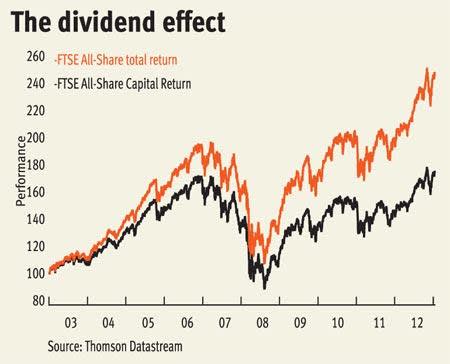

Dividends are the most common tangible reward that investors can expect from holding shares - and, what's more, they make up an incredibly important part of the overall return most people can expect from their equity investments. Over the past 10 years almost half of the total return from the FTSE All-Share has come from the dividends paid by the index's constituents (see graph below). However, this key ingredient of stock performance is often overlooked due to the 'wow' factor associated with the potential for high capital returns from high-risk growth stocks. But steady dividend payers are a tried and tested method and, in the US, there’s even an index known as the S&P Dividend Aristocrats, which attempts to give long-term dividend success stories the billing they deserve. Investors Chronicle is a big fan of that index.

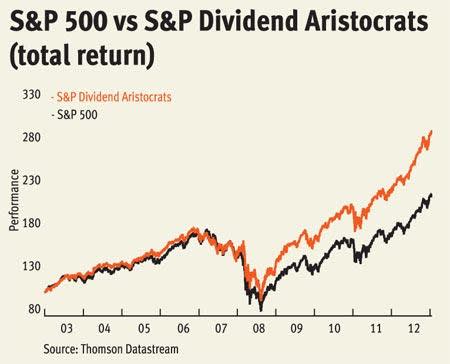

As our graph mapping the total return of the S&P 500 against the Aristocrats (see below) shows, the value of the index is more than just an exercise in promoting America's most reliable dividend payers. Often these stocks substantially outperform the wider market as has been particularly evident during the past five years. The index itself is made up of stocks that have increased their dividends for 25 years on the trot and assigns equal weightings to every share. Mergent, a research house, compiles a similar index tracking dividend 'achievers' that have increased their payouts 10 years in a row.

Why are dividends important?

The role that dividends play in determining overall total return only partly explains why reliable dividends can offer a steer to shares that are likely to outperform in the future. By handing money back to shareholders, companies are effectively reducing the amount they have available to invest in growth, so in one respect they are stymieing themselves in their attempts to produce superior returns. Non-dividend-paying growth stocks on the other hand are, in theory, considered to have such hot prospects that the returns available to the company are likely to be superior to anything shareholders could find to spend the money on.

However, in practice growth stocks often come a cropper. Meanwhile, companies that have paid and raised their dividends year after year have demonstrated the financial strength that is synonymous with a good long-term business.

What's more, the requirement to keep up dividend payments puts pressure on management to make sure the investment opportunities that are chased are sensible ones and that finances are solid enough to make payments. Dividends more often than not are paid as cash and therefore solid cash generation needs to underpin them, which is ultimately the acid test of corporate health.

A management's commitment to dividend payments can also be seen as an indication of its attitude towards shareholders and the importance assigned to shareholder value. After all, when a company hands over capital to its owners it is sacrificing the chance of spending it on corporate glory projects as well as providing tangible thanks for the support and proof of its wellbeing.

There is evidence that the mere fact that a company pays dividends can be an indicator that on aggregate it will outperform over the long term. Fund manager BlackRock released a study at the start of the year, for example, showing that between 2000 and 2012 S&P 500 dividend payers had produced average annualised returns of 7.7 per cent compared with 1.7 per cent from the broader index.

It also found that dividend-payers substantially outperformed during the 2000 to 2002 bear market with an 8.3 per cent return compared with a negative 14.6 per cent, and again during the 2003 to 2006 bull market when payers returned 21.8 per cent compared with 14.7 per cent from the index. From the 2007 bear market to the end of 2012, payers pretty much level pegged with the index returning 2.2 per cent a year compared with 2.3 per cent.

It's not all about track record

Identifying dividend aristocrats is not a panacea on its own, though. Like any single-factor stock-picking method it can produce underperformance as well as outperformance. What's more, track records can easily be broken - there is a long list of examples of once steadfast income stocks disappointing, the banks being a good recent example. And, following 25 years plus of dividend growth, some companies are likely to be well out of their high-growth phase and possibly facing a slowdown in top- or bottom-line growth. Tesco's recent troubles could prove a case in point.

There are a number of other fundamental factors aside from track record that investors can look out for to further assess income stocks' dividend prospects (see box, 'What else to look out for' below). However, we think the long-term track record is nevertheless a very good starting point. What's more, the dividend stocks we have identified as UK Aristocrats offer a number of attractive characteristics compared with the wider market.

MEET THE ARISTOCRATS

Our Aristocrats are FTSE All-Share stocks that have shown dividend growth in each of the past 25 calendar years based on Thomson Datastream data.

Vodafone (VOD) is the highest yielding of the Aristocrats and was also the IC's income tip of the year for 2013. While the dividend cover in our table may look anaemic, this reflects a series of one-off items and underlying EPS came in at 15.7p last year compared with a payout of 10.2p. While trading conditions are tough for the group's core European operations the business generates good cash and remains very profitable, even if those profits are struggling to move upwards. The strategy of broadening Vodafone's offering also holds promise and has been aided by the €7.7bn (£6.65bn) acquisition of Kabel Deutschland. There has also been much excitement about the potential for a bid for Vodafone's 45 per cent stake in Verizon by the US company's parent. Given the strength of trading at Verizon recently a high price tag could be put on the stake.

■ Last IC view: Buy, 180p, 25 June 2013.

High-street baker Greggs (GRG) looks as though it may be in danger of becoming a member of the fallen Aristocracy. With its recent interim results, the group's recently appointed chief executive announced a second profits warning of the year and broker Canaccord Genuity now expects full-year underlying EPS to drop 22 per cent to 30.9p. Worryingly, recent like-for-like sales have also been weak suggesting things could continue getting worse. However, the company is trying to address the problems by increasing its focus on selling 'food-to-go', such as a new pizza range, increasing refurbishments and reducing new openings. While Canaccord forecasts that the full-year dividend will be down by a fifth from 19.5p to 15.4p, the payout is likely to become an increasingly important talisman for shareholders and, were it minded to, the group has the balance sheet strength and cash generation to support the payment even if cover gets thin.

■ Last IC view: Sell, 401p, 6 August 2013.

The profit warning from supermarket giant Tesco (TSCO) last year sent shock waves through the market as investors digested news that such a previously unthinkable event had actually occurred. However, following the reassessment of the group that has followed there are signs that the City is rekindling its fondness for the stock. The shares still represent value compared with those of sector peers, but there are growing hopes that the company can pull off a recovery in the UK while re-focusing investment in the business to produce better returns. And the dividend on offer in the meantime is an attraction in itself. While the payment in the year to the end of February 2013 was frozen, expectations of growth in the current year (broker Investec expects a rise from 14.8p to 15.6p) means Tesco should continue to show ongoing dividend improvements measured on a calendar year basis as we have done with this screen.

■ Last IC view: Hold, 377p, 17 April 2013.

In 2012 a 33-year run of revenue growth came to an end at Domino Printing (DNO). However, the hiatus should prove temporary as improved trading conditions and new product launches have started to help sales move in the right direction again. Reported half-year results were hit by a massive write-down to Domino's investment in a product-traceability joint venture with TEN Media. However, the group performed solidly on an underlying basis. What’s more, following a 5 per cent boost to the half-year payout, the prospects for ongoing dividend growth look intact.

■ Last IC view: Hold, 579p, 25 June 2013.

Despite the UK’s consumer woes, Greene King (GNK) has managed to produce solid growth over recent years. The company has invested in expansion in hotspots such as London as well as increasing its exposure to growth areas such as value-for-money food. The company has also been improving its overall performance and funding expansion by selling off its less desirable tenanted pubs - a part of the market that suffered particularly badly following the credit crunch. There is little reason to think the dividend will not keep rising, although the yield has been pushed down to historically low levels recently as the market warms to the ongoing growth story.

■ Last IC view: Hold, 579p, 27 June 2013.

Given its exposure to the defence sector, Cobham's (COB) prospects have recently taken a hit. However, the canny purchase of commercial aerospace company Thrane & Thrane just over a year ago means the group has been able to mitigate much of the damage from the downturn in the defence sector. This switch in focus means that, following a brief dent in underlying growth, the company should be returning to top-line growth this year and profit growth in 2014 without going through a very deep trough. Brokers expect dividend growth to be maintained throughout this period and, as illustrated by recent share price performance, confidence is growing.

■ Last IC view: Hold, 235p, 7 March 2013.

Halma's (HLMA) long-term track record is built on the long-term growth in its end markets in the fire and safety-equipment sector. Rising regulatory standards are a key driver of growth and, over recent years, this has been particularly evident in demand from emerging markets, such as China. Indeed, over a quarter of the group's business now comes from outside Europe and the US and it is these regions that are the focus of its expansion. The strong structural growth story is, however, reflected in a high rating.

■ Last IC view: Hold, 502p, 14 June 2013.

Pump and valve maker Weir Group (WEIR) had a tough first half in its current financial year due to weak orders from the oil and gas sector, and particularly companies involved in fracking. Demand is now coming back, though, and management continues to predict growth for the year. A recent build-up in orders adds weight to this case. Prospects are also being underpinned by the increased demand for after-market services due to the growth in the company's "installed base". But while the company offers solid growth prospects, the level of the yield is little to write home about.

■ Last IC view: Buy, 2,152p, 30 July 2013.

Serco (SRP) has been under pressure due to government allegations of billing errors. However, whatever comes of this, investors are likely to remain optimistic about dividend growth due to the group's pledge to bring dividend cover down from about four times to closer to 2.5 times over the coming years. This gives an added allure to the company's longer-term dividend growth prospects based on growth in the international outsourcing sector. Serco has recently reported some encouraging order wins, which, along with its track record for making acquisitions, should help underpin the company's prospects.

■ Last IC view: Buy, 620p, 5 March 2013.

The UK's Dividend Aristocrats

| Company | TIDM | Market cap | Price | Fwd PE | Dividend yield | DPS 5-yr CAGR | Dividend cover | Interest Cover | Net Debt | RoE | 3-mth momentum |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Vodafone | LSE:VOD | £97bn | 199p | 13 | 5.10% | 6.30% | 0.1 | 3.5 | -£29bn | 0.90% | 2.90% |

| Greggs | LSE:GRG | £399m | 402p | 12 | 4.60% | 6.90% | 2.1 | - | £12m | 18% | 1% |

| Tesco | LSE:TSCO | £30bn | 371p | 11 | 4.00% | 6.30% | 0.1 | 6.9 | -£7.8bn | 8.00% | 1.00% |

| Domino Printing Sciences | LSE:DNO | £721m | 649p | 17 | 3.20% | 15% | 0.6 | 32 | £14m | 6.40% | -4.10% |

| Greene King | LSE:GNK | £1.9bn | 884p | 14 | 3.00% | - | 1.8 | 2.8 | -£1.7bn | 10% | 20% |

| Cobham | LSE:COB | £3.3bn | 306p | 15 | 2.90% | 14% | 1.9 | 8.4 | -£368m | 17% | 20% |

| Halma | LSE:HLMA | £2.1bn | 559p | 20 | 1.90% | 6.70% | 2.5 | 38 | -£110m | 22% | 9.10% |

| Weir Group | LSE:WEIR | £4.8bn | 2,239p | 14 | 1.70% | 18% | 3.6 | 10 | -£950m | 22% | 1.60% |

| Serco | LSE:SRP | £3.1bn | 636p | 15 | 1.60% | 19% | 5.9 | 6.4 | -£582m | 23% | 1.90% |

| Source: S&P CapitalIQ | |||||||||||