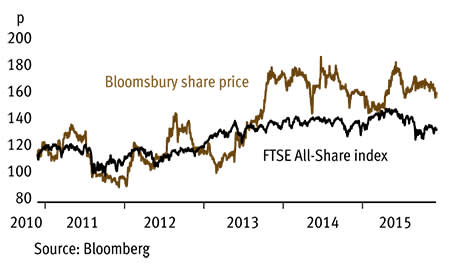

Harry Potter publisher Bloomsbury Publishing (BMY) has been supplementing strong growth in its key children's and educational, and academic and professional divisions with acquisitions and digital investments, and now looks set to benefit from an unexpected recovery in the printed-book market. We feel this attractive business mix is being undervalued by shares priced at 11 times forecast earnings and promising a yield of over 4 per cent.

- Digital offerings are gaining traction

- Shares are cheaply rated

- Forecast yield of over 4 per cent

- Phenomenal Harry Potter franchise

- Modest growth forecasts

- Mixed first-half performance

Bloomsbury has successfully offset tepid trading in the printed-book market by investing in digital offerings and focusing on more reliable markets in children's books, as well as academic, professional and specialist content. Growth has been augmented by acquisitions, such as last December's purchase of Osprey, a military and national history publisher.

Moreover, the group is currently in its second half, when it typically benefits from Christmas gift-giving and the start of the academic year. This period could provide positive surprises based on a strong release slate that includes a biography of spy novelist John Le Carre, cookery books from top chefs and Sunday Times bestsellers Sweet Caress and Silk Roads. It recently launched the first of its illustrated Harry Potter books and has licensed the rights to the images to 27 foreign-language publishers. The upcoming spin-off film trilogy - Fantastic Beasts and Where to Find Them - and a West End play also promise to fuel demand. Further grounds for optimism come from recent sales figures for printed books that suggest this market, which has long been losing out to ebooks, is actually staging a comeback.

The group posted impressive first-half gains from its key children's and educational division thanks to strong sales of young-adult bestseller Paper Towns and Harry Potter boxsets, along with a 57 per cent rise in digital revenues. Overall sales rose 45 per cent to £16.3m (31 per cent of the group total) and operating profits were up from £1m to £1.6m.

Similarly, academic and professional digital sales increased by 21 per cent, helping increase revenues by 3 per cent to £14.4m and double adjusted operating profit to £0.4m. The division also expanded its Drama Online platform, which allows universities and other institutions to subscribe for access to hundreds of audio plays and play texts, as well as Shakespeare productions filmed live at the Globe Theatre.

Bloomsbury's recent progress underpins solid growth forecasts (see table). Yet its shares trade at just 11 times expected earnings for the year to February 2017, and there's a forecast yield of 4.1 per cent, too. One reason for the low valuation may be that investors are concerned by the 11 per cent decline in first-half organic sales in the group's adult division. But that largely reflected the timing of cookery book releases and a tough comparative period. What's more, a potential revival in the printed-book market is very welcome. Similarly, Bloomsbury's information business suffered due to the timing of contracts. But several recent deals - including one to provide online business and financial content for US publisher Stephens - suggest a recovery could be on the horizon.

| BLOOMSBURY PUBLISHING | ||||

|---|---|---|---|---|

| ORD PRICE: | 158p | MARKET VALUE: | £119m | |

| TOUCH: | 157-162p | 12M HIGH / LOW: | 185p | 141p |

| FORWARD DIVIDEND YIELD: | 4.1% | FORWARD PE RATIO: | 11 | |

| NET ASSET VALUE: | 166p* | NET CASH: | £0.9m | |

| Year to 28 Feb | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2013 | 99 | 12.5 | 13.1 | 5.50 |

| 2014 | 110 | 12.0 | 12.9 | 5.82 |

| 2015 | 111 | 12.1 | 14.7 | 6.05 |

| 2016** | 120 | 12.9 | 14.0 | 6.29 |

| 2017** | 124 | 13.9 | 15.0 | 6.55 |

| % change | +3 | +8 | +7 | +4 |

Normal market size: 2,000 Matched bargain trading Beta: 0.07 *Includes intangible assets of £63.7m, or 85p a share **Numis forecasts, adjusted PTP and EPS figures | ||||