Source: Paul Marsh and Scott Evans; London Business School’s London Share Price Database

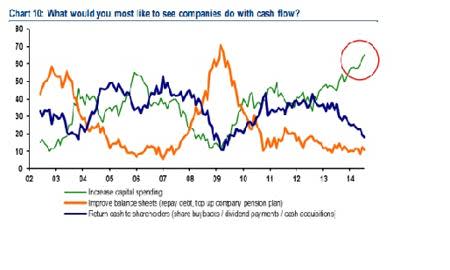

Splash the cash!

After a lengthy period of encouraging companies to repair their balance sheets and return excess funds to investors it appears as though fund managers are now increasingly keen to see companies begin to ramp up their capital expenditure. More than half of the fund managers surveyed by Bank of America Merill Lynch expressed their preference for more capital spending by the companies in which they were invested, with the pressure growing according to this chart.

Source: Bank of America Merrill Lynch

Upwards Inflation

According to the same Bank of America Merrill Lynch survey institutional investors are increasingly forecasting a build up of inflationary pressure in the global economy over the coming years with inflation outlook expectations now reaching their highest level for almost three years.

Source: Bank of America Merrill Lynch

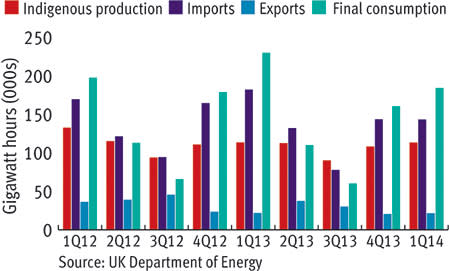

Its a gas

UK natural gas production has struggled to match output from the first quarter of 2012. During that year the number of UK oil and gas fields starting production hit its highest level in five years. Yet the following year experienced a 10 per cent drop in total production. This was largely attributable to maintenance work – in some cases unplanned – that was carried out on ageing infrastructure. Unfortunately, with a recent onus on capital projects, insufficient operating expenditure has been allocated to the performance of existing assets. The old infrastructure is beginning to squeak.

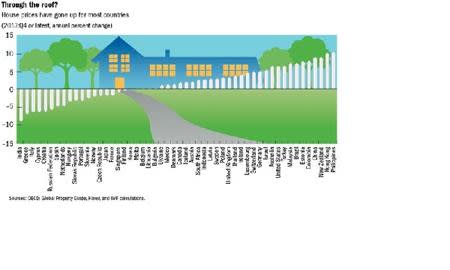

Pressure building

We think we might have runaway house price inflation in the UK, but this neat graphic shows just how many countries world wide are seeing higher house price growth than we are. Whether it signals an impending global problem or not is difficult to say, but its a great graphic.

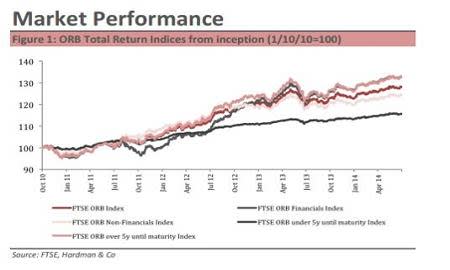

Glowing Orb

The latest quarterly review of performance of retail bonds traded on London Stock Exchange's Orb market shows continued solid, if rather unspectacular performance. Over the second quarter the FTSE ORB index rose by 2.2 per cent, with most of the performance recorded in April and May with rising interest rate expectations keeping a lid on things in June. Over the past three years the FTSE ORB index has returned 27.3 per cent.