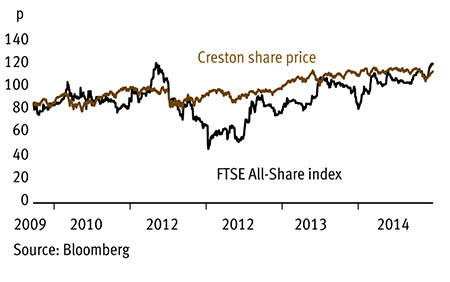

Investors in search of a bargain should consider Creston (CRE). After two years of listless growth, the communications and marketing group has appointed new management, refreshed its strategy and looks set to deliver. Moreover, its shares do not currently seem to be pricing in improving prospects. We think any evidence of progress in the company's upcoming results later this month could provide a real boost to the shares.

- New management and strategy

- Net cash

- Shares are cheaply rated

- Exposed to high-growth markets

- Tepid top-line growth

- Volatile advertising revenues

Creston's new chief executive and finance director plan to unite its pack of media agencies under a single brand, 'Unlimited'. The idea is to coax the group's communications, health and insight segments into sharing and referring clients, driving organic growth and lowering costs. True, former chief executive Don Elgie trumpeted a similar strategy back in 2012. But there's definite scope for improvement - only six of the group's 50 largest clients use services from all three divisions.

Creston is in a good position to pursue growth as it has a lot of exposure to the fast-expanding digital-marketing industry, as well as the enormous US healthcare market. The group's digital and online sales rose 10 per cent last year and account for more than two-thirds of its communication revenues and over half of total sales. Geographically, Creston may prove well positioned too. While it aims to earn about half of its revenues overseas over the next five years, for now two-thirds of its revenues come from the UK, which should make it a beneficiary of economic recovery. The company can also boast an impressive customer base that spans from food retailers to automotive manufacturers, and includes Unilever and Diageo.

Furthermore, its solid net cash position should support investment in growth opportunities and acquisitions. Creston is already using acquisitions to broaden its business to include new services such as technology consulting. It recently acquired Walnut, a neuroscience consultancy, and Liberation, a healthcare communications agency. It is also expanding internationally through partnerships and acquisitions - it acquired digital healthcare agency DJM two years ago, and launched it in the US in September.

There is work to be done for Creston to realise its potential. Underlying profits fell last year, but importantly they rose in the second half of the year, reflecting £8.6m in new business with HSBC, Novartis and others. And first-quarter revenues climbed 3 per cent thanks to further client wins and international work. So things seem to be heading in the right direction, with broker Liberum forecasting an 8 per cent increase in EPS this year to 12.8p, followed by 6 per cent growth in the year to March 2016.

| CRESTON (CRE) | ||||

|---|---|---|---|---|

| ORD PRICE: | 121p | MARKET VALUE: | £ 71m | |

| TOUCH: | 120-122p | 12-MONTH HIGH: | 121p | LOW: 78p |

| FWD DIVIDEND YIELD: | 3.6% | FWD PE RATIO: | 9 | |

| NET ASSET VALUE: | 191p* | NET CASH: | £7.5m | |

| Year to 31 Mar | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 74.9 | 10.3 | 12.3 | 3.5 |

| 2013 | 75.1 | 10.0 | 14.7 | 3.7 |

| 2014 | 74.9 | 9.6 | 11.8 | 3.9 |

| 2015** | 77.9 | 9.8 | 12.8 | 4.1 |

| 2016** | 81.1 | 10.3 | 13.6 | 4.3 |

| % change | +4 | +5 | +6 | +5 |

Normal market sizr: 3,000 Matched bargain trading Beta: 0.60 *Includes intangible assets of £105m, or 179p a share **Liberum forecasts, adjusted PTP and EPS figures | ||||