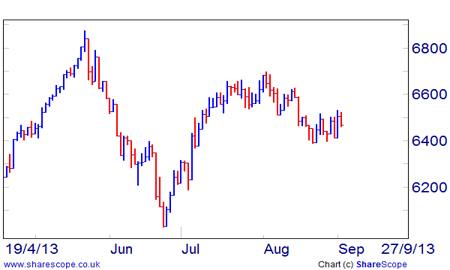

The rally in risky assets goes on. I am especially impressed at the FTSE’s progress, after such a long spell where it lagged the other markets. As a result of its steady climb, it has been giving a near-overbought reading on its daily relative strength index (RSI) since around the start of the year. This is entirely normal in a powerful uptrend. The last such episode was back in early 2010, when the market stayed in the region of 70% for almost the whole of March. Therefore, I am not too worried about the FTSE’s current overboughtness. However, I would like an intraday pullback to let me buy once again. The DAX is much less overextended, and I would welcome a bounce to get in here too.

for analysis of some leading European markets.COMMODITIES OUTLOOK

09.58

EURUSD’s latest recovery highs on Monday and Friday last week around $1.34 were not accompanied by fresh high readings in the daily RSI. Such “negative divergence” will worry some traders, but not me. I find divergence more worrying when the market in question is also overbought or oversold, which is not the case with EURUSD. As such, I am looking for the single currency to extend its recent burst of strength and to make new highs above the $1.34 level. This should be good for my bullish calls on copper and silver too.

for analysis of commodities and EURUSD.WALL STREET OUTLOOK

11.59

While the most effective version of the Dow Theory gave a buy-signal on the first trading day of 2013, the traditional version of this approach has now followed suit. The Dow Jones Industrials went above their November 2012 highs on Friday, joining the Transports, which had done so on 2 January. Traditional Dow Theorists will now likely seek to join the uptrend once more, and rightly so. The near-term outlook is still bright in my outlook, and I look for entries in the Dow and S&P especially.

for analysis of the US indices.Please note that the IC website does not alert me when a comment is left. If you want a guaranteed reply to your comment or query, please write to me at dominic.picarda@ft.com