The country's stockmarket is heavily populated with commodity stocks as well as financial businesses which makes performing in these markets hard but data from The Share Centre shows just how much of a tough ride it has been of late.

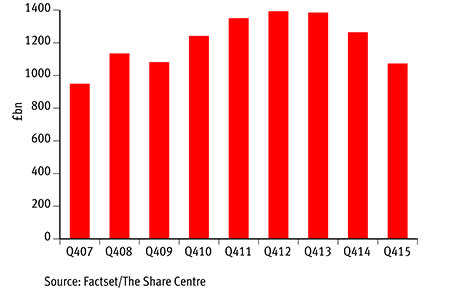

The company's Profit Watch UK data set showed revenues for the UK's 350 largest listed companies dropped 15.1 per cent (see chart below) among those which reported between January and March.

This is equal to a hefty £191bn and means the aggregate £1.07tn reading is the lowest since 2007.

Potentially worse still is the fact the £1.64tn in revenues reported for the whole of last year was 10.5 per cent lower year-on-year - the third consecutive year sales have fallen.

Mining, oil and banking saw some £202bn wiped off salles in the latest reporting quarter, which masks a 2.5 per cent sales rise for companies outside these areas. Building materials businesses and construction companies were those doing well, as were the majority of retailers outside the supermarkets. Media and support services also traded strongly.

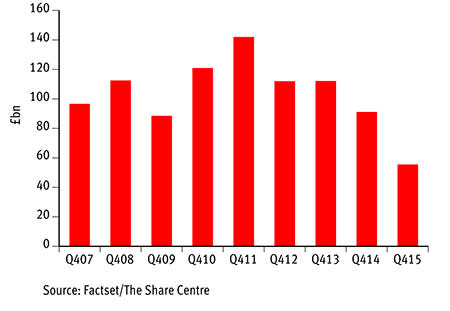

Another concern for investors is the fact profits plunged strongly too. The chart below shows operating profits for the FTSE 350 fell by two fifths compared to a year ago (-38.5 per cent like-for-like), dropping to £55bn as profit margins were squeezed. This again was the lowest figure since Profit Watch began back in 2007.

Again oil and mining were the main culprits here while the travel and leisure sector performed well alongside the construction industry.

Pre-tax profit falls were even more stark, with this figure down 42.7 per cent to £50.3bn for those who had annnual results by the end of March. Amid this, the banking sector reported profit levels not seen since 2008 when they were struck by the financial crisis. The focus by some banks, including the like of Barclays (BARC), on their core operations might well be a symptom of this reduced profitability.

Outside oil, mining and the banks though, pre-tax profits actually rose 14.9 per cent, albeit largely due to GlaxoSmithKline (GSK) making a tidy sum on the sale of its oncology business. In total, 20 sectors saw pre-tax profits fall while 17 saw them rise.

Helal Miah, investment research analyst at The Share Centre, said the impact that oil, mining and the banks can have on the whole index was an important point for investors to consider.

"For passive investors, this hammers home the fact that tracker funds can leave them with a dangerously skewed portfolio," he said.

"This re-emphasises our view that 2016/2017 is a stock pickers market and that active fund investing is an easier way to diversify away from risks."

He added profitability was "likely to begin to improve" but that the oil sector had "another tough year ahead while the banking industry must continue to grapple with record low interest rates".