This could, of course, be for rational reasons, but it could also be because they have become what Canaccord Genuity Wealth Management calls 'cherished holdings'.

The wealth manager said many investors struggle to let such investments go and often for "illogical reasons" such as emotion or historical attachment. "Perhaps we once worked there, inherited some shares from a favourite uncle or we spent a long time analysing and investing in a company which once delivered great returns - but that was a few years ago," said Richard Champion, deputy chief investment officer.

"The trouble with a prized portfolio is that your investments can often get skewed towards a single company - and the risk is that sentiment gets in the way of judgement. All too often, investors stay in love with things that stopped being good for them a long time ago."

And the company has identified 10 stocks using its proprietary research tool, Quest, which are likely to be prominent holdings in many an investor portfolio, but which have perhaps gone "stale" and could see their dominance undermined by new entrants.

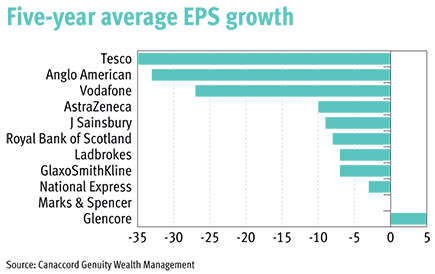

Mr Champion said he and his team looked for dividend security, balance sheet weakness and a negative returns trend, something highlighted by the EPS chart below.

"The result suggests investors should be prepared to let go of household names like GlaxoSmithKline, AstraZeneca, Vodafone, Tesco, Marks and Spencer and most of the mining sector, among others," Mr Champion said.

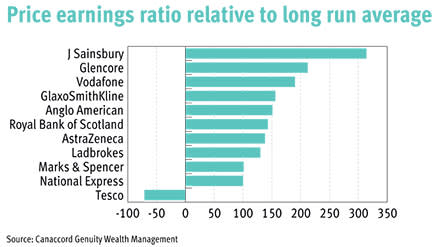

As the second chart below shows, nine out of the 10 stocks identified have price-to-earnings valuations well above their long-run average, in spite of their weak return profiles.

Mr Champion said Glaxo was a stock that had "consistently disappointed over the past decade with 2015 EPS 29 per cent lower than in 2010 and 3 per cent below the 2005 level".

He said blockbuster drugs were more difficult and expensive to deliver and with a new chief executive due to replace incumbent Andrew Witty, the company was a "prime candidate for a potential dividend cut [even though it was] once considered a staple income stock".

The deputy CIO also said Marks & Spencer's EPS was 23 per cent below the level achieved in 2008 and that operating margins were higher in 2004 at 10.4 per cent than they are today at 7.6 per cent.

"Amazon was also in its infancy and the global economy was - arguably - in better shape - or so we thought at the time," Mr Champion added.