the company's shares, which have declined by 99 per cent since their 2011 high.

So why did so many people see this coming, given that coal still fuels some 40 per cent of global electricity generation, and is integral to steelmaking? Simply put, coal has been wildly oversupplied, not just in the US, where excess production caused a 23 per cent hike in inventories by the end of 2015, but globally. The decline in Chinese demand, which began in 2014, continued last year, the first time the country has posted a fall in consecutive years since 1982, according to the US Energy Information Administration (EIA).

For Peabody, this was an example of "weakness in the Chinese economy", rather than a pivot away from high power demand and a greater reliance on renewables. Similarly, the increase in shale gas in the US, which thanks to falling costs has rendered coal economically non-viable in a low price environment, was characterised as "overproduction".

This has left Peabody with massive write-downs, $6.3bn in debt by the end of 2015, and desperately in need of $800m of debtor-in-possession (DIP) financing, secured following court approval. Peabody is perhaps the most high-profile coal collapse, but it is not the first. In the last year alone, Arch Coal (US:ACI) - the second-largest domestic supplier in the US after Peabody - filed for bankruptcy, as did Virginia-based Alpha Natural Resources (US:ANR). Bond prices for Cloud Peak Energy (US:CLD), which was spun out of Rio Tinto's (RIO) US operations in 2009, suggests the Wyoming coal miner is headed the same way.

Peabody is convinced that coal prices will turn a corner, supported by a stabilisation in thermal coal demand and the commissioning of new coal-fired power plants. The EIA thinks differently: it is forecasting an average price of $2.16 per MMBtu in 2016 and just $2.19 in 2017, against an average coal price of $2.23 last year.

Just two years ago, Peabody founded a pro-coal campaign called Advanced Energy for Life. Its goals were to frame coal as a solution to global energy poverty, and to champion the adoption of carbon capture and storage (CCS). On this second point, Peabody probably saw its own future salvation, although until the adoption of CCS technology is widespread, the company, like much of its industry, is living precariously.

An unconscious decoupling

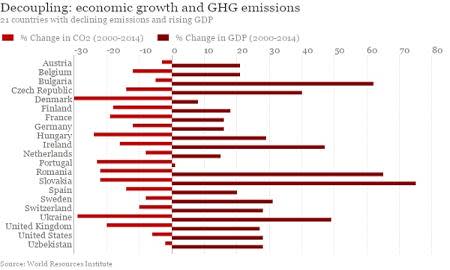

The US shale revolution has not only given the coal industry a kicking (and, if you buy the theory, forced Saudi Arabia's hand to try and wipe out the market share increasingly hoovered up by unconventional producers) it has disrupted a long-standing correlation in the US between economic growth and energy use. That's based on recent research by the World Resources Institute (WRI), which singled out 21 countries that have reduced their greenhouse gas emissions since the turn of the century, despite boosting GDP.

This so-called 'decoupling' has mainly taken place in Europe, among economically advanced countries with the means to reduce emissions. However, in the United States, this decoupling has largely been achieved thanks to the boom in domestic natural gas. With the development of safe hydraulic fracturing techniques and horizontal drilling, the country has stumbled upon an abundant and affordable source of relatively cleaner energy. Indeed, the EIA forecasts that natural gas will be the country's number one fuel source for electricity generation in 2016.

The question for other nations is whether this model can be replicated. BP (BP.) forecasts that the vast majority of the 5.6 per cent annual growth in shale gas in the next decade will come from the US, although this growth will eventually be surpassed by China.

Oil shifts

Among the 21 countries highlighted in the WRI report, demand for oil is also likely to fall, wiping around 5m barrels of oil a day from current global requirements by 2035. However, this will be more than offset by non-OECD growth, namely from China, India, the Middle East and other Asian countries, bringing the global demand for liquids to 112m daily barrels by 2035.

It's important to reflect that this increase in demand - even in 2016 - is likely to be the ultimate catalyst for a rebound in the oil price. Last Friday, the IEA's monthly communiqué suggested "the oil market looks set to move close to balance in the second half of this year", as the surplus falls to 200,000 barrels per day.

The report also acknowledged the recent rally in crude prices may have been froth ahead of this month's meeting of OPEC members and Russia in Doha, which proved to be the red herring many expected it to be. The talks were not so much a sign of intransigence as irrelevance: ahead of the meeting, Iran had said it would not agree to freeze production at current levels, thereby scuppering Saudi Arabia's attempt at co-ordinated action in advance.

Domestic demand, and supply optimism

One place where demand is forecast to decline is the UK. But in contrast to the US - which thanks to the full-scale development of unconventional resources witnessed an 18.5 per cent decline in crude oil imports between 2009 and 2014 - the UK's import deficit is set to significantly expand between now and 2030. This trend began in 2005, when imports first started to exceed exports from the North Sea and elsewhere. In 14 years' time, the UK will rely on other nations for 71 per cent of its oil.

Last week a report by the consultancy group EY was published, offering one highly speculative solution to this shortfall: the Kimmeridge Limestone in the Weald Basin in the south east of England. In common with the rest of its output, EY did not compile the analysis out of the kindness of its accounting heart, but because it was commissioned to do so by UK Oil & Gas (UKOG), which owns a series of licences in the Weald, including a 27 per cent stake in the Horse Hill HH-1 discovery well. With that in mind - as well as the still nascent understanding of the discovery's commercial profile - the claims are nothing short of staggering.

Yes, the aggregate flow rate of Horse Hill's Kimmeridge limestones yielded 1,365 barrels of oil in recent tests. But EY's report then contained several quantum leaps. On these provisional results alone, future peak oil production could provide between 4 and 27 per cent "of UK daily oil demand over the life of the project", thereby adding up to £52.6bn in gross value to the UK economy, up to 5,600 jobs over the project lifetime, and tax revenues up to £18.1bn. It gets better. Because the production profiles used by EY assume an initial oil flow rate of 400 barrels a day, these economic impacts "should be considered as conservative".

Another announcement pertaining to UK oil security - all the more impressive for its lack of bombast - came on the same day from Hurricane Energy (HUR). The Aim-traded group has managed to raise £52m in a placing at a whopping 39 per cent premium to its share price. The proceeds, from seasoned oil and gas investor Kerogen and existing shareholder Crystal Amber, will be used to drill two wells this summer on Hurricane's Lancaster oil field, West of Shetland, which has contingent resources of 450m barrels. If EY's forecasts are to be believed, it is surely a matter of time before UKOG and the other Horse Hill operators receive such market-defying investment.