Every once in a while, a game-changing technology comes along that has the potential to revolutionise a market along with the fortunes of the company responsible for developing it. That's exactly the opportunity Iofina (IOF) has: a patented, highly profitable technology to extract iodine from waste water associated with shale oil and gasfields in the US.

- Patented, proven technology to produce iodine

- Rolling out low-cost production plants

- Strong cash flow profile

- Blue-sky upside

- Teething problems at first two plants

- Speed of plant roll-out uncertain

Iodine has a vast range of uses, ranging from speciality electronics to animal health products and disinfectants, but is conventionally expensive to produce. It currently sells for around $50 a kilogramme, yet Iofina's IOsorb plants can produce it for as little as $10-$20 a kilogramme - about half the cost incurred by competitors mining iodine in Chile.

The company has built two plants so far. It has one small trial plant in Texas and a larger, commercial-grade plant in Oklahoma that was commissioned in January 2013. Between them, Iofina made impressive gross profits of $2.5m (£1.6m) in the six months to 30 June 2013 on record revenues of $11.6m. But most importantly Iofina proved that its technology really works.

Granted, both plants experienced some initial teething problems. Iofina could not find a reliable enough supply of waste water at the first plant and water had to be trucked in. The second plant is faring much better, though, as it receives waste water directly via pipeline from oil-producing wells owned by a single supplier. This gives greater certainty of supply as well as higher water temperatures, which increase plant efficiency. This will be the model going forward. Unfortunately, a "highly improbable" event occurred in June whereby produced oil was not separated from the waste water. This temporarily hindered the plant's operations, but Iofina's equipment is now back to normal. On the positive side, this demonstrated that the plant is robust enough to withstand a large shock of oil.

With new design improvements incorporated, Iofina plans to rapidly ramp up development and roll out dozens of plants across the US. A third plant is on track to be completed by the end of September 2013 and three more are under construction and are expected to be installed by the year-end. A further six plants are expected in 2014. Analysts from Investec estimate each plant adds $20m (10p per share) of value versus a capital cost of just $2-3m.

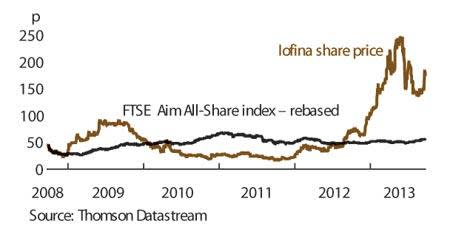

IOFINA (IOF) | ||||

|---|---|---|---|---|

| ORD PRICE: | 177p | MARKET VALUE: | £225m | |

| TOUCH: | 176-177p | 12-MONTH HIGH/LOW: | 252p | 59p |

| FWD DIVIDEND YIELD: | NIL | FWD PE RATIO: | 12 | |

| NET ASSET VALUE: | 25¢* | NET CASH: | $1.76m | |

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2010 | 8.85 | -3.3 | -3.2 | nil |

| - | Turnover ($m) | Pre-tax profit ($m)** | Earnings per share (¢)** | Dividend per share (p) |

| 2011 | 16.1 | -2.8 | -2.4 | nil |

| 2012 | 18.6 | -1.2 | -0.9 | nil |

| 2013** | 30.9 | 0.9 | 0.7 | nil |

| 2014** | 77.5 | 29.5 | 23.2 | nil |

| % change | +151 | +3178 | +3214 | - |

Normal market size: 2,000 Matched bargain trading Beta: 1.87 *Includes intangible assets of $8.9m, or 7¢ a share **Investec adjusted forecasts, underlying PTP and EPS figures £ = $1.61 | ||||

Encouragingly, Iofina should soon be able to fund the roll-out from cash flow. But to kick-start the operation, the company raised $15m in a convertible bond issue in May. This has placed Iofina on a much stronger financial footing, with $16.2m in ready cash as at 30 June.

Investec's analysts estimate the current value of Iofina's chemical assets and expansion plans to 2016 at 227p a share, based on a conservative four plants installed each year rather than six, plus a further two plants per year beyond 2016. However, if management delivers on its stated expansion targets then this 408p a share looks a fair price, according to Investec.

The estimate doesn't include any potential upside from Iofina's non-core assets, either, including the Atlantis water project in Montana or Iofina's deep-shale exploration rights. The water project could be particularly lucrative. Iofina plans to sell water to oil and gas companies that need it for drilling activities, and the project is at an advanced stage of the permitting process.