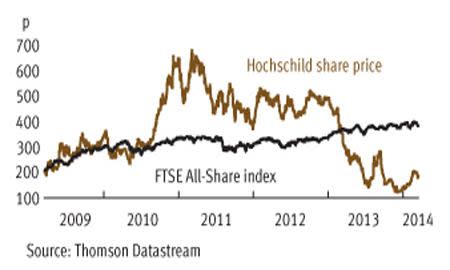

We initially became concerned about the rating for Hochschild Mining (HOC) in the wake of last April's collapse in precious metals prices. With unavoidable - and weighty - capital commitments and falling sales receipts, we felt that market sentiment would invariably weigh on valuations for the Latin American miner. Since we expressed our reservations on the release of Hochschild's half-year results (sell, 227p, 21 Aug 2013), its share price performance has been volatile, and is currently 22 per cent down from our August call. But with the company's enterprise value representing 22 times consensus forecasts for operating profits over the next 12 months, and at a 25 per cent premium to book value, there's reason to think that Hochschild could lose further support, particularly in light of the cancellation of its full-year dividend.

- Capital commitments

- Cancellation of dividend

- Silver surplus predicted

- High rating

- Cost-cutting

- Inmaculada project on track

The board announced that it will not reinstate the dividend until the cash position improves. The encouraging news for existing shareholders is that the miner, majority-owned by Eduardo Hochschild, has been actively paring back costs since silver prices headed south last year. The miner is targeting $200m of cash cost savings, although, a glance at the miner’s latest income statement suggests that there is still some leeway. Despite the fact that revenues were down by a quarter, Hochschild’s cost of sales was up by $49m, including $22.9m in increased depreciation charges. To the displeasure of some investors, Hochschild has also hedged around 20 per cent of this year’s production with forward sales at prices roughly equivalent to current levels. These actions are essentially defensive in nature and are certainly not guaranteed to underpin the miner’s share price going forward.

| HOCHSCHILD MINING (HOC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 177p | MARKET VALUE: | £650m | |

| TOUCH: | 176.75-177.5p | 12-MONTH HIGH: | 311p | LOW: 119p |

| FORWARWD DIVIDEND YIELD: | 1.9% | FORWARD PE RATIO: | 13 | |

| NET ASSET VALUE: | 236¢ | NET DEBT: | 16% | |

| Year to 31 Dec | Turnover ($m) | Pre-tax profit ($m) | Earnings per share (¢)* | Dividend per share (¢) |

|---|---|---|---|---|

| 2011 | 988 | 421 | 49 | 6 |

| 2012 | 818 | 212 | 19 | 6 |

| 2013 | 622 | -120 | -15 | nil |

| 2014* | 550 | 32 | -3 | nil |

| 2015* | 736 | 163 | 22 | 6 |

| % change | +34 | +409 | - | - |

Normal market size: 3,000 Matched bargain trading Beta: 0.95 £1=$1.67 *Westhouse Securities forecasts, adjusted EPS figures | ||||

Hochschild is hoping to further insulate its business against the vagaries of precious metals markets through the scale benefits that should flow from its acquisition of the 40 per cent minority interest held by International Mineral Corporation in the Pallancata mine and Inmaculada Advanced Project in Peru. Hochschild plans to complete the works at Inmaculada later this year at a remaining cost of around $200m (£121m). Over the next four years, Hochschild intends to raise output by around 70 per cent, bringing another mine on stream once Inmaculada is up and running - probably in the fourth quarter. The company also completed the sale of $350m in bonds in the early part of this year to fund its Peruvian exploits.

Of course, Hochschild's share price performance over coming months will be predicated to a large extent by prices for precious metals, particularly that of silver. Although we are reluctant to make any short-term predictions on prices, there are some worthwhile pointers that suggest Hochschild may have to contend with a dampened bullion market for a while longer. A recent report from HSBC stated that silver prices are likely to trade in a range between $17.75 and $22.75 for the remainder of 2014, with the excess of silver bullion supplies over this year's demand growing to around 156m ounces - or around 15 per cent of annual off-take.