Package holidays could be a Godsend for holiday operators should UK consumers tighten their belts in response to the uncertainties of Brexit. That's why we think it might be a good move to buy shares in Dart (DTG), which has had growing success with such offerings. The benefit of selling package holidays through its Jet2holidays brand is that they're far more profitable than the flight-only options available through its Jet2.com business, while families know exactly what they're paying, right down to the food and drink on the all-inclusive deals that make up 40 per cent of Dart's packages.

- Share rating excluding net cash

- High-margin products selling well

- New Birmingham hub

- Food distribution growing fast

- Capital spending requirements

- Sterling's weakness pressing margins

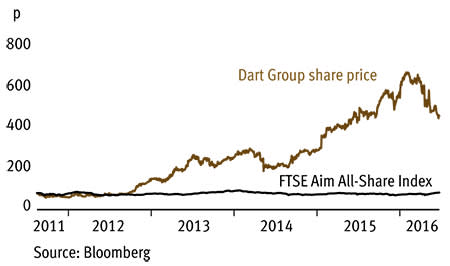

After a savage post-referendum dip, Dart's shares now trade on a cash-adjusted multiple of just six times 2016-17's forecast earnings (see table), which we feel undervalues the company. True, Dart has heavy capital spending commitments and some of that cash will pay for its order of 30 Boeing 737-800 planes, but this investment will rejuvenate the group's fleet. Roughly half the new aircraft are 189-seaters, which will replace 148-seater B737-300s. In addition, the new aircraft will be more fuel efficient, so should provide a cost-per-seat benefit. The group's fleet also has the in-built flexibility of including some leased aircraft, which, in the event of poor demand, could be returned when leases expire. Any cost benefits should further boost Dart's cash generation, which was strong in 2015-16 at £244m (£116m in 2015).

Terrorism is a rising fear but, among susceptible nations, Dart only has a presence in Turkey and a small one in Tunisia. That makes it less vulnerable than some rivals. Conversely, it is well placed to benefit from increased demand for mainland European destinations and the Canary Isles. The group has also worked hard to secure more advance bookings and at the end of March had secured £767m of such reservations compared with £580m a year earlier.

Dart's expansion means it now offers 590,000 seats a year on 57 weekly flights from its new hub at Birmingham, which will be its third-largest base behind Manchester and Leeds/Bradford and should add to profits after some initial start-up costs.

Granted, the weakness of sterling will be a problem since fuel and new aircraft are priced in dollars, but its competitors face the same difficulty. Besides, Dart has hedged virtually all its fuel requirements for the 2016-17 financial year and, in 2016, paid $674 per tonne for fuel compared with $922 in 2014-15.

Dart also owns a small but rapidly-growing food distribution business, Fowler Welch. In 2015-16, Fowler's profits rose nearly two-thirds to £5.4m. It expanded one of its fruit-ripening sites by 50,000 sq ft and agreed a contract with Dairy Crest (DCG) to take over its Nuneaton UK distribution centre, moves that should contribute to sales growth.

| DART (DTG) | ||||

|---|---|---|---|---|

| ORD PRICE: | 454p | MARKET VALUE: | £672m | |

| TOUCH: | 453-454p | 12-MONTH HIGH: | 684p | LOW: 435p |

| DIVIDEND YIELD: | 1% | PE RATIO: | 14 | |

| NET ASSET VALUE: | 215p | NET CASH: | £248m | |

| Year to 31 Mar | Turnover (£bn) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 1.12 | 49.2 | 29.1 | 2.7 |

| 2015 | 1.25 | 50.8 | 29.9 | 3.0 |

| 2016 | 1.41 | 105.5 | 60.8 | 4.0 |

| 2017* | 1.61 | 89.3 | 47.7 | 4.4 |

| 2018* | 1.77 | 61.1 | 32.6 | 4.6 |

| % change | +10 | -32 | -32 | +5 |

Normal market size: 3,000 Matched bargain trading Beta: 0.2 *Canaccord Genuity forecasts, adjusted PTP & EPS | ||||