I touched on a classic case of divergence in last week’s column. Both in early 2003 and early 2009, the S&P 500 index was hitting new bear-market lows, but its weekly relative-strength index (RSI) was not. This 'positive divergence' was a clue that a major low was coming. Unfortunately, I saw fit to ignore that signal on both occasions, and missed fantastic buying opportunities.

Two further potential divergences in the markets have been brought to my attention this week. While the S&P 500 is knocking on the door of new highs, the price of copper is wilting. Since 1 February, the red metal has dropped by as much as 10 per cent, during which time the S&P has added more than 3 per cent.

Soaring stocks, melting copper

The recent past suggests this divergence may be a cause for concern. The S&P’s big spring/summer retreats in 2010, 2011 and 2012 were each preceded by weakness in the price of copper. Especially since stocks are looking stretched right now, and are heading into their weaker period, this is not an encouraging omen.

My main complaint with copper’s negative divergence is its lack of pedigree. It does not seem to have had much relevance before the present bull market. The red metal peaked well after the S&P at the major highs of 2000 and 2007, for example. You might argue that recency matters most. I just can’t get excited over such a limited sample, though.

Nasdaq short-circuits

By contrast, the principle that the Nasdaq 100 index ought to lead the way during bull markets on Wall Street is well established. Lately, however, the Nasdaq has been lagging both the S&P and Dow Jones. I read a bulletin-board posting the other day suggesting that this did not bode well for the health of the overall rally.

This notion is easily dismissed, in my view. The Nasdaq recent poor showing is not because traders are shunning racy technology stocks, but because of the woes of just one of its members. Apple has fallen from $705 to as low as $419, a 41 per cent drop. At its peak, it accounted for more than 20 per cent of the Nasdaq. Its decline has therefore been a major drag on the index.

Nasdaq without Apple

The accompanying chart shows Nasdaq’s actual performance, alongside its performance minus Apple. It makes a world of difference. With Apple taken out, the Nasdaq 100 is up strongly. Traders are therefore buying racy tech stocks, as they ought to be doing. They’re just not buying Apple.

Having brushed aside these false omens of impending doom, what about some positive reasons for being long? While it is not my job to have views on fundamental events, I have been predicting that the Cypriot crisis would be contained, allowing the markets to embark on yet another leg higher.

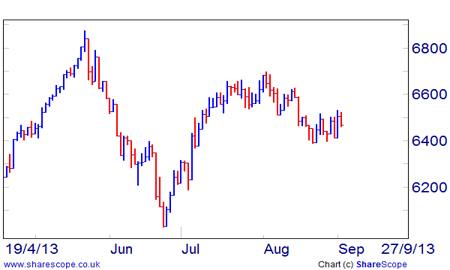

FTSE buy signal

It appears that I was right. On Monday 25 March, the DAX and FTSE both gave repeat buy-signals on their swing-charts in response to reports of a Cyprus rescue-deal. I am now looking for the DAX to retest its record highs at 8157 and the FTSE to attack the 6750 level in due course. Now is not the right time to give up on this rally, on either side of the Atlantic.