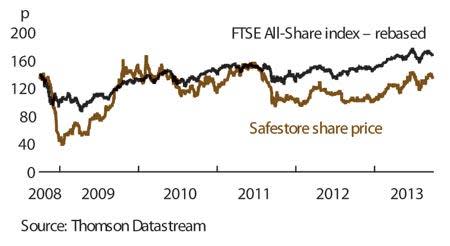

The prospect of a housing recovery has sent most residential property stocks through the roof. But pockets of value remain - notably Safestore (SAFE), Britain's largest self-storage company, which should benefit as more people move home.

- Structural growth potential

- Recovering regional housing market

- Shares trade at discount to peers'

- Attractive dividend yield

- VAT legacy

- High debt

The company is still licking its wounds after Chancellor George Osborne introduced VAT on self-storage services last October. Safestore had to hike prices to customers even as it reduced its margins, leading to falls in both average rates and occupancy. Revenues are expected to fall this year for the first time since its flotation in 2007.

Yet the company only has one more month of pain before the pre-VAT numbers drop out of the annual comparatives, resetting the business for growth. And this is a rare niche of the commercial property industry that still has scope for structural expansion.

Safestore is fond of repeating that Britain contains just half a square foot (sq ft) of self-storage space per person, compared with 1 sq ft in Australia and 7 sq ft in the US. This is particularly surprising given the diminutive size of British homes and the country's fondness for online retail, which often uses self-storage for logistics.

SAFESTORE HOLDINGS (SAFE) | ||||

|---|---|---|---|---|

| ORD PRICE: | 136p | MARKET VALUE: | £255m | |

| TOUCH: | 135-136p | 12M HIGH / LOW: | 145p | 99p |

| DIVIDEND YIELD: | 4.4% | PE RATIO: | 13 | |

| NET ASSET VALUE: | 167p | NET DEBT: | 123% | |

| Year to 31 Oct | Turnover (£m) | Pre-tax profit (£m)* | Earnings per share (p)* | Dividend per share (p) |

|---|---|---|---|---|

| 2010 | 89.2 | 21.8 | 10.3 | 4.95 |

| 2011 | 95.1 | 25.1 | 11.0 | 5.30 |

| 2012 | 98.8 | 29.8 | 10.6 | 5.65 |

| 2013* | 97.0 | 24.4 | 10.1 | 5.70 |

| 2014* | 101 | 26.1 | 10.7 | 6.00 |

| % change | +4 | +7 | +6 | +5 |

Normal market size: 2,000 Matched bargain trading Beta: 0.8 *Investec forecasts, adjusted EPS and PBT figures | ||||

The housing recovery should add a cyclical kicker to that growth, which has been sluggish since the 2009 recession. There were 88,690 housing transactions in July, according to the stamp duty collectors at HMRC - 18.5 per cent more than in July 2012. Management has downplayed the company's links to the property cycle for half a decade, but may choose to reconnect with its boom-era flame in next week's trading update.

Customer growth would have a dramatic impact on Safestore's bottom line. The company only called time on its aggressive store-building programme last year, so capacity has been building even as demand has softened. The result was an occupancy rate of only 63.1 per cent at the end of April, suggesting the company can increase revenues by about a half without meaningfully increasing costs. That bodes well for dividend growth. The company adopted the real-estate investment trust regime in April, which exempts it from income tax on condition it distribute 90 per cent of rental profits.

Debt is an issue. At £386m, Safestore's net borrowings totalled 55 per cent of the value of its property portfolio in April - high by today's standards. Yet the company appears to have decent access to capital markets, having completed a major refinancing in May 2012. The average interest rate was high, at 5.5 per cent, but is easily covered by the 7.9 per cent rental yield at which the properties are held in the books.