Factor investing (the attempt to outperform the market benchmark by giving portfolios a strategic tilt towards well-attested return factors) is a hot topic for institutional investors, and our recent screen for UK companies that exhibit tilts towards value or momentum is trialling a system that might prove workable for private investors. Our methodology requires a period of observation before deciding on appropriate rebalancing and profit-taking rules, but there are other factor-investing strategies, with simulated back-testing going back many years, that are accessible using exchange traded funds (ETFs).

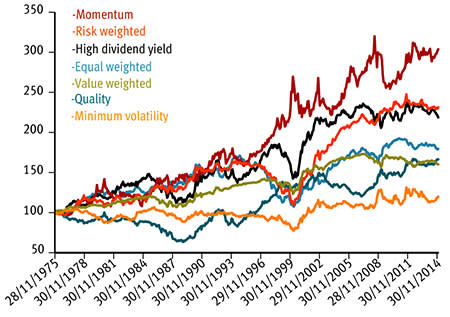

Global index company MSCI has identified six key factors (minimum volatility, value, quality, high dividend, momentum and low size) that, as the graph shows, would all have outperformed their parent index, the MSCI World, over time. Theoretical reasons for the six factors are detailed in the table below, with two broad schools of thought to explain each premium. The first, in keeping with the efficient market hypothesis (EMH), is that factor returns are the trade-off for specific risks that cannot be diversified away. For example, it has been argued that small-cap premiums are compensation for less liquidity (Liu, 2006) or less transparency (Zhang, 2006) and there are theories that other risk factors are rational compensation for macroeconomic sensitivity (Winkelmann et al, 2013). The alternative school of thought, which poses a challenge to the efficient markets hypothesis, is that risk premiums exist due to behavioural tendencies. For example, Jegadeesh and Titman explain momentum in terms of investors underreacting to good news about companies, so that share prices continue to rise as the market belatedly catches on to a positive story.

Risk premium factors

| Factor | What is it? | Captured by? | Systematic risk theories | Systematic error theories |

|---|---|---|---|---|

| Value | Low prices relative to fundamental value | Price to book, earnings to price, book value, sales, earnings, cash earnings, net profit, dividends, cash flow | Higher systematic (business cycle) risk | Errors in expectations Loss aversion Investment-flows-based theory |

| Low size (small-cap) | Captures the excess returns of lower market-cap shares | Market capitalisation (full or free float) | Higher systematic (business cycle) risk Proxy for other types of systematic risk | Errors in expectations |

| Momentum | Reflects excess returns to stocks with stronger past performance | Relative returns (3 mth, 6 mth and 12 mth) historical alpha | Higher systematic (business cycle) risk Higher systematic tail risk | Underreaction and overreaction Investment-flows-based theory |

| Low volatility | Captures excess returns to stocks with lower than average volatility, beta and/or idiosyncratic risk | Standard deviation (1-yr, 2-yrs, 3-yrs), downside standard deviation, standard deviation of idiosyncratic returns, beta | - | Lottery effect Overconfidence effect Leverage aversion |

| Dividend yield | Captures excess returns to stocks with higher than average dividend yields | Dividend Yield | Higher systematic (business cycle) risk | Errors in expectations |

| Quality | Captures excess returns to stocks characterised by low debt, stable earnings growth and other "quality" metrics | ROE, earnings stability, dividend growth stability, strength of balance sheet, financial leverage, accounting policies, strength of management, accruals, cash flows | - | Errors in expectations |

Combining factor strategies

Using its granular global securities data, augmented with the data from Barra (the US research company acquired in 2004), MSCI has simulated 40 years of back-testing for its suite of factor indices. In spite of superior performance overall, there are also spells of serious drawdown (peak-to-trough losses) for some factors, so chasing return premiums needs to be considered in the broader context of a balanced investing strategy. Previous studies, such as Markowitz et al. (2013) showing negative correlation between value and momentum, are the basis for the First Trust Global Portfolios methodology that inspired our under-trial UK stockpicking system. Looking at the back-tested MSCI indices, the cyclical performances also suggest that other combinations of factors can achieve higher returns with lower levels of volatility.

MSCI Factor indices' performance relative to the MSCI World index

MSCI has carried out analysis on defensive, balanced and dynamic strategies; the results of simulations between May 1988 and September 2015 are shown in the accompanying table and chart, along with a 50:50 value and momentum system that we have added. The back-test results are based on equal-weighted combinations of the listed MSCI indices for each strategy. Historically, there would have been little point trying to invest in this way due to high turnover costs, some liquidity issues and the risks of trying to time periods when each factor would outperform. The advent of low-cost ETFs however, does make it possible to diversify around factors.

Factor investing is still in its infancy and there are a limited number of ETFs on the market that offer investors these specific exposures. The iShares products that track the MSCI indices are listed in the table below and there are also factor products available from Lyxor, UBS and Ossiam. None of the products, including those referenced here, have a particularly long track record and all have yet to be tested in periods of severe market stress. There is always the concern, as strategies become more complex, that liquidity (the ease with which providers can trade stocks in the index) may become an issue in tougher times.

Does factor investing replace market cap investing?

For investors who want to take a truly passive approach to capturing the overall market risk premium, investing to a market-cap-weighted index provides structurally low turnover, very high trading liquidity and large investment capacity. By contrast, there is an element of active portfolio management implied in targeting factor tilts, as investors must make a decision on which return factors they believe are going to cyclically outperform. This naturally implies the uncertainty of getting timing right, although as we have seen, investing in a multi-factor strategy can diversify this timing risk and achieve superior returns. There are two main reasons not to exclusively adopt the passive multi-factor approach, however. Firstly, while ETFs are an outstanding addition to investors' armouries, there may be underlying liquidity risks for products attempting to replicate certain factor performance. Secondly, the performance of individual factors might weaken; or it is possible that the negative correlations between factors (that are relied on for diversification benefits) could break down at points in the future.

Where does factor investing fit in an ideal portfolio?

True portfolio diversification entails investing across different asset classes and not just shares. This fundamental point made, within the equities portion of an asset allocation, strategic factor tilts offer additional returns. If a passive approach is being taken, it is prudent to combine products that track factor indices with those that follow a market capitalisation whole-of-market index, for the reasons discussed.

Active investors may be prepared to take on greater risk investing away from a suitable benchmark market capitalisation weighted index. To this end, the relative performance of shares with quality or value tilts offer intriguing possibilities. Quality tilts, such as return on equity, stable earnings and dividend growth are all signs that a share is worth holding on to for the long term. Applying quality screening criteria alongside value metrics, and if sector diversification is also taken into account, can establish a core of direct share holdings. It must be noted that choosing individual shares via a stock screen is not quite the same as investing in a value or quality tilted index. Although the MSCI value and quality indices have delivered higher returns with lower volatility than the MSCI World, investors should not assume that their own stock picks based on a screen will do the same. As with any, more concentrated, active strategy there is a degree of added risk investing away from the benchmark, which is the trade-off for potentially higher rewards. With this disclaimer made, combining a core of quality and larger value shares, with ETFs that focus on other return factors in either the defensive, balanced or dynamic systems discussed, could help a diversified multi-asset portfolio deliver alpha over time.

ETFs targeting MSCI indices with return factor tilts

| Factor | Regional Exposure | Product | Ticker | Exchange |

|---|---|---|---|---|

Minimum Volatility | World | iShares MSCI World Min Vol. UCITS ETF | MVOL | London |

| Value | World | iShares MSCI World Value UCITS ETF | IWVAL | London |

| Momentum | World | iShares MSCI World Momentum UCITS ETF | IWMO | London |

| Quality | World | iShares MSCI World Quality UCITs ETF | IWQU | London |