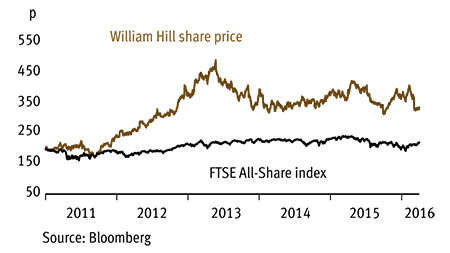

The recent merger and acquisition race among bookies searching for ways to better cope with increased betting taxes has left some lagging behind. One such laggard is William Hill (WMH), which has played the role of tortoise rather than hare in this tale. But we're inclined to think the moral of the Aesop fable will come true for the gambling group, which has been laying the foundations for improved performance in the coming years.

- Cheap compared with history and peers

- Football tournament boost

- Improving trends in Australia

- Growth investments being made

- Big competitors following M&A flurry

- Rise in gamblers self-excluding

True, Hill has endure a tough run of late, in part caused by poor results at Cheltenham and in European football. Still, the group's most recent results show that without the point of consumption (PoC) tax, introduced in December 2014, its online business's operating profit would have risen 9 per cent instead of the near-30 per cent decline caused by the £66.4m extra levy. Likewise, profit from the retail estate would have been off just 1 per cent - not bad in a year without a major football tournament - had it not faced an extra £19.1m in machine gaming duty, which rose from 20 per cent to 25 per cent. These underlying figures suggest there's a robust business behind the reported 17 per cent drop in 2015 earnings and in the next few years there is the potential for Hill to move up the pack, which would provide grounds for its cheap shares to re-rate.

There are a number of reasons to be positive about the future despite recent grim trading. Hill's retail business, which accounts for 56 per cent of sales, has developed a proprietary self-service betting terminal (SSBT) system which will effectively bring the online experience into its shops. This is increasingly important as customers want to be able to access their online accounts inside betting shops and also bet on multiple sporting events quickly. The aim is to have 500 such terminals in its shops for the Euro 2016 football tournament this summer, something that should improve its appeal and thus revenues.

Within the online business, which accounts for 35 per cent of turnover, its Project Trafalgar has meant the launch of a new app and, more importantly, the construction of a technology platform that means it is now in control of the 'front-end' of its website, which its customers get information from and place bets through. Management says this will allow it to innovate faster and deliver a more personalised customer service. The technology will also be behind the retail estate's SSBTs. What's more, Hill's recent investment in NYX, a digital gaming content and technology supplier, should help the group redevelop the back end of its system over coming years, too, which should help it further enhance its online offering.

That said, the online business does face a new hurdle. The Gambling Commission in October dictated all gambling companies allow web-based gamblers to 'time out' - effectively bar themselves from betting for a specified time - under its licensing conditions and codes of practice. Management acknowledged in February that it was seeing an impact and since then has issued a profit warning saying lower revenue would reduce the online division's profit by £20m-£25m this financial year.

Elsewhere, there are some promising trends in Hill's Australian business, which is only 6 per cent of turnover but could grow quickly. The group has been building its presence in the country and moved Sportingbet and tomwaterhouse.com under its brand in the past year. It was also the first group to launch in-play betting in Australia and its app, launched in September, is one of the highest rated betting apps in the App Store.

| WILLIAM HILL (WMH) | ||||

|---|---|---|---|---|

| ORD PRICE: | 329p | MARKET VALUE: | £2.89bn | |

| TOUCH: | 328.8-329p | 12-MONTH HIGH: | 432p | LOW: 312p |

| FORWARD DIVIDEND YIELD: | 4.3% | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 138p* | NET DEBT: | 40% | |

| Year to 30 Dec | Turnover (£bn) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2013 | 1.48 | 290.4 | 28.3 | 11.6 |

| 2014 | 1.61 | 326.3 | 29.9 | 12.2 |

| 2015 | 1.59 | 251.8 | 24.8 | 12.5 |

| 2016* | 1.59 | 221.7 | 20.9 | 10.5 |

| 2017* | 1.73 | 301.4 | 28.4 | 14.3 |

| % change | +9 | +36 | +36 | +36 |

Normal market size: 5,000 Matched bargain trading Beta: 0.76 *Includes intangible assets of £1.73bn, or 197p a share **Peel Hunt forecasts | ||||