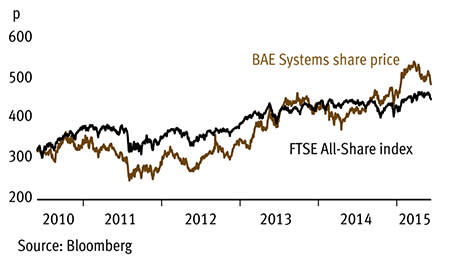

BAE Systems' (BA.) niche growth businesses and budding relations with war-torn emerging economies have not been enough to offset the damaging impact of austerity programmes in the US and Europe. But recent events suggest that its core customers could be ready to unleash the shackles on defence budgets again, which is great news for a company that already boasts a £40.5bn order book that gives it multi-year revenue visibility. Yet trading at just 13 times consensus earnings forecasts for the next-12-months, the shares are priced a fifth below those of its international peers. Add in a yield of over 4 per cent, and that looks too cheap.

- Defence spending cuts bottoming out

- Tory win good for Trident

- Building exposure to growth markets

- Decent dividend yield

- Shares trade at discount to peers

- Big pension deficit

- Slowdown in Eurofighter production could affect sentiment

Early this year, news spread of President Obama's proposal to increase defence procurement and development spending by 13 per cent next year. This came as a marked relief for BAE, as the US Department of Defence accounts for about a quarter of its revenues. Yet the share-price response has been muted. Admittedly, the spending ambitions may not be fully realised, but what it does show is a growing appetite to finally increase defence spending. Broker Espirito Santo reckons the final increase is likely to come in at about 4 per cent, which would provide a nice boost to revenues and earnings.

Elsewhere, the UK general election result arguably presented the best outcome for defence companies. BAE generates about 25 per cent of revenues from the Ministry of Defence, where brutal spending cuts have crippled sentiment. Though UK defence budgets aren't ring-fenced, and could potentially fall below the 2 per cent of GDP requested by Nato, a Tory win should yield a new fleet of four Trident submarines. This should improve sentiment towards the shares, although, concern remains about the impact on exporters of a referendum on the UK EU membership.

BAE certainly looks like it should be operating from a more stable base in its core markets in coming years, which should allow investor focus to switch towards its success at building exposure to exciting growth areas.

Importantly, there's growth coming from other quarters. While spending on war has plummeted since troops were pulled out of Afghanistan, cyber security has blossomed into a top global priority. A recent government-commissioned report by consultancy firm PwC found that the average cost of cyber attacks for companies employing more than 500 people soared from £600,000 to £1.46m this year.

The good thing about this market is that cash-rich corporate giants are willing to pay up to protect themselves from being compromised by hackers. That reduces BAE's reliance on government budgets and is already yielding decent results - last year the group's Applied Intelligence business grew its order backlog by 37 per cent. Soaring demand explains why BAE splashed out $232m (£149m) on commercial cyber service provider SilverSky, in an acquisition that immediately bolstered access to the lucrative US e-security market. Deals like this, and a recent announcement that BAE will move into the cloud security space, should please shareholders.

Equally encouraging is order growth from overseas defence markets. For example, rising tensions in Saudi Arabia, which is the source of about a fifth of group revenues, and big demand for naval products in Australia meant orders from outside the US and UK amounted to £4.3bn last year. Sceptics are concerned, however, that the Middle East may spend less due to oil-price weakness. That could be bad for the Eurofighter Typhoon programme that BAE has a 33 per cent stake in, although the rising presence of terrorist groups means orders are expected to keep flooding in regardless.

Meanwhile, BAE's yield is covered 1.9 times by earnings, which while in line with the current payout policy of keeping cover at about 2 times, leaves scope for further hikes even if pressures from austerity and sequestration do not alleviate as quickly as hoped. A £5.4bn pension deficit shouldn't derail this either - management has pledged to maintain the dividend and continue buying back shares as part of its ongoing £1bn buyback programme.

| BAE SYSTEMS (BA.) | ||||

|---|---|---|---|---|

| ORD PRICE: | 492p | MARKET VALUE: | £15.6bn | |

| TOUCH: | 491-492p | 12-MONTH HIGH: | 549p | LOW: 410p |

| FORWARD DIVIDEND YIELD: | 4.5% | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 58p* | NET DEBT: | 55% | |

| Year to 31 Dec | Turnover (£bn) | Pre-tax profit (£bn)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 17.8 | 1.68 | 38.6 | 19.5 |

| 2013 | 18.2 | 1.74 | 41.8 | 20.0 |

| 2014 | 16.6 | 1.49 | 37.9 | 20.5 |

| 2015** | 17.2 | 1.53 | 39.7 | 21.0 |

| 2016** | 17.6 | 1.64 | 42.5 | 22.0 |

| % change | +2 | +7 | +7 | +5 |

Normal market size: 3,000 Matched bargain trading Beta: 0.91 *Includes intangible assets of £10bn, or 315p a share **Espirito Santo forecasts, adjusted PTP and EPS figures | ||||