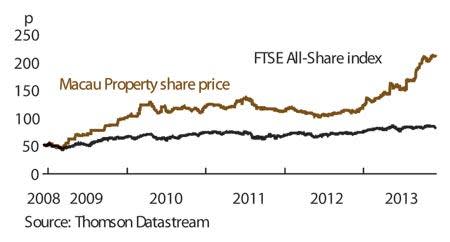

We first recommended Macau Property Opportunities (MPO) to readers some 20 months ago (Buy, 110p, 26 Apr 2012), since when the shares have almost doubled. Astonishingly, however, the Far Eastern developer has grown so fast that even at 212p the shares remain clearly undervalued. At the end of September, the company's book value stood at 413¢ or 251p per share.

- 20 per cent discount to historic book value

- Exceptionally strong market

- One-off dividend expected this year

- Strong track record

- Cooling measures introduced by Macau's government

- No regular dividends

The company has grown thanks partly to strong portfolio revaluations, partly to share buy-backs. By far the fund's largest asset is The Waterside, a block of luxury rental flats for expat executives launched in 2010. Macau Property has been aggressively increasing rents to maximise the asset valuation. Over the 12 months to 30 June the average rent per square foot rose by 9 per cent, even as occupancy leapt from 75 per cent to 94 per cent (though it has since fallen back to 88 per cent). The portfolio valuation, which is conducted by the local branch of brokerage Savills, consequently rose 23 per cent to $221m.

And that was one of the more modest revaluation figures in Macau's annual results. Another residential project, The Fountainside, was marked up 54 per cent thanks to progress on development and pre-sales. The Green House, an unusual detached home the company bought in 2007, rose 32 per cent to $16m even though Macau Property did nothing to it. Even Senado Square, a retail redevelopment project that has been held up by planning, increased 16 per cent.

The sheer strength of such numbers inevitably calls into question their sustainability. The Macau property market has been roaring since 2010, despite various attempts by the government to cool it. The latest measures, introduced in July, include compulsory licensing of estate agents and a new checklist of requirements for off-plan sales. The latter has delayed Macau Property's exit strategy for The Fountainside - though the developer still expects to obtain the permit necessary to sell the remaining 20 flats by the end of the year.

MACAU PROPERTY OPPORTUNITIES (MPO) | ||||

|---|---|---|---|---|

| ORD PRICE: | 212p | MARKET VALUE: | £188m | |

| TOUCH: | 210-213p | 12-MONTH HIGH / LOW: | 215p | 110p |

| FWD DIVIDEND YIELD: | NIL | TRADING PROP: | $64.8m | |

| DISCOUNT TO FWD NAV: | 25% | |||

| INVESTMENT PROP: | $266m | NET DEBT: | 36% | |

| Year to 30 Jun | Net asset value (¢) | Pre-tax profit ($m) | Earnings per share (¢) | Dividend per share (p) |

|---|---|---|---|---|

| 2011 | 272 | 36.5 | 34.8 | nil |

| 2012 | 301 | 6.03 | 5.9 | nil |

| 2013 | 395 | 34.2 | 35.6 | nil |

| 2014* | 444 | 56.6 | 64.2 | 13.0 |

| 2015* | 460 | 65.0 | 73.4 | nil |

| % change | 4% | 15% | 14% | - |

NMS: 2,000 Matched bargain trading BETA: 0.1 *Liberum forecasts £=$1.63 | ||||

But - as the inefficacy of previous cooling measures shows - it is impossible for the government to address the underlying problem: rapid growth on an island market where supply is radically constrained by geography. In the first half of 2013, Macau's economy grew by 11 per cent year on year to $10.6bn. Revenues in the gaming sector - the backbone of this economy - were up nearly 17 per cent. Retail sales rose 20 per cent by value. The government reckons the island's population will have to expand by 20 per cent over the coming three years to support this economic growth.

Crucially, however, investors don't even need to believe in this admittedly distant growth story to find Macau Property’s stock attractive. The valuation case alone is compelling enough. In August Macau Property agreed to sell its two assets in Zhuhai, just across from Macau on mainland China, for $64m - a 42 per cent premium to their latest book value. When this deal completes early next year, it will crystallise a one-off gain of 13p, which broker Liberum Capital expects to be distributed as a dividend, which would be equivalent to a yield of over 6 per cent.