Individual savings accounts (Isas) just get better and better! The latest announcement in the Autumn Statement that the taxation benefits of an Isa can be effectively passed to a surviving spouse adds yet one more benefit to this extremely attractive investment/savings wrapper. To have the opportunity to invest up to £15,000 per annum – and rising – free of income tax and capital gains tax, and – if qualifying Alternative Investment Market (Aim) shares are chosen – free also of inheritance tax, provided they are held for two years, must represent one of the most attractive offerings available to an investor in the western world.

My love affair with Isas – originally called personal equity plans or Peps (to all intents and purposes the same thing) - started in 1987 when they were first introduced by Nigel Lawson. From memory up to £3,000 per annum could be invested then. In those days there were relatively few plan managers, and it took me some time to find one who would allow me to “self-select” stocks which I wished to invest in rather than having to choose from a limited list of shares deemed suitable by such managers. I remember selecting Pifco – the Manchester-based manufacturer/distributor of small electrical appliances – Russell Hobbs being one of their brands; it had the characteristics which I still ideally look for today – substantial family shareholding, significant cash resources, valuable market position, and growing profits and dividends – in sum a very solid, conservative, carefully “stewarded” business. Subsequently Pifco was taken over by Salton of the US at a very nice profit for me.

For the next 16 years I invested the maximum possible allowances: a total of £126,200, reinvesting all dividends, and thus by 2003 had created a Pep/Isa worth £1m. I subsequently modestly invested more but then ceased as the Isa’s value appreciated further. For all that time Aim shares were ineligible for Pep/Isas thus Christie Group – now one of my largest holdings – had to be “bought out“ from my Isa when it moved from the main market to Aim, only for it to go back into my Isa in 2013 when Aim shares became eligible.

FIVE TIPS FOR ISA INVESTORS

My longstanding advice to existing and future Isa investors remains:

1. Buy into “proper” businesses which you understand, and are prepared to hold for many years – established companies trading profitably, paying dividends, and are cash positive or with a very low level of debt.

2. Adopt a conservative approach - no speculative exploration or biotech investments (an ISA is not your own mini-casino) – and focus on avoiding losses.

3. Try to invest a certain amount each year, even if you haven’t the funds available to commit the maximum allowance.

4. Reinvest all dividends if possible and try to avoid withdrawals from your ISA – once done you can’t put the monies back.

5. The funds you build up in your Isa represent a very valuable “tax free” pot, thus try to avoid Isa plan managers debiting their annual charges to your Isa – try to get them to invoice you separately outside your Isa.

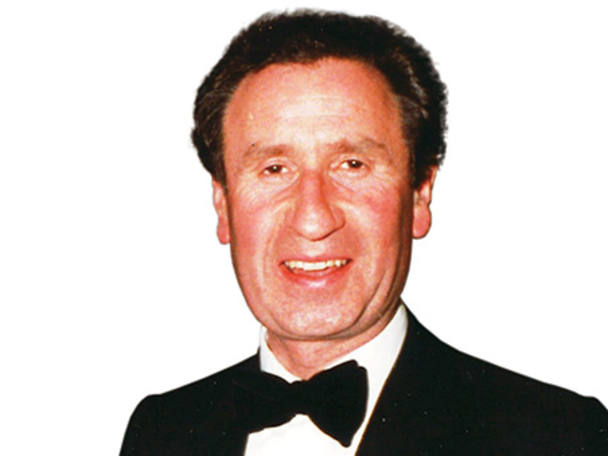

• How to make a million - Slowly: My Guiding Principles from a Lifetime of Successful Investing by John Lee (FT Publishing) is available from Amazon priced £14.39.

Click here for more Isa investment ideas, including funds, investment trusts, shares and passives.

Not a subscriber? Click here to view all of our subscription packages.