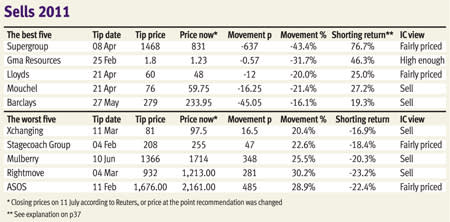

In general, the performance of our weekly tips has not thrilled so far. But it does show the potential for quick gains that comes from selling short. Take a quick look at the profits you could have made following our recommendations, and you will get an idea why there are full-time bears in any leading financial market – punters who make a crust by betting that prices will fall.

It's not just that the sell tips that appeared in the Tips section of the magazine during the first half of 2011 did better than many of our buys. The point is that share prices will almost always fall faster than they will rise. So an investor who wants to make a fast return is more likely to achieve that via selling. And one piece of evidence to support that is the fast pace at which the price of the IC's sell tips have fallen so far this year.

The average share price decline of the 19 shares that we have recommended selling since mid-January has been around 2.4 per cent. That's better than our value and speculative buys. The potential returns from short-selling these shares are even higher, because of the mathematics of short-selling (see '' for information on how to calculate sell tip performance).

Among the stand-out performances was a suggestion to sell shares in gold explorer GMA Resources. The shortcoming is that GMA is a penny stock, and a tiny one at that. So dealing at the prices shown in the table might have been easier said than done.

Meanwhile, there is a startling contrast between the performance of Supergroup's shares – our top-performing sell tip – which we reckon are now fairly priced, and shares in similar fashion groups, Mulberry and Asos, which our among our worst sell ideas. True, the Duchess of Cambridge may have been spotted sporting a hugely expensive Mulberry bag, but we still think its share rating is far too luxurious. Not so Asos. So long as there are grounds for thinking that it may turn itself into the Amazon of clothes retailing, its share rating is likely to be sustained. So we have switched our view to fairly priced.

We have made the same switch with Lloyds Banking now that its newish chief executive, António Horta-Osório, is taking huge swathes of cost out of the business, and with Stagecoach, which is trading better than we expected when we wrote our sell tip in February.

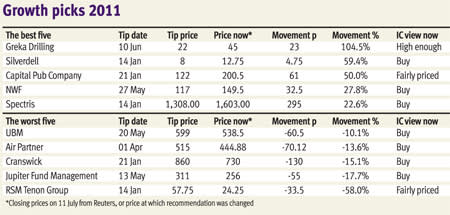

Among the buy recommendations the best performer has been mining services provider Greka Drilling, which slotted into our growth category. Whatever Greka's longterm prospects, ignoring the 88 per cent gain that was available within two weeks of our tip was nigh-on impossible. So we told readers to take profits and the shares now look high enough.

As regards another growth pick, pubs operator Capital Pub Company, we sort of messed up. That's because we switched our recommendation to good value a month after tipping it because, having said it would not raise fresh capital, the company then announced a surprise share placing. Still, with an indicative bid from Fuller, Smith & Turner now in the offing, those who stuck with Capital's shares are sitting on a nice gain, with the possibility of more to come.

Then there is hazardous waste processor Silverdell, whose shares we considered as a tip of the year. The share price is up 59 per cent but still trades around net asset value, so the shares remain a buy.

Among the poorest-performing growth stocks there are several that have so far been uninspiring, but which may yet come good. Then there is RSM Tenon, whose price has changed little since we switched our recommendation to fairly priced in May following a profits warning.

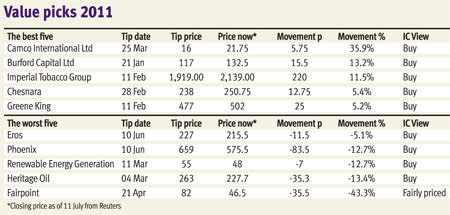

Then again, it has been a surprisingly lousy time for insolvency specialists. This helps explain why the worst of our valuestyle tips is Fairpoint, which had its own profits warning in June, prompting us again to downgrade to fairly priced.

Elsewhere among our value tips, we are sticking with our buy recommendations for good or ill. So far it has mostly been ill, but value investing usually requires patience. On average, the value of our 18 tips under the 'value' moniker has fallen 4 per cent. There has been one terrible tip – Fairpoint – and one good one – shares in carbon abatement specialist Camco International, which have prospered since the German authorities decided to close down the country's nuclear power stations by 2022 following the Fukushima disaster in Japan.

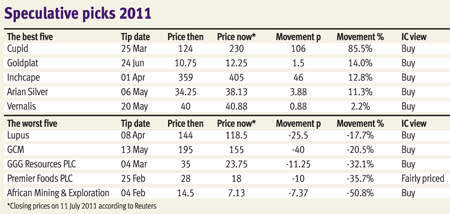

The weakest performers overall have been the speculative tips. The average value of the 16 fell 5 per cent between being tipped and the end of June. That's consistent with portfolio theory – speculative stocks, which include recovery plays and turn-around situations, should be volatile – but it's still disappointing. Only one speculative tip – dating website operator Cupid – has performed strongly and a clutch has performed badly.

Interestingly, two of the worst are plays on the same theme – the rising price of bullion. While silver miner Arian Silver has perked up lately, gold explorers GGG Resources and African Mining & Exploration are still searching for the find that will transform their prospects.

Well, aren't we all? The IC's gold diggers aim to do better in the second half of the year. One thing's for sure – we'll never stop trying.